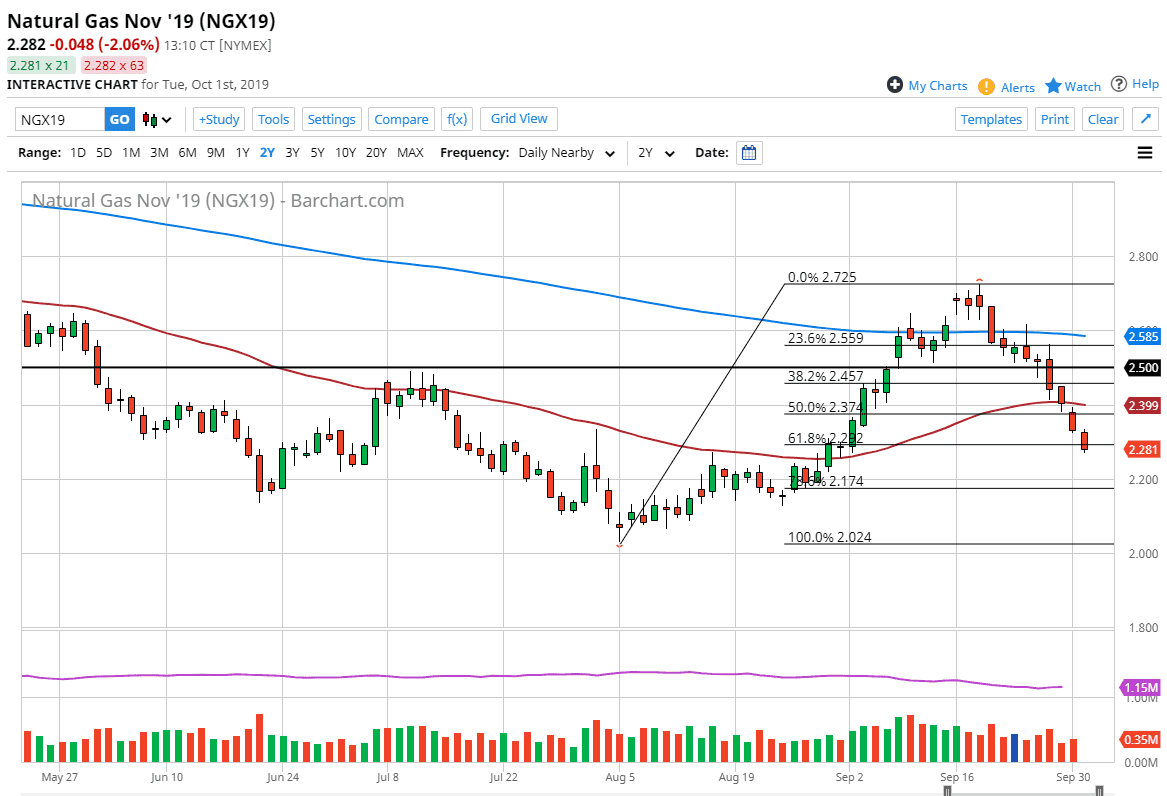

Natural gas markets have fallen a bit during the trading session on Tuesday, slicing through the $2.30 level. This is also where we had seen the 61.8% Fibonacci retracement level. At this point, the market should eventually see buyers, but based upon the candlestick that we have printed for the Tuesday session, it’s very unlikely that we are quite ready to turn around and go higher. That being said though, I think there is a lot of support underneath, and it’s likely that the market will eventually find it. However, as this is a major shift in sentiment and of course a major shift for me, I believe in waiting for a daily signal to start buying.

The main reason I am looking at buying natural gas is simply the time of day. This is a market that is very cyclical, and as the front month in the futures markets is now November, it makes sense that we should see a bit of strength due to the fact that demand would start to pick up with cold temperatures in the United States and Europe coming. Ultimately, there is probably a bit of buying pressure coming rather soon, but I would wait for a daily confirmation, as there should be plenty of room to run. The area just below at the $2.25 level should offer a bit of support as it was previous resistance and therefore I would expect some type of supportive daily candle stick. That being said though, the market is one that I am going to be very patient with because I think the target could be at the very least the $2.72 level which was the recent high. After that, we are looking at the $3.00 level, and possibly even the $3.50 level.

To the downside, it’s possible that the market could extend all the way down to the $2.00 level, but I think it’s very unlikely to happen. I think there is enough support underneath to keep this market afloat, assuming that we could even get down to that area. I will be watching the daily charts for a sign of buying such as a hammer, or a bullish and golfing candlestick. Given enough time, I do believe that the natural gas markets will give us an opportunity. I believe at this point market has been oversold, and it’s only a matter time before cooler temperatures prevail.