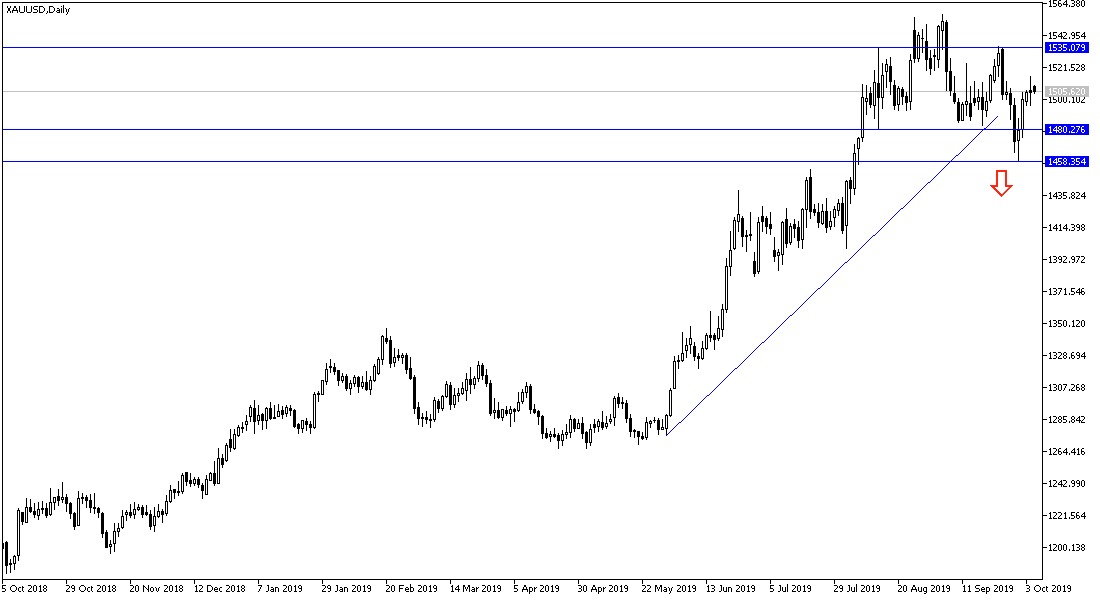

Last week's trading sessions were characterized by strong volatility of gold prices, as after Gold prices dropped to $1459, the lowest in almost 2 months, Gold purchases increased by investors to hedge against the renewed trade and political tensions around the world, which pushed gold prices to %1515 resistance during Friday's session, especially after the announcement of weak US jobs figures that negatively impacted the dollar and gave gold a new impetus to breach the $1500 psychological resistance. The mixed jobs data from the US Department of Labor increased the likelihood of a rate cut by the Fed and helped ease fears of a recession as well. It is well known that the relationship between the dollar and gold is inverse.

The US Labor Department's jobs report showed weaker-than-expected growth in September, while the unemployment rate unexpectedly fell to its lowest level in nearly 50 years. The report indicated that non-farm payrolls rose by 136,000 in September, compared with economists' estimates of an increase of about 145,000. Meanwhile, the increase in employment in July and August were revised to 166,000 jobs and 168,000 jobs, respectively, reflecting the addition of 45,000 more jobs than previously announced.

The monthly job growth rate is still slowing from 223,000 jobs in 2018 to 161,000 jobs so far in 2019. The Labor Department also reported that the unemployment rate fell to 3.5% in September from 3.7% in August, falling to its lowest level since it reached a similar rate in December 1969.

This week the US CPI data is expected to show a 0.1% rise in September, and the core CPI will rise 0.2%. Core CPI is expected to rise 2.4% year-on-year when data is released next Thursday at 13.30 GMT.

According to the technical analysis of gold: Stability around and above the $1500 psychological resistance will continue to support the strength of the uptrend. Above there, resistance levels 1515, 1527 and 1540 respectively will be bull’s targets, especially if the pressure on the US dollar continues and investor appetite for safe havens increases. On the downside, the closest support levels for gold today are 1500, 1492 and 1485 respectively. I still prefer to buy gold from every bearish level.

As for today's economic data: the US dollar as well as gold will react to comments by Federal Reserve Governor Jerome Powell later in the day, as investors try to find strong evidence about the future of US interest rates for the remainder of 2019.