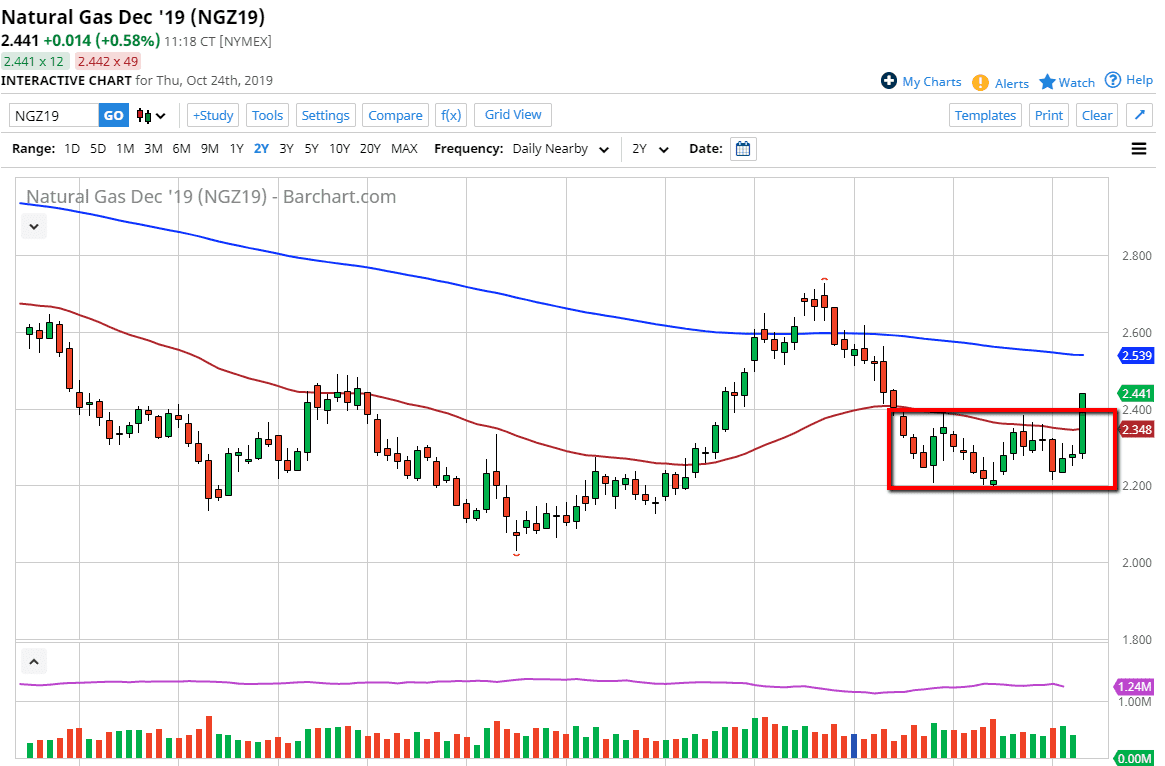

Natural gas markets have exploded to the upside during the trading session on Thursday, as the $2.40 level was left behind. At this point, the market looks very likely to continue to see buying pressure going forward as we are getting into the wintertime and trading the December contract now. But it is very likely that the market participants will continue to focus on weather reports which are starting to look a bit cooler in the United States. If that’s going to be the case, that will drive up demand, thereby driving a price.

Pullbacks at this point should continue to buy plenty of support, especially near the 50-day EMA. Those pullbacks are going to be looked at as value, and therefore it’s likely that the buyers will look at it as buying opportunities. The $2.40 level was a major barrier as of late, and now that we are broken above it and are closing towards the top of the candlestick, it suggests that we are ready to go higher.

To the upside, the market will try to get above the 200-day EMA, which is massive resistance. Ultimately though, if we can break above that level, that is very likely that we continue to go even further. Market participants will probably try to drive this market towards of the $3.00 level but that’s a longer-term call rather than something that should happen in the next few days.

If the market was to suddenly turn around and break down below the $2.20 level that would be a very negative sign, but it doesn’t seem to be very likely. Breaking below that level could open up the door to the $2.00 level but I fully believe that the buyers will be coming much sooner than that. Colder temperatures are expected around Halloween, and that will drive up demand. Natural gas tends to be a market that moves very rapidly and based upon whether reports from a weekly basis. Going forward, expect a lot of erratic behavior but I would also expect that any time we pull back it’s going to be thought of as a value play. Longer-term, I still believe that natural gas is going to struggle but the next couple of months should be bullish based upon historic norms. The road higher is going to offer plenty of opportunities.