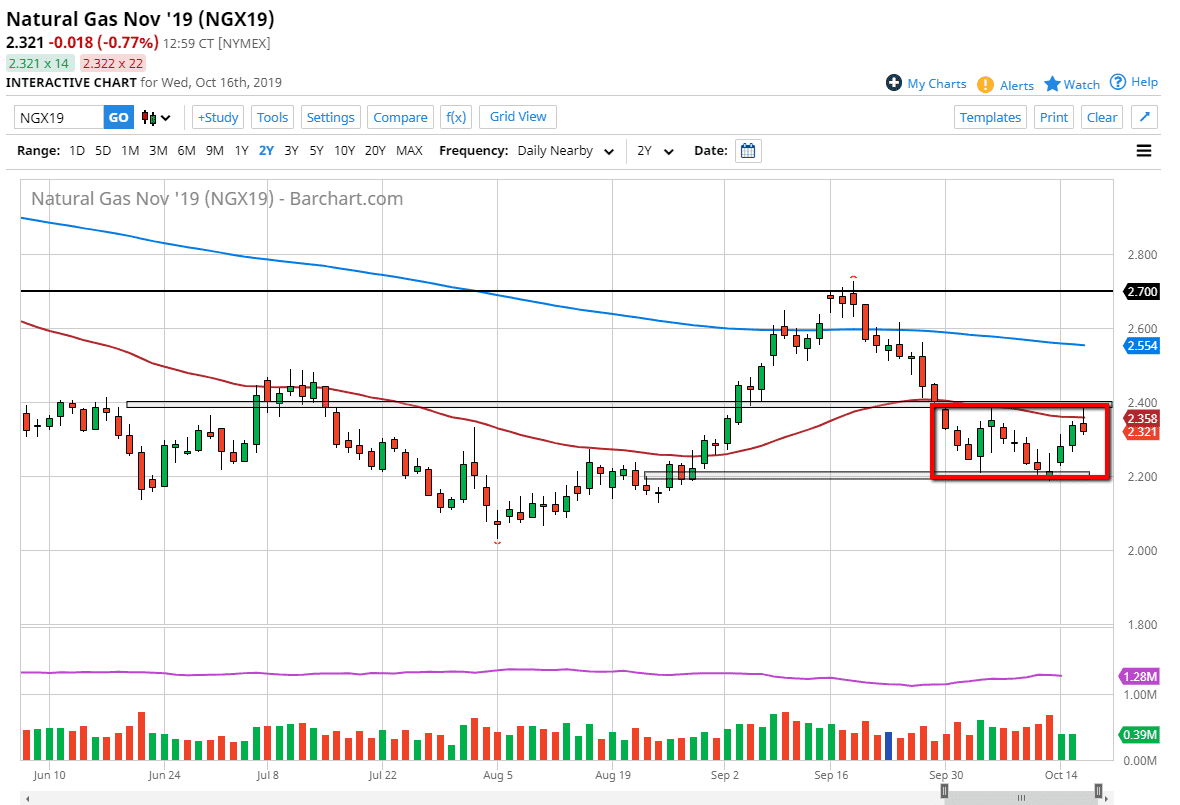

The natural gas markets have rallied significantly during the trading session on Wednesday to reach the $2.40 level again, only to turn around and form a bit of a shooting star. That being the case it looks as if we will probably struggle a bit but all things being equal I suspect that this is a base building operation. In other words, the $2.40 level offering resistance makes quite a bit of sense as it has previously. This is an area that I look at as a trigger for fresh longs. By pulling back the way we have from the $2.40 level, it’s likely that we probably pull back towards the bottom again, which is the $2.20 level.

The shooting star for the trading session of course shows that perhaps there is little hesitation but I also recognize that temperatures are starting to drop in the northern part of the United States, and there of course lies in the potential for an explosive move to the upside. If the market was to break above the $2.40 level, it would not only clear the 50 day EMA, but it would also break above the $2.40 level which is the middle part of what could potentially be a “W pattern.” The measured move from there would be to the $2.60 level which is essentially the area from which we felt.

As this time of year will certainly bring in more demand, the market will eventually find plenty of buying opportunities given enough time, and for the longer-term trader they will be more than rewarded given enough time. At this point, a short-term pullback could be thought of as value being brought into the market, because although the structure does look as if it is ready to fall another $0.10 or so, I’m not interested in shorting. I recognize this time a year can produce explosive moves, and as HVAC gets turned on to warm up homes in Boston, New York, and Washington DC, you will start to see more supply being burned through. It is only a matter of time before that overwhelms the supply, although temporarily. After all, the longer-term outlook for natural gas is always going to be weakness, as there are over 300 years’ worth of proven reserves in the ground in the United States alone. Fracking will continue to weigh upon the overall pricing of this commodity, but every year we get that massive pop.