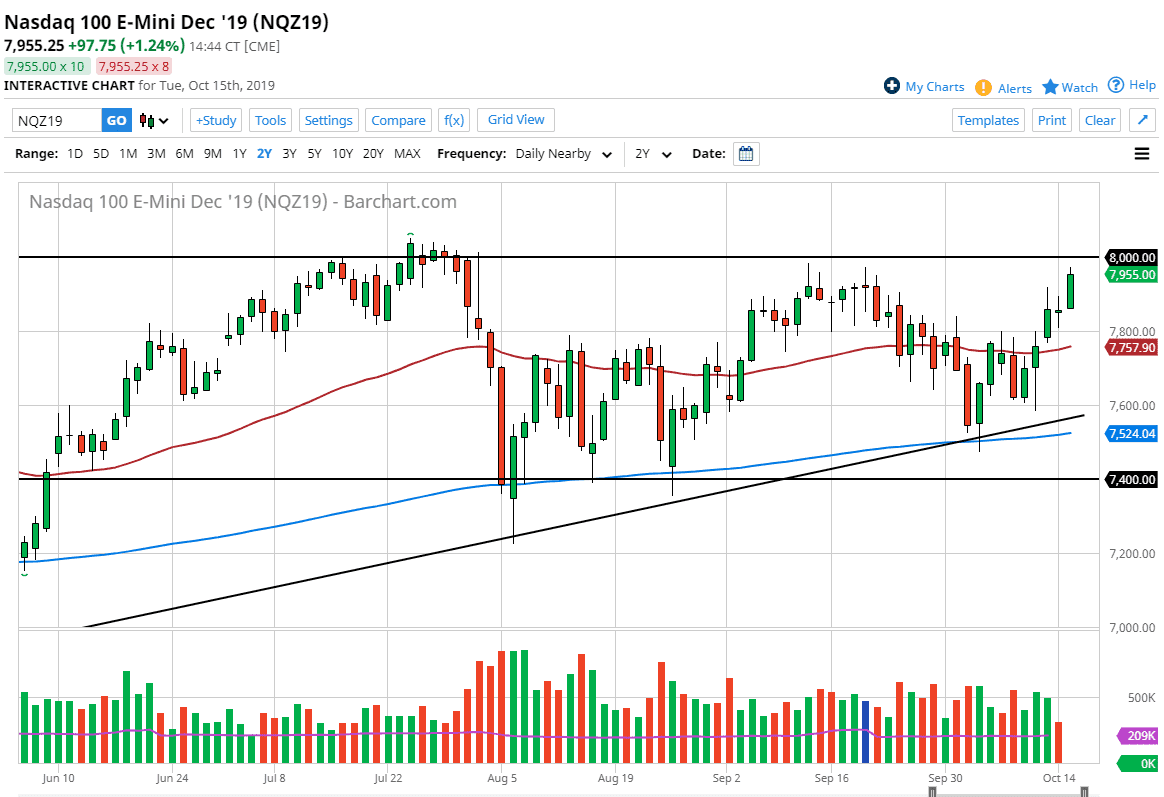

The NASDAQ 100 had a very bullish session during the day on Tuesday, breaking above the recent highs from the last couple of sessions, wiping out some sellers. At this point though, we are approaching the psychologically and structurally important 8000 handle, so it will be interesting to see whether or not we can power through that. The US/China trade talks offering nothing substantial, I’m the first to admit that I am a bit surprised to see this market up here.

That being said we are closing towards the top of the range for the day and that’s always a bullish sign. With that being the case I feel that we will probably go looking to test the 8000 level rather soon, possibly even today. Pullbacks at this point in time should continue to have plenty of buyers underneath, especially at the 7900 level and the 7800 level which is backed up by the 50 day EMA. After all, the Federal Reserve is willing to cut rates going forward and liquefy the markets. That’s all stocks need, as has been evident for the last decade. Earnings won’t matter much, but they could give a bit of a bump to the stock market if they are good. After all, it would be just another reason to buy.

Breaking below the 50 day EMA would be rather shocking, but there is still plenty of support below the 7600 level, the uptrend line, and of course the blue 200 day EMA. In other words, it’s not really a matter of whether or not you should be buying the NASDAQ 100, but more or less when you should be buying it. I do like dips, I don’t necessarily think that we are going to break the 8000 handle easily, but once we do this market should take off to the upside rather stringently. Ultimately, this is a market that I think does break out and continue to go towards the 8250 level, possibly even the 8500 level. Look for value, take advantage of it as we are in and uptrend, despite the fact that it has been so messy as of late. Selling is an option, at least not until we break down below the 200 day EMA which is 500 points below current trading levels and unlikely to be had anytime soon, barring some type of major macro event.