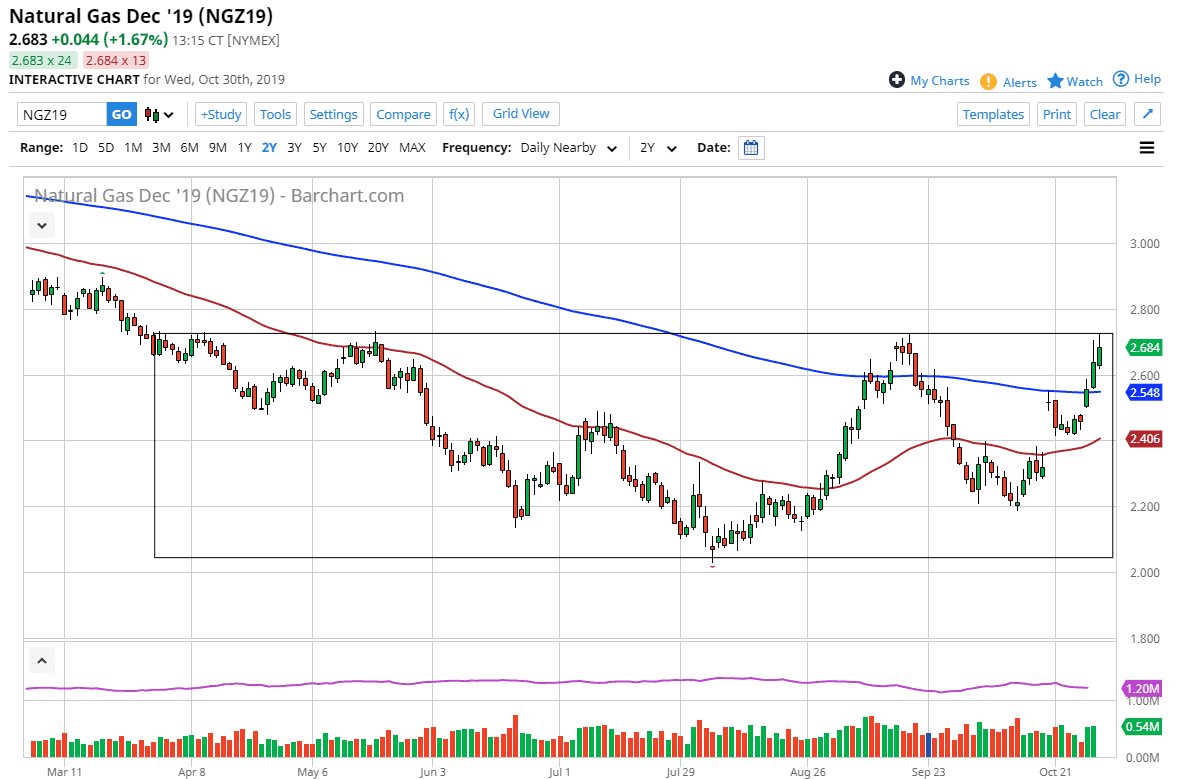

Natural gas markets rallied again during the trading session on Wednesday, reaching towards the recent highs that we have seen, near the $2.73 level. If we can break up other than is likely that the market is ready to go much higher, as it would be a breakout of a major consolidation area. Beyond that, it’s very likely that the cooler temperatures coming in the United States will continue to drive the value of natural gas higher as demand picks up. This is a cyclical trade that tends to happen every year around this time, as the heating demands in the United States will pick up. Ultimately, this trade tends to run for a few months, and then will drop off early January. As the recent temperatures in the United States were much lower than anticipated, this has jolted the market to the upside.

It should be noted that the market did give back the gains at the absolute highs, but this pullback should end up being a nice buying opportunity as inventory numbers come out. Given enough time, the market could drop as low as $2.35 and still be bullish as there is a massive gap down there that has yet to be filled. That being said, this is a market that continues to be looking at whether reports more than anything else, something that will certainly have to be updated after the last several sessions in the US. As somebody who lives in the area of the United States that uses so much natural gas for heating, I can tell you that suddenly things have gotten much colder.

Typically, this breakout will last until the middle of January, when you should start to see traders focusing on the spring, and therefore less demand for natural gas to heat homes. I think short-term pullbacks offer value, and there are a couple of areas that I’d be looking to buy. The $2.60 level would be the first support level, followed by the 200 day EMA, and then the 50 day EMA. Finally, then the gap below would be the buying opportunity. The $3.00 level above will be the initial target, followed by every $0.20 after that. I am a buyer and not interested in selling this time a year. However, in the middle of January this market suddenly becomes whether you can sell hand over fist.