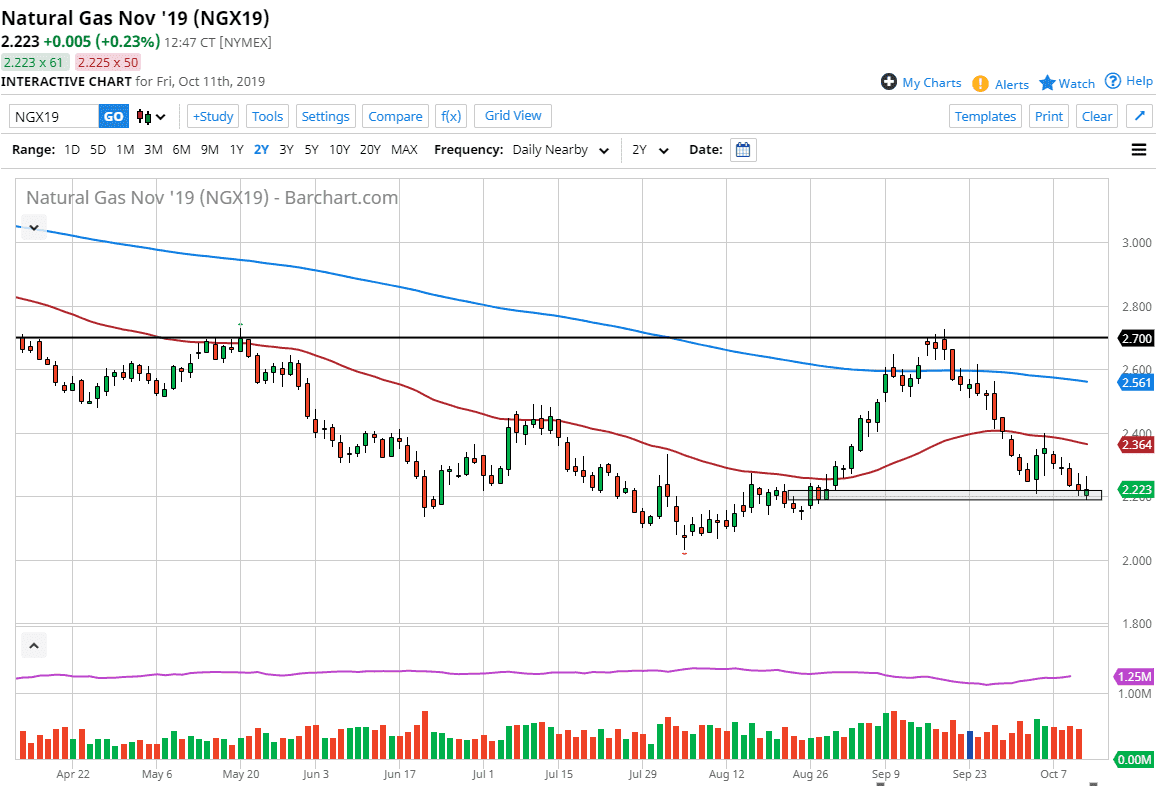

Natural gas markets initially tried to rally during the trading session on Friday but gave back quite a bit of the gains to turn around and form an inverted hammer again just as we had on Thursday. At this point it looks as if the market is trying to find a bit of support underneath, as I have drawn on the chart. This is where we had launched from previously, so by doing so it shows that there is a certain amount of buying pressure in this area anyway. With that being the case I would anticipate the buyers will come back but the question then is can the market breakout above significant resistance?

By breaking above the top of the last two trading sessions, that would be a very bullish sign, as it would show a resiliency in the buying pressure that can’t be ignored. At that point I would anticipate that the market would go looking towards the 50 day EMA above, which is painted in red on the chart. Currently, that is at the $2.36 level, which could extend to the $2.40 level next. Obviously, if we can break above there then things get particularly bullish.

Looking at the chart, it’s obvious that we have sold off quite drastically, but we are also at a major support level, and this of course is an area of inflection that’s worth paying attention to. Ultimately, we are trading the November contract which of course is typically bullish eventually, as we start to focus on colder temperatures in the United States and Europe. We have not gotten cold weather reports or forecasts yet, but it is only a matter of time. As soon as that happens, natural gas markets will take off to the upside as demand will obviously pick up.

With all that being said, the market is likely to struggle in the short term, but if we can break above those tales for the last couple of days that would be an export nearly bullish sign. If we do break down below the $2.20 level, we could go as low as the $2.15 level. That being said though, I don’t have any interest in shorting this market because it would simply be “chasing the trade” at this point as we have fallen so far. Remember, anytime you get a trend change it is typically very messy and that’s exactly what we’ve seen lately.