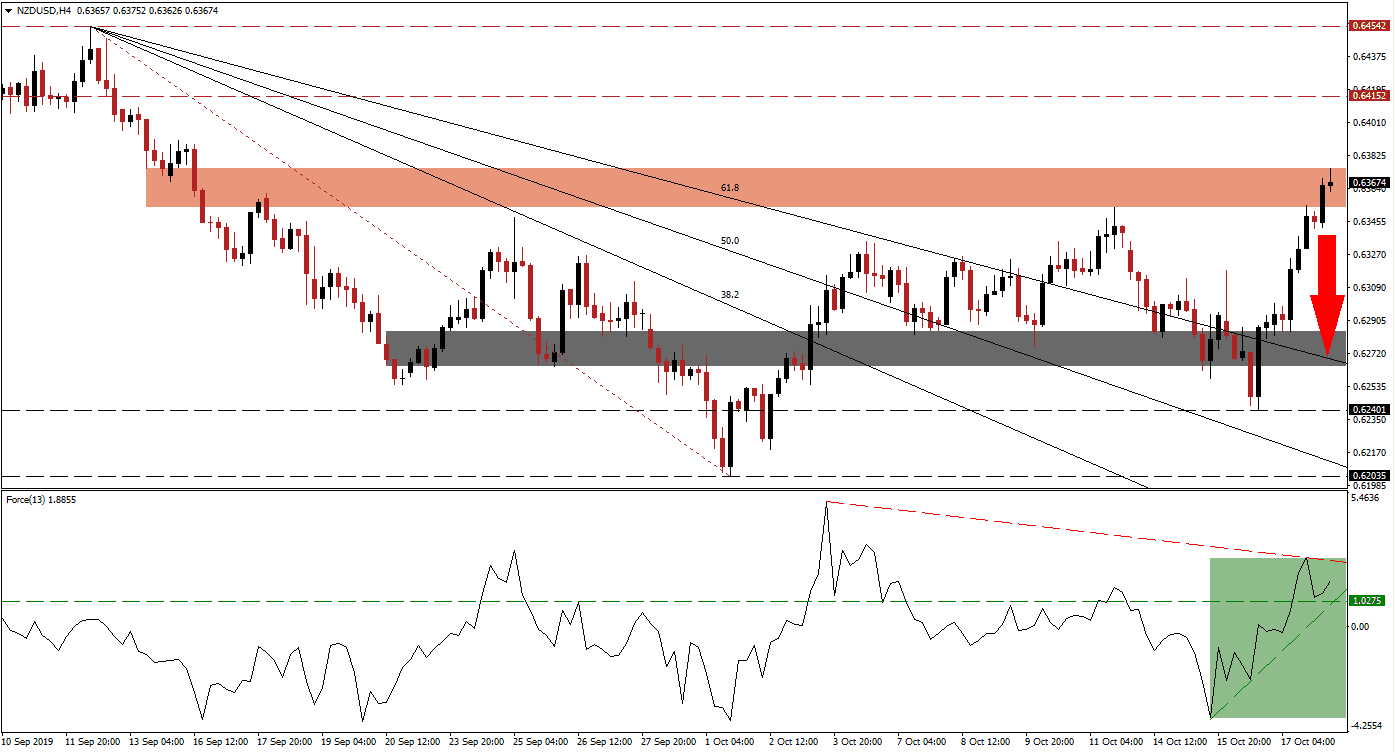

After a strong rally in the NZD/USD, inspired by a combination of much weaker-than expected economic data out of the US and a short-covering rally in the extremely oversold New Zealand Dollar, a short-term reversal is expected to follow. Price action has reached its short-term resistance zone following a complete breakout above its Fibonacci Retracement Fan sequence which turned it from resistance to support. Weaker than expected Chinese GDP data has dampened the advance in the New Zealand Dollar, as its economy is closely tied to the Chinese one.

The Force Index, a next generation technical indicator, has formed a negative divergence which represents a bearish trading signals and suggests that a short-term reversal should be expected. A negative divergence forms when an assets extends its rally, but the underlying technical indicator fails to confirm it and retreats. The Force Index accelerated from its low as the NZD/USD pushed above its 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. This technical indicator recorded a lower high and reversed, but currently remains above its horizontal support level; after a breakout reversed it from resistance while a steep ascending support level has emerged as marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bullish momentum started to recede inside its short-term resistance zone which is located between 0.63536 and 0.63752 as marked by the red rectangle. The rally which originated from its long-term support zone, located between 0.62035 and 0.62401, created a series of higher and highs and higher lows; this is a long-term bullish development and the NZD/USD is expected to follow through with another higher low following the expected short-term price action reversal. A breakdown in the Force Index below its horizontal support level is likely to lead this currency pair into a reversal; this would also take it below its ascending support level.

While the fundamental picture favors an extension of the advance, the technical scenario points towards a short-term reversal, partially induced by profit taking. The next short-term support zone is located between 0.62649 and 0.62843 as marked by the grey rectangle; the descending 61.8 Fibonacci Retracement Fan Support Level is currently passing through it. A correction by the NZD/USD into this short-term support zone will created another higher low and keep the long-term uptrend intact and healthy. You can learn more about a Breakout, a Breakdown and the Resistance Zone here

NZD/USD Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.63650

Take Profit @ 0.62700

Stop Loss @ 0.63900

Downside Potential: 95 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.80

Should the Force Index be able to sustain a breakout above its descending resistance level, the negative divergence will be invalidated and the NZD/USD should follow through with a breakout above its short-term resistance zone and extend its rally. The next long-term resistance is located between 0.64152 and 0.64542 from where a further breakout would require a fundamental catalyst.

NZD/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.64000

Take Profit @ 0.64500

Stop Loss @ 0.63800

Upside Potential: 50 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.50