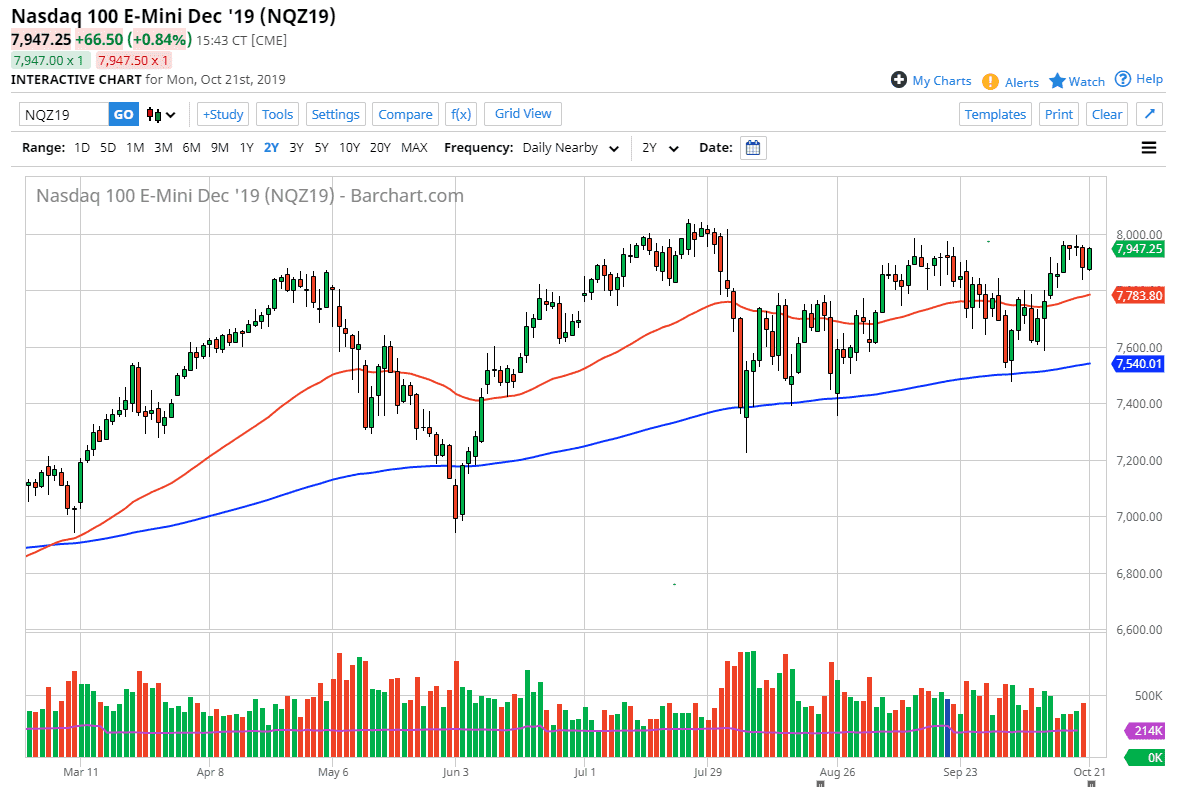

The NASDAQ 100 had a bullish session during the training session on Monday to kick out the week, but as you can see, we are still below the crucial 8000 level. This is an area that continues offer a lot of psychological resistance, but at this point it seems as if the market is trying to pick itself up and breakout to the upside. That of course will be something to pay attention to, the recent highs near the 8035 level, and a break above there could unleash quite a bit of bullish momentum. In the meantime, I look at short-term pullbacks as buying opportunities and most certainly the rest of the market seem to think so as well. The 50-day underneath should continue to offer plenty of support, but at this point I think it will struggle even break down below there.

If the market were to break down below there, then the next support level will be closer to the 7750 handles, and then the 7600 level. The market is in an uptrend, regardless of what’s happened over the last couple of weeks, and although it has been choppy, the reality is that the market is fighting as hard as he can to break out, with a tenacity that you should be paying attention to. The fact that it won’t give up the fight tells you most of what you need to know. If the market can breakout to a fresh, new high, the NASDAQ 100 is going to rocket higher. In fact, we will probably be looking at a move to the 8250 level initially and based upon the ascending triangle that seems to be forming, we could even be looking at a move to 8800 over the longer term.

Obviously, that will take some time to get there but as time goes on it’s obvious that the buyers are refusing to step away. With the Federal Reserve out there looking to cut interest rates and support the markets as much as they can, it’s likely that the NASDAQ 100 will continue higher. Remember though, this market is highly sensitive to the US/China trade situation, which at least seems to be calming down so that gives us a little bit of a tailwind as well. Selling is something I’m not interested in doing right now as it’s been a fool’s errand.