By the end of last week's trading, the price of gold suffered the strongest losses that pushed it towards the $1474 support, before settling around $1489 at the time of writing. Adding to the losses was the increased risk appetite among investors amid optimism that the United States and China will reach a trade agreement between them to stop tariff warfare between the world's two largest economies, which is adversely affecting the future of global economic growth. Investors' risk appetite was also heightened by the positive developments in Brexit after intense meetings last week, which resulted in the possibility of avoiding a no-deal Brexit.

The deal agreed between the United States and China is basically a trade-off. The United States agrees to delay implementation of China's import tariff increases on Oct. 15, in return China approves to buy US agricultural goods. Part of the deal was also some intellectual property and currency procedures and access to US financial services. The agreement will eliminate global growth concerns and may support the US dollar. The extent of support is hard to guess because the US dollar is also a safe-haven currency gaining support when the outlook for the global economy is negative.

The price of gold shrugged off the US dollar index's decline to its lowest level in 20 days, supported by expectations that US interest rates could be cut for the third time in 2019, when the Federal Reserve meets later this month.

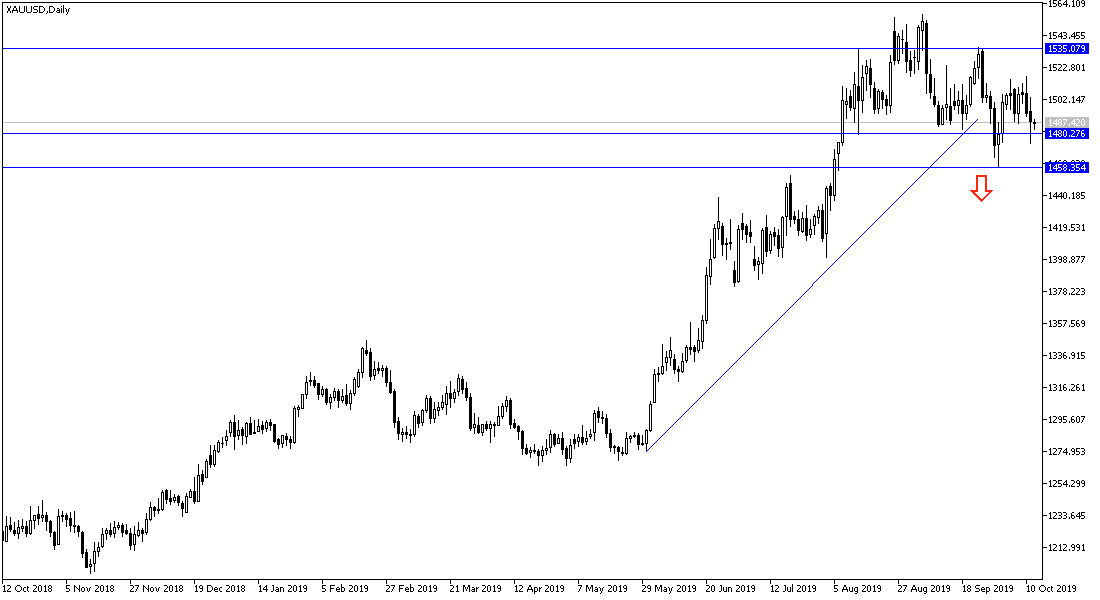

According to the technical analysis of gold: I still prefer to buy gold from every bearish level and at this time the most appropriate levels of buying will be 1478 and 1460 respectively. The US-China trade war is far from over and may last longer, and continues to be the main issue in the continuation of gold gains in the vicinity of $ 15000 psychological resistance, which remains key to the strength of the gold bullish trend. The closest resistance levels are currently at 1500, 1515 and 1527 respectively. Gold is one of the most important safe havens for investors in times of uncertainty and increasing global trade and geopolitical tensions will motivate investors to buy gold and thus increase its gains.

As for today's economic data: Today is a public holiday in the Japanese, Canadian and US markets. There are no significant issues from China other than the announcement of China's trade balance and industrial production in the Eurozone.