The gold price was positive at the beginning of this week by moving towards the $1508 resistance, but the trend quickly shifted towards the $1489 support, as investors returned to take risks and abandon safe havens after the European Union gave Britain a three-month chance to reconcile with the opposition to find a formula an agreement between them to approve the Brexit agreement between Boris Johnson and the Union. The gold price was steady around 1493 dollars at the beginning of Tuesday's trading. Despite the recent performance, gold is still bullish in the medium and long term.

Tensions between the United States and China have slowly calmed, as the two sides work together to reach agreement on their trade war. Next month, US President Trump is expected to meet with Chinese leader Xi Jinping in Chile. If the two sides reach an agreement on the overall trade war, investor confidence will increase and gold will be adversely affected. October is not over and the Fed will announce its interest rate decision. We expect more significant fluctuation between both events in gold prices in the coming days. Expectations have become almost certain that the US central bank will be forced to cut US interest rates by a quarter of an additional point for the third time at this meeting to counter the overall weakness of the US economy sectors that has been evident in the results of economic data in recent weeks.

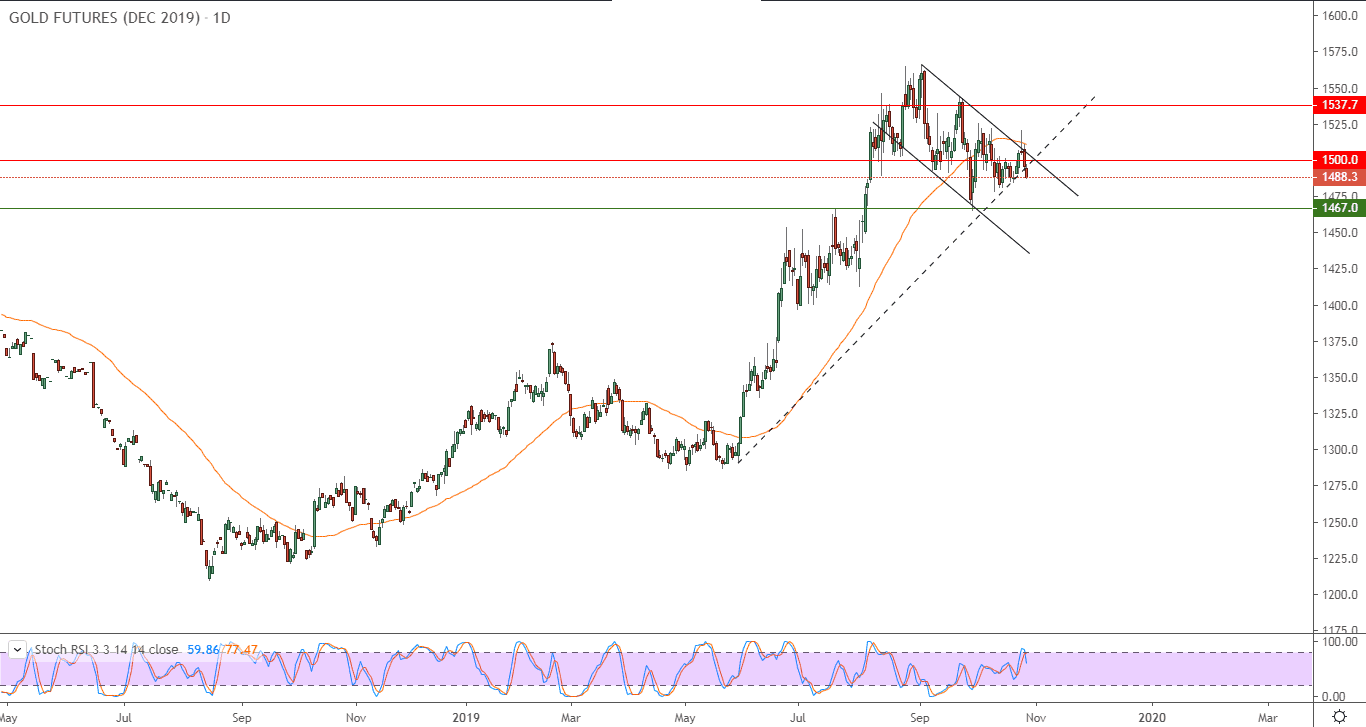

According to technical analysis of gold: The future of the continuation of the rise expectations depends on the gold prices breaking the $1500 psychological top, because it motivates investors to buy more yellow metal and thus test new record highs, with the nearest ones currently at 1515, 1527 and 1540 respectively, depending on the return of global trade and geopolitical tensions that motivates investors to use gold as an ideal safe haven in times of uncertainty. On the other hand, increased confidence and optimism will be negative for the price of gold and therefore may move towards support levels 1491, 1483 and 1475 respectively. Despite the recent performance, gold is still bullish in the long run.

As for the economic calendar data today: the price of gold will react to the release of UK data on net lending to individuals and mortgage approvals. And from the US, consumer confidence and pending home sales data.