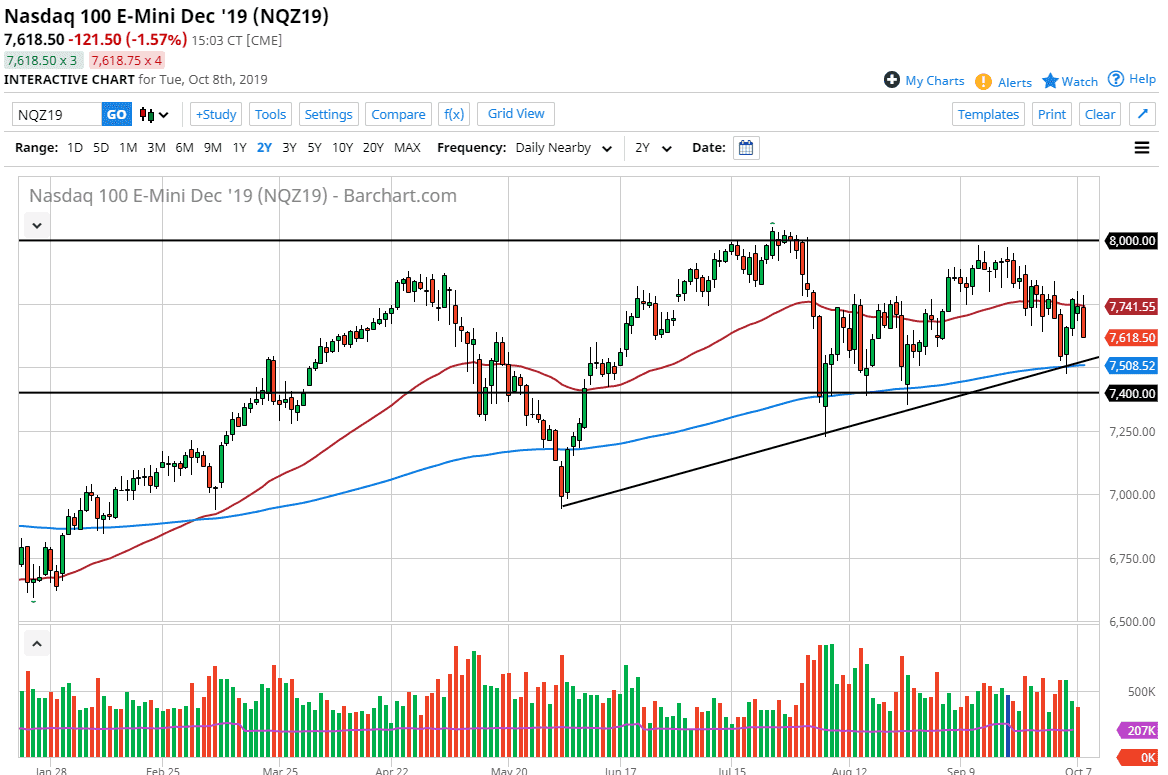

The NASDAQ 100 has initially tried to rally during the trading session on Tuesday, breaking above the 7750 level and perhaps even more importantly the 50 day EMA. However, we have turned around quite drastically to fall hard and enclosed towards the bottom of the range. This suggests to me that we are going to continue to go lower and go looking towards the uptrend line underneath, and of course the 200 day EMA which is at the 7500 level.

Ultimately, this is a market that shows plenty of support underneath, that I think it extends all the way down to the 7400 level. If we can break down below that level, it’s likely that the NASDAQ 100 will break down rather significantly. As the Americans and the Chinese are speaking this week, that could have a great influence on what happens with the NASDAQ 100 next, as most technology companies are so highly sensitive to US/China trade. With that, I suspect that we have probably more downward pressure than up, but the massive support underneath will take some type of catalyst to rip through.

We are still in and uptrend, although we would have recently made a slightly lower high, so at this point it’s probably only a matter time before we have to get some type of resolution to what’s been going on. The market seemingly has a different attitude every day, and therefore I suspect that short-term trades will probably be the best way to play this market as the markets continue to show quite a bit of confusion in both directions. All things being equal though, it’s very likely that we will continue to see an attempt to break to the upside, but ultimately I think that the resolution is coming rather soon, and once it does it should be somewhat remarkable.

If we do get some type of breakdown, we could see a 15% pull back rather quickly as it will essentially be the “floodgates opening” in a market that has been nervous for quite some time. To the upside, the move would probably be a bit more tempered, but if we were to ever break above the 8000 handle, the market is very likely to continue towards the 8500 level after that. You should also notice that the EMA and both the 50 and 200 day range are relatively flat and sideways.