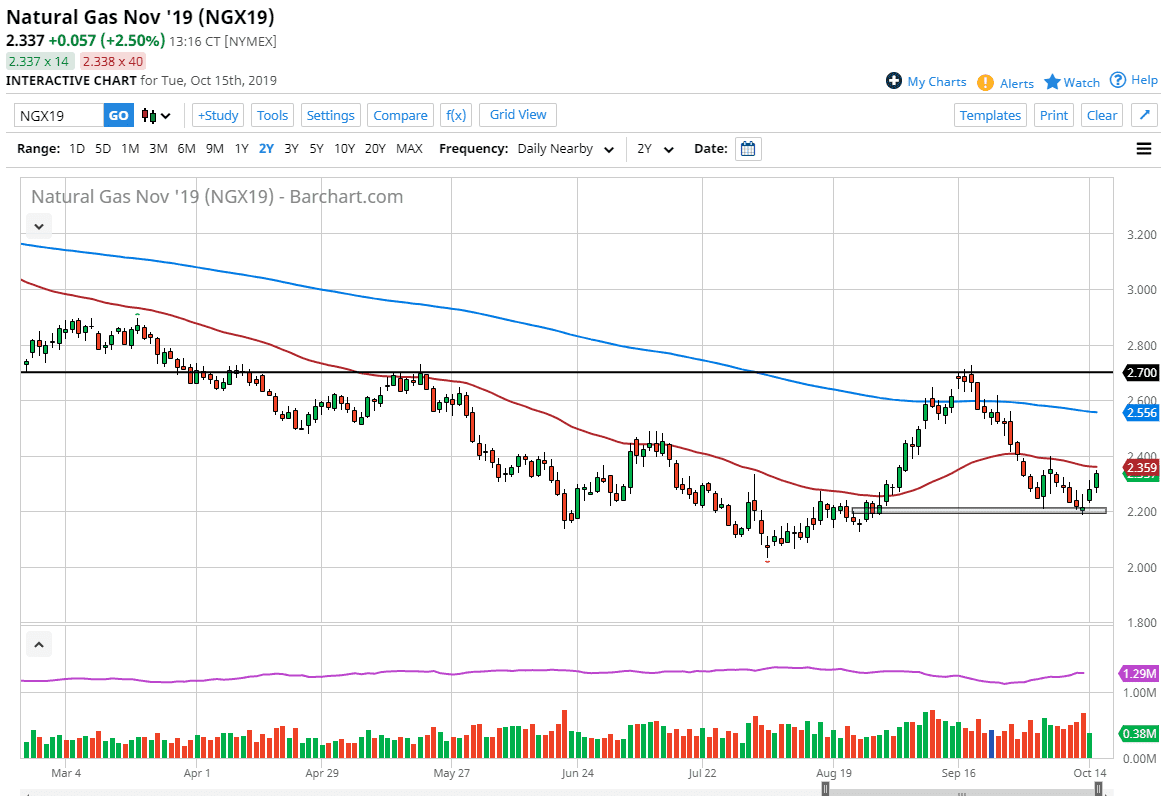

Natural gas markets shot higher during the trading session on Tuesday after initially pulling back. As we closed out the open pit session, the market is very close to the 50 day EMA. Ultimately, the market looks likely to test this area, which of course is very crucial, from a technical analysis standpoint. If we can break above the 50 day EMA it’s likely that this market will continue to go higher and test the $2.40 level. That’s an area that you being broken could open up the door to much higher trading.

The candle stick for the trading session is rather strong, and we are getting close to cold temperatures in the northern part of the United States and of course the European Union. Ultimately, this drives up quite a bit of demand for natural gas, because in the winter trade that I get involved with every year. Beyond that, you can make out a “W pattern” based upon the last couple of attempts to break down below the $2.20 level. At the $2.40 level, the market would break the middle of that “W”, so that kicks off a trade scenario for another $0.20 higher.

That being said, I believe that the market goes much higher than that, as the demand will only accelerate from there. I believe that the $2.70 level would be the initial target after that, followed by the $3.00 level. In the short term, I like buying pullbacks going forward, as we continue to see a lot of value hunters come back into this market. The $2.20 level underneath should continue to be massive support, and a break down below that it could cause quite a bit of noise, but at this point I think that the $2.00 level underneath would be the hard floor. The hard floor of course is representative of the bottom of the range for the warmer months, and I don’t think that we break down below there because it is such a large, round, psychologically significant figure. Obviously, we can pull back occasionally, but that should be thought of as a value proposition at this point. Granted, the moving averages still suggest a slight downtrend, but it’s only time before the seasonal trade and of course demand continues to push the market to the upside. I have no interest in shorting and I believe that it’s only a matter time before we rocket to the upside.