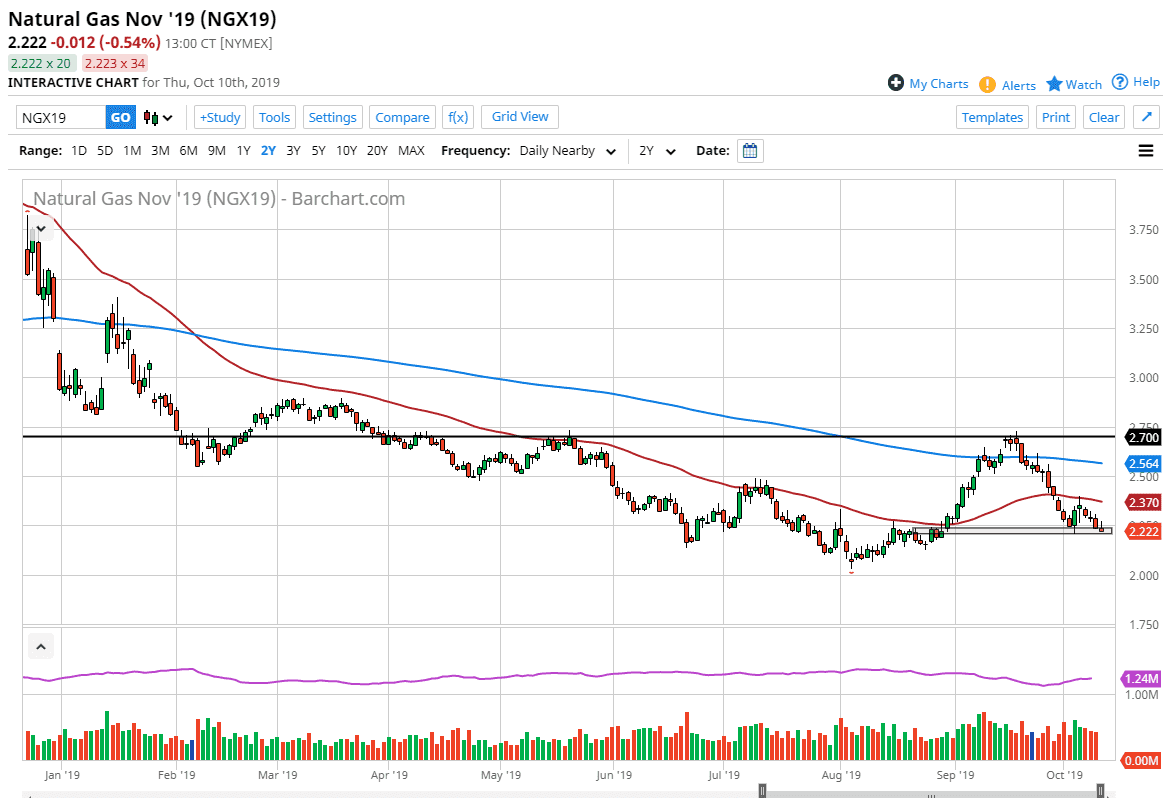

Natural gas markets initially tried to rally during the trading session on Thursday as we had reached significant support, but at this point we have turned around to show signs of weakness yet again. The shooting star shaped candle stick, or perhaps if you prefer inverted hammer, suggest that we could continue to go lower. The inventory number that came out during the day still shows no signs of dwindling, and therefore it suggests that we are going to continue to have to wait for buyers come back. Notice how I don’t say anything about selling, because we are at such extreme lows and it is the wrong time of year to do this. Yes, you could be missing a bit of a downdraft, but the winter trade is so brutally positive that it’s the best trade in the year out of most of the markets that I follow.

There are multiple areas including the $2.20 level, the $2.15 level, and then below at the $2 level that could turn things around. That being said, what I would like to see is a break above the top of the inverted hammer for the Thursday session to send this market higher, perhaps reaching towards the 50 day EMA, and then maybe even the 200 day EMA above there. By breaking above the top of the inverted hammer, you start to see traders get trapped and have to return to the markets to close out those positions.

Overall, I believe that we will eventually see an impulsive candle stick once the temperatures drop in the United States and the European Union, and when we get that massive green candle stick, it’s very likely that we will push much higher, and quite rapidly. Overall, the $2.70 level could be the target for longer-term traders, but if you do not have the ability to trade the CFD market, you may find natural gas markets a bit too expensive, simply because the volatility is going to be off the rails. Beyond that, we have the US/China trade talks influencing almost everything right now, and of course natural gas won't be any different than some of the other markets around the world. There is the idea of natural gas production and demand coming into focus based upon whether or not trade will pick up between the two economies. Granted, it’s very convoluted, but it does in fact seem to be happening during the Thursday session.