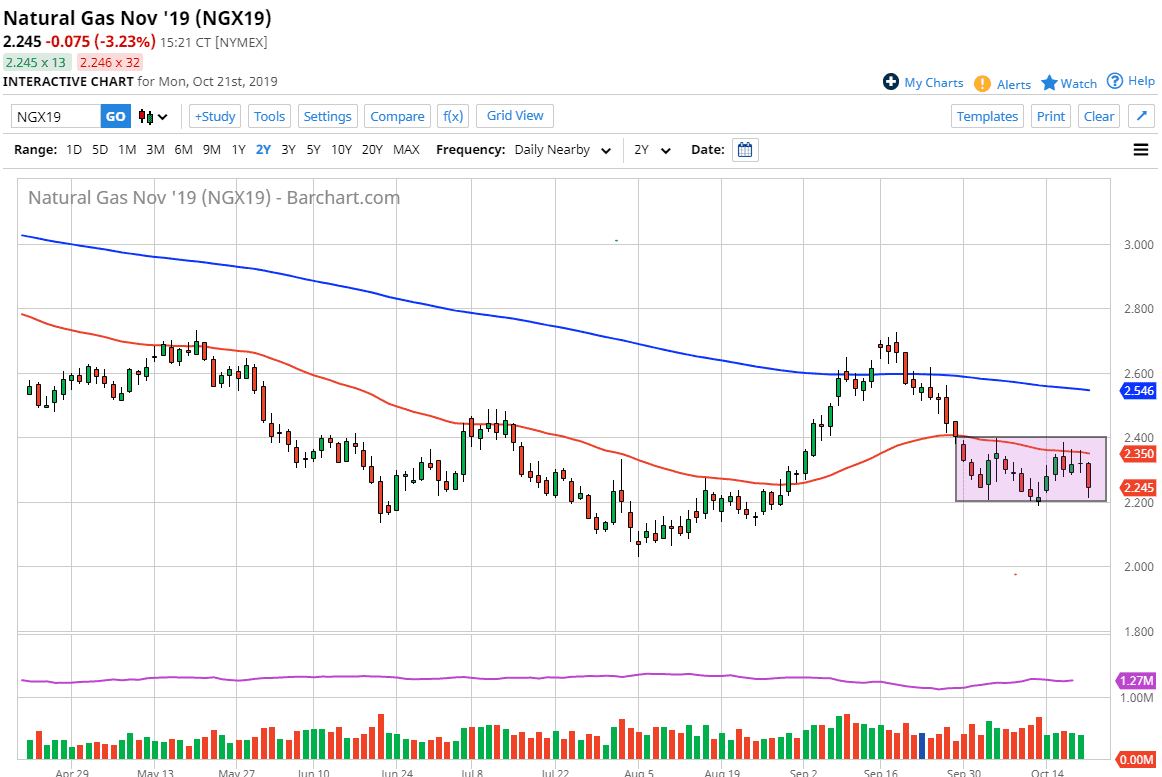

Natural gas markets are likely to find buyers at current levels, the $2.20 level, as it has been so supportive over the last several days. We have essentially been shopping around in a $0.20 range, with the $2.20 level being the bottom and the $2.40 level above being to the top. The 50-day EMA is at the $2.35 level and that of course puts a certain amount of bearish pressure in this market. However, as we get closer to cold weather in the United States, that will drive demand drastically higher and that should bring down some of the supply.

If we can break above the $2.40 level, it’s likely that the market could then go to the $2.55 level which is the 200-day EMA. Breaking above there, then it is likely that the markets will continue to reach towards the $2.70 level. All things being equal I believe that the market will continue to build some type of base here, perhaps getting ready to launch a move to the upside.

Even if we were to break down below the $2.20 level, I anticipate that there should be a significant amount of support out of the $2.00 level and it should represent even more value. Value of course is something that a lot of market participants will look to, and as a result is likely that the market will continue to see buyers coming in to pick up the market and drive it much higher due to the winter pop that we see along with demand. Keep in mind that quite often we see a brutal shot to the upside, and this is something that I have been preparing for. Overall, this is a market that needs to see some type of catalyst, and that catalyst could be coming rather soon as cold temperatures and more importantly cold weather reports come out of America. Once that happens, this thing is going to take off like a rocket but having said that it will do the exact opposite in the early part of January, as we search a trade spring month. Currently, we are testing the November contract, which is the beginning of colder temperatures. Short-term traders will probably look at the $2.20 level as a bit of a base. Again though, even if we break down below there only look to buy at lower levels.