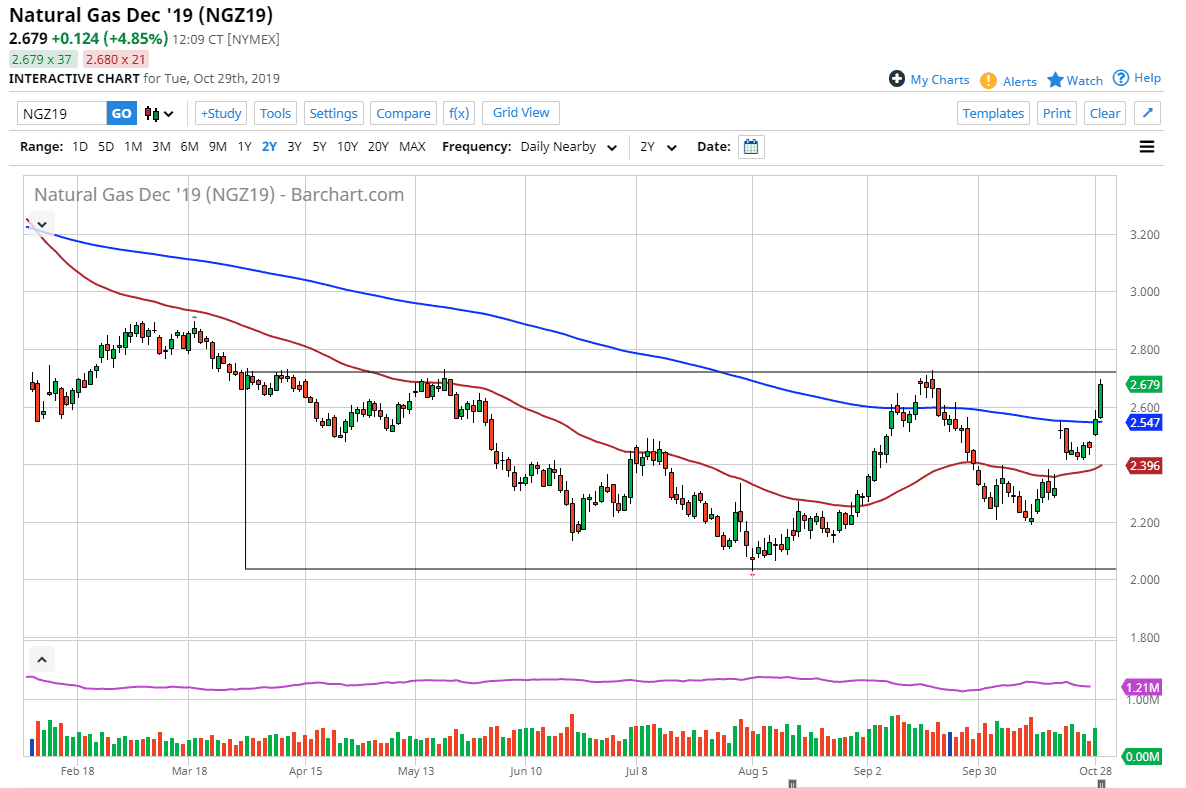

Natural gas markets have rallied significantly during the trading session on Tuesday, reaching towards the $2.68 level late in the day. The $2.70 level has been massive resistance, and it’s likely that we will continue to see a lot of bullish pressure going forward as the temperatures in the United States continue to fall. At this point in time the market looks very likely to continue to see a lot of buying pressure on pullbacks, as the market continues to be pushed higher and higher. If we can break above the recent high at the $2.70 level, then the market is likely to start reaching towards the $3.00 level.

Short-term pullbacks offer buying opportunities, as the 200 day EMA is now underneath the price. At this point, that should offer a bit of support, just as the Below the $2.40 level should be. In fact, I believe that the $2.40 level should be essentially the “floor” in the market going forward. The 50 day EMA is sitting in that general vicinity as well, so I think it’s all a matter of time before buyers would jump in in that area.

Overall, I think that this is a continued “buy on the pullbacks” type of situation, and at this point it’s very likely that the market is going to continue to look for value on short-term pullbacks, and of course weather reports will continue to have their influence. That being said, we are beginning the bullish season for this commodity. The market will continue to be very erratic and bullish, but over the longer term it’s likely that we are going to continue to see more or less a longer-term grind until the middle of January. Once we get to the January timeframe, then you start to talk about trading spring contracts. At this point though, we are not trading those warmer months and we are looking for bullish pressure due to the fact that the front contract right now is December which is of course one of the strongest months for demand. The Thursday session will feature the natural gas inventories figure, which of course will offer quite a bit of information as far as this market is concerned. It’s likely that the market will continue to be bullish, but if we get some type of pullback due to the inventory figure, it should be a buying opportunity.