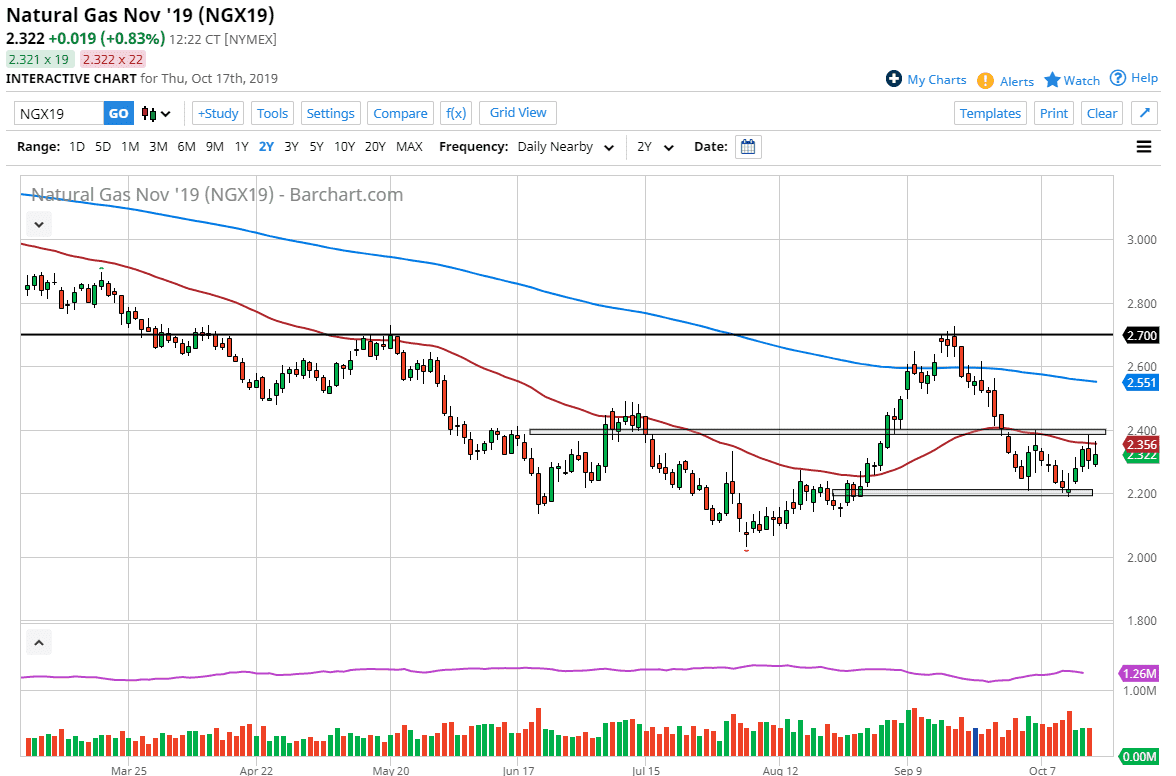

Natural gas markets initially rallied during the trading session on Thursday, as the inventory numbers came out. At this point, natural gas markets came out with an inventory number of 104 billion, as opposed to the expected 100 billion. While that was a little bit of a miss, the reality is that we are heading towards the colder months, so that of course will drive a bit of bullish pressure in this market. Perhaps that’s why we did not pull back any more drastically than we should have, and it now looks as if at least some sense of buoyancy has come back into this market. The 50 day EMA is cutting through the wicks of the last couple of days, so this suggests that there may be a little bit of resistance above, but I think that the $2.40 level will offer resistance as well. If we can break above that, then it’s likely that the market will go looking towards the 200 day EMA which is closer to the $2.55 level.

Looking at the chart, there is significant support below the $2.20 level, so it gives the impression that we are going to continue to build a little bit of a base, and therefore we could get a lot of back and forth trading. That being said, not only would the $2.40 level offer a significant barrier that we could shoot straight above if we break out of, but it’s also a sign of strength as we will have been breaking a couple of tails.

Currently, the market is simply going back and forth and I think that should continue to be the way going forward until we finally build up enough inertia to shoot straight up in the air. At this point, keep in mind that the $2.20 level should offer plenty of support, and I think that support extends down to the $2.00 level. I’m not interested in shorting this market, because the time a year simply doesn’t warrant to that type of reckless behavior. True, we could drop from here but there’s no point in trying to fight what is most certainly going to be a demand story over the next couple of months. Has somebody that lives in the northern part of the United States, I can tell you things are getting colder and heat is starting to be ran.