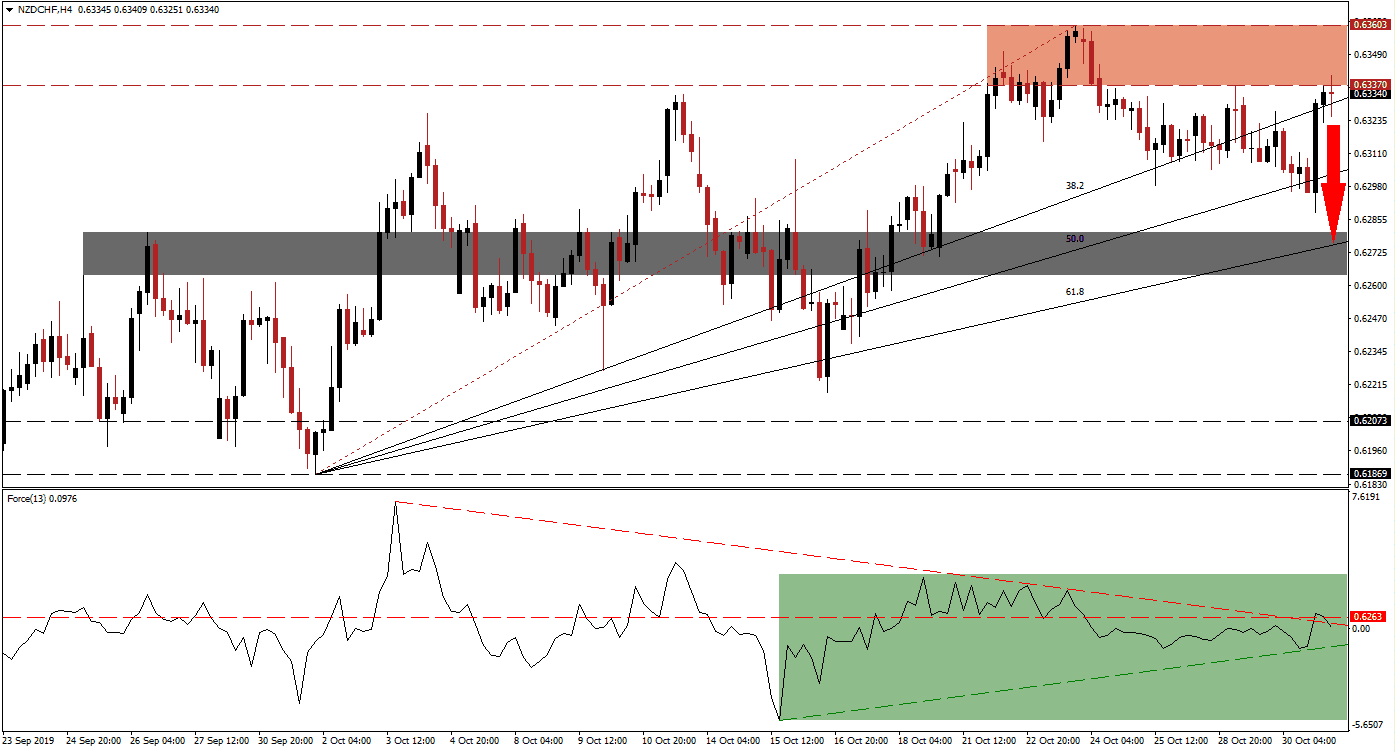

New all-time highs in US equity market after the US Fed cut interest rates as expected, but signalled that a pause is next, extended the risk-on mood across financial markets. This pushed the NZD/CHF back into its resistance zone following a breakdown, on the back of a weaker Swiss Franc which saw capital outflows; forex traders shifted funds out of this safe haven asset into riskier ones. The 38.2 Fibonacci Retracement Fan Support Level is approaching the bottom range of its resistance zone and pressures on this currency pair are on the rise for either a breakout and extension or a breakdown and reversal.

The Force Index, a next generation technical indicator, shows the gradual decrease in bullish momentum which suggests that the next move in this currency pair is likely to be to the downside. The most recent spike higher, after the NZD/CHF briefly pierced its 50.0 Fibonacci Retracement Fan Support Level to the downside, caused the Force Index to advance of its ascending support level. This led to a brief push above its horizontal as well as descending resistance levels, as marked by the green rectangle, in a move which was since reversed. This technical indicator is now on its way to cross below the 0 center line which will place bears in charge of this currency pair and is expected to lead to a price action reversal. You can learn more about the Force Index here.

Price action is currently trapped above its 38.2 Fibonacci Retracement Fan Support Level and below its resistance zone which is located between 0.63370 and 0.63603 as marked by the red rectangle. Economic data out of New Zealand surprised to the upside, but Chinese data showed the continuation of contraction in its manufacturing sector; this is the latest sign that the economic slowdown remains in place. Forex traders should monitor the Force Index closely, as a move into negative conditions could trigger a profit-taking sell-off and push the NZD/CHF through its Fibonacci Retracement Fan and back into its next short-term support zone.

A price action reversal from current levels would also mark a lower high which is a bearish development in this currency pair. With the contraction in bullish momentum, the NZD/CHF is expected to descend until it will reach its short-term support zone which is located between 0.62639 and 0.62802; the 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone. The long-term uptrend would remain intact if price action doesn’t complete a breakdown below this zone, developments in the US-China trade truce negotiations may provide a fundamental catalyst for this currency pair and the process should be followed closely. You can learn more about a breakdown here.

NZD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.63350

Take Profit @ 0.62750

Stop Loss @ 0.63550

Downside Potential: 60 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.00

Should the Force Index reverse and sustain a breakout above its horizontal resistance level, the NZD/CHF may be able to push through its resistance zone and extend its advance. The next resistance zone, following a confirmed breakout, is located between 0.64012 and 0.64726. Without a fresh catalyst, such as breakout is not sustainable and forex traders should consider this as a solid short-entry opportunity given the current fundamental scenario.

NZD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.63750

Take Profit @ 0.64300

Stop Loss @ 0.63500

Upside Potential: 55 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.20