Natural gas markets initially fell during trading on Thursday, as the inventory number came out a bit more bearish than anticipated, but something interesting has happened: buyers stepped in to pick up the market. As I have been talking about for some time we are getting close to the time of year where natural gas naturally rallies quite a bit, as the market braces for colder temperatures in the north part of the United States and of course the European Union. At this point, we are starting to trade the November contract, as the front month. This of course is a cooler month and whether of course will come into effect rather soon.

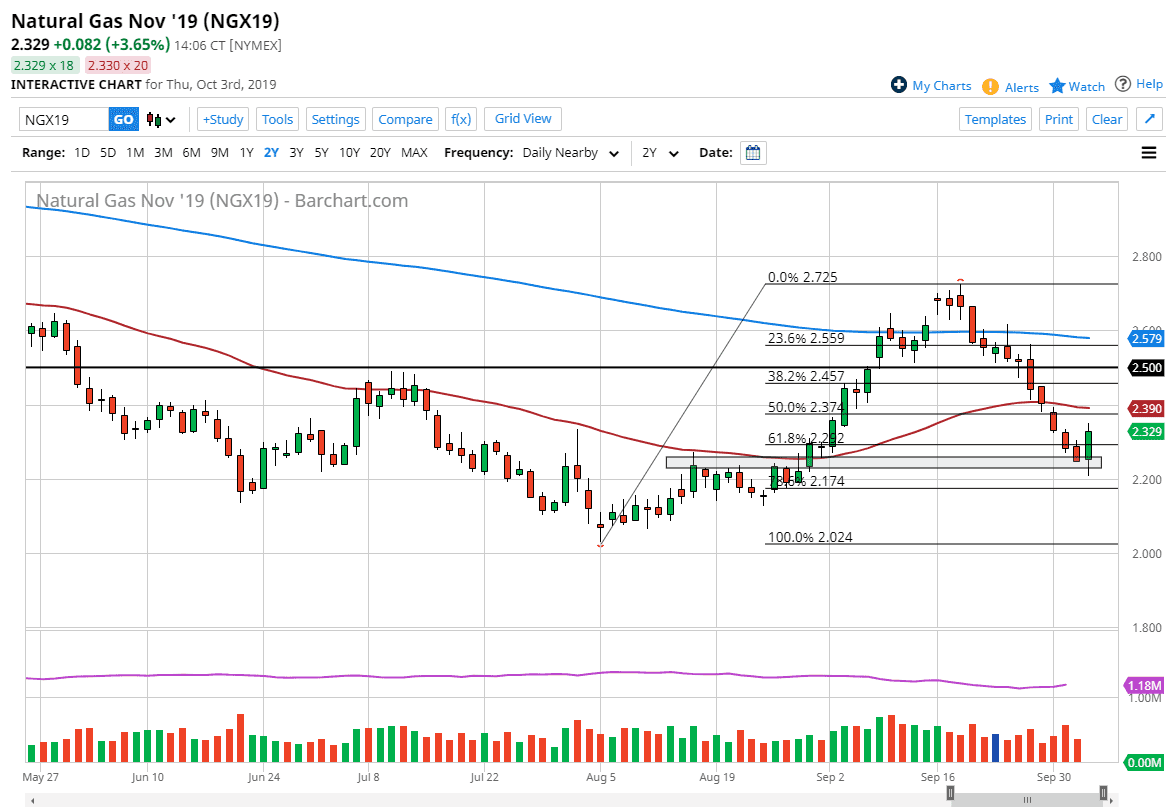

To the downside the $2.20 level looks to be rather supportive, as it was previous resistance. The size of the candle is also somewhat impressive so we can break above the top of it I think that the buyers will probably continue to try to push towards the $2.50 level above which is a large, round, psychologically significant figure. Just above there, we have the 200 day EMA which of course can cause some issues, so that doesn’t mean that it’s going to be easy to get a lot higher than that, but I do think that it’s what happens over the longer-term. In the meantime, I like buying short-term dips and believe that we are continuing to build a bit of a bottoming pattern for the season.

The move that is coming could reach towards the $3.50 level before rolling over again sometime in early in January. At this point, it would take quite a bit of warmth in the winter months to drive this market back down. Beyond that, it would also take something extraordinary to get natural gas below the $2.00 level which was the recent low. At this point, I think the bottom has been put in for the winter and buying on the dips should continue to work longer term. Again, this is a very choppy and oversupplied market, so it’s not going to be easy but clearly the path of least resistance over the next couple months typically is higher, so that’s how I choose to trade natural gas for the time being. Once this is over, we have an even better trade to the downside, but that typically doesn’t happen until about the second week of January.