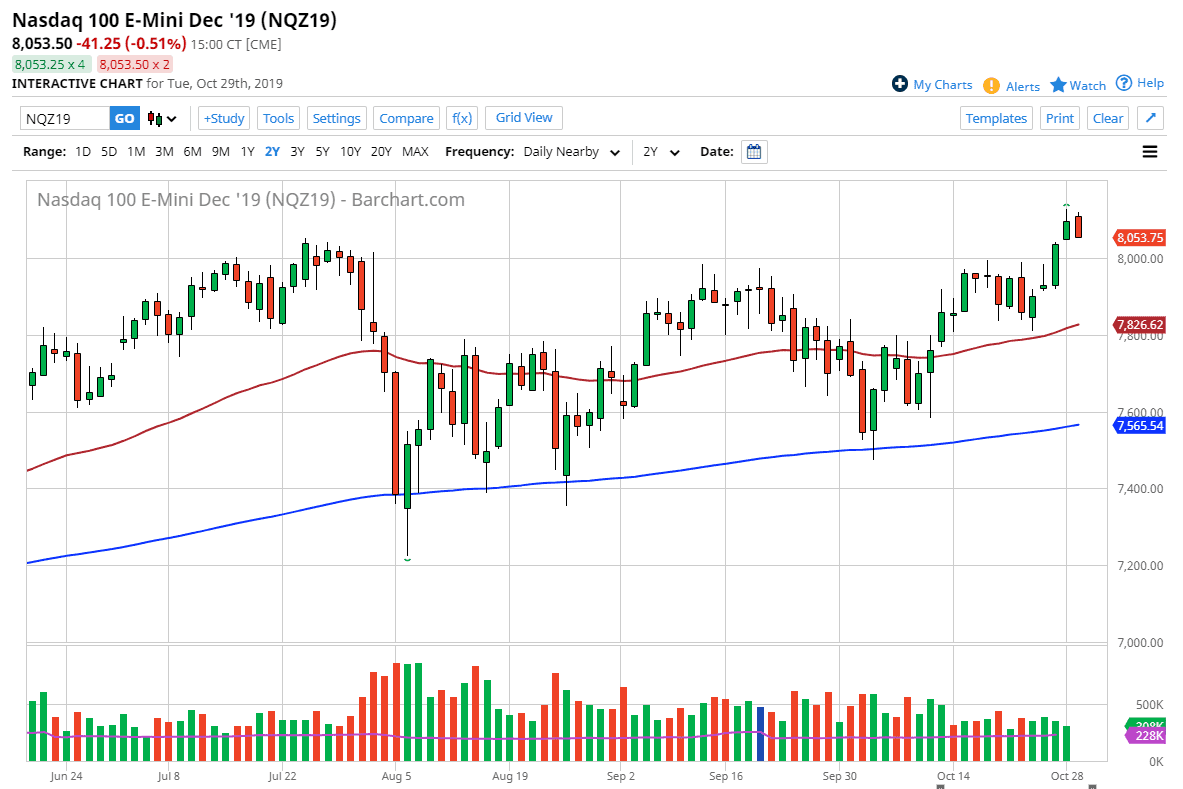

The NASDAQ 100 has pulled back a bit during the trading session during Tuesday, reaching towards the 8050 handles. The market is very likely to find support underneath, especially near the 8000 level as it is such a large, round, psychologically significant figure. At this point, it is a very important level as it had been significant resistance in the past, and now should become support.

The candlestick for the trading session on Tuesday was negative, but at this point in time it’s very likely that we will continue to go higher, continuing the overall uptrend. The 50 day EMA has offered support when we pulled back to that level and should continue to be thought of as supportive as well. I don’t have any interest in shortening this market considering that the trend has been so strong, and we have broken out so recently. Unless the Federal Reserve drops the ball on this announcement, it’s very unlikely to break down significantly.

To the upside, it’s very likely that the market will go looking towards the 8100 level, and then possibly the 8200 level. Looking at this market, it looks as if it continues to be a lot of buying opportunities on dips, and it’s likely that we will continue to see value hunters out there as the stock market has been very bullish over the longer term. Ultimately, this is a market that continues offer plenty of opportunities to go forward. With this, I believe that selling this market is going to be almost impossible unless of course the Federal Reserve breaks things down with an overly hawkish statement.

The 7800 level could offer significant support. But if it gives way to the selling pressure, then the market could go down to the 200 day EMA. At this point, the market would then be in very serious threat of change in the overall trend and go much lower. Ultimately, this is a market that will eventually offer value of that people are more than willing to take advantage of. Buying on the pullbacks will continue to be the longer-term move in this market for traders trying to take advantage of what has been one of the more obvious trends. With this, I anticipate that there should be plenty of interest in this market, and therefore we should continue to see an upward move.