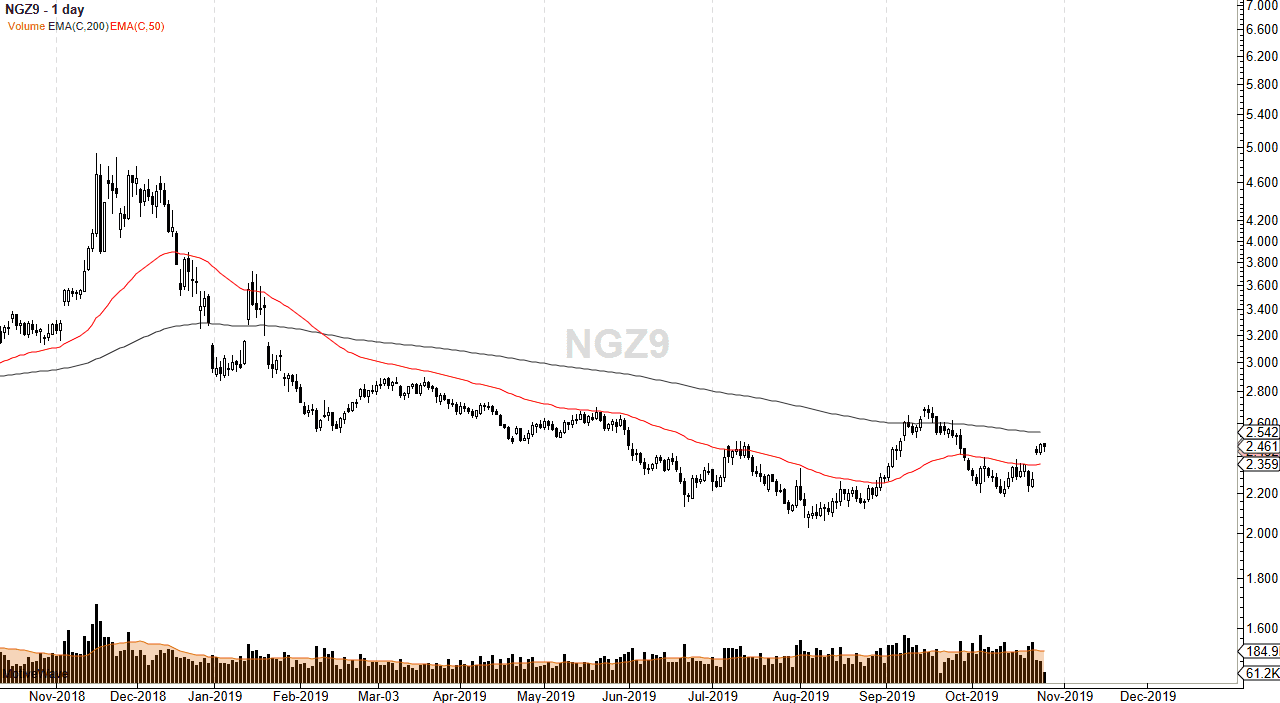

Natural gas markets have continued to see strength during the week, and Friday was no exception. Although we did have a slightly negative day, buyers came back in to take advantage of the cheaper pricing and send the market back towards the opening price. We have recently gapped above the 50-day EMA and now that we are trading the December contract, it makes quite a bit of sense that bullish pressure comes back in as temperatures will certainly cool off and drive up demand in the United States.

If that’s going to be the case, then it’s very likely that this market will continue to find plenty of reasons to go higher. This doesn’t mean that we take off right away but clearly, we are in the time of year where the demand for heating the home will outweigh anything else. It’s only a matter of time before that takes over the marketplace, and then we shoot much higher. The initial target of course would be the 200-day EMA which is currently trading at the $2.542 level. If we can break above there, then it’s likely that the $2.60 level will be targeted. Pullbacks to the 50-day EMA and of course the gap from a couple of days ago should continue to offer value the people are willing to take advantage of.

It should be noted that the most recent low is higher than the previous one before that, and you can also look at three “micro bottoms” that have formed a bit of the triple bottom. This shows the $2.20 level be very important, and it should continue to be a “floor” in the market. If the market was to break down below the $2.20 level, that could be a rather strong turn of events, but at this point the $2.00 level should be relatively supportive as well. To the upside, it’s only a matter of time before the market goes looking towards the $3.00 level as it is a large, round, psychologically significant figure. In fact, that natural gas markets will probably continue to rally into the early to middle part of January. At that point, the market tends to collapse just as quickly as it rallied. All things being equal, I am a buyer of dips and I do think that natural gas will continue to attract a lot of attention.