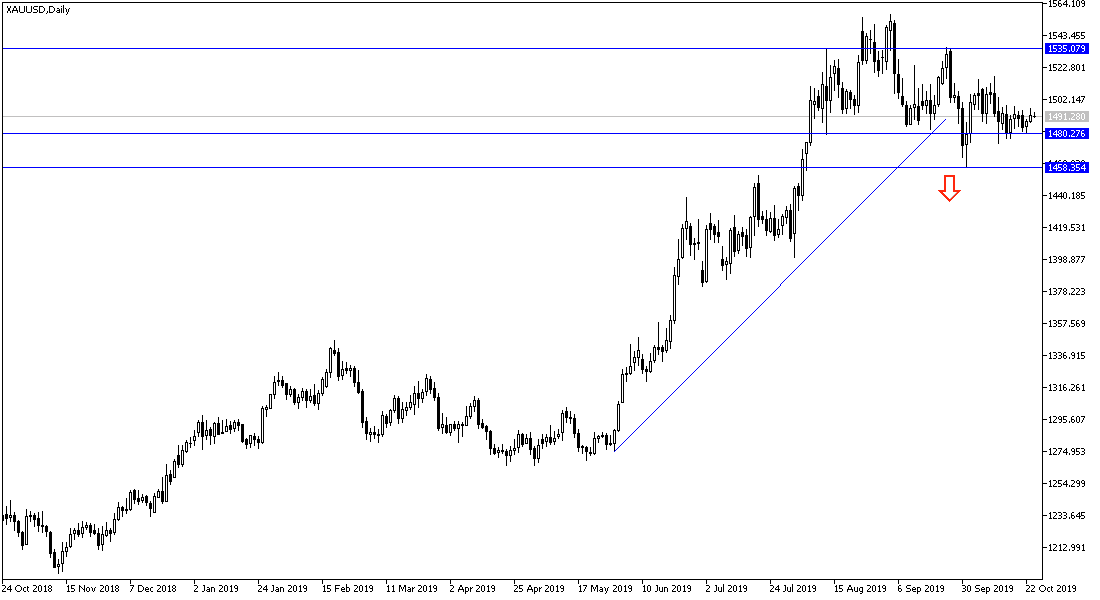

The limited performance in narrow ranges of the gold, and for several sessions, as evident on the daily chart, warns of a price explosion in one direction and will be stronger upward if moving towards psychological $1500 resistance. The price of gold rose to the $1496 level during Wednesday's trading for the first time in the last four trading sessions. This is amid political uncertainty, particularly about the Brexit, which boosted the yellow metal's gains. Gold has failed to return the $1500 resistance since the last time on the 10th of this month.

Positive developments in the course of trade talks between the world's two largest economies has not prompted investors to buy more gold bars. Yesterday, the US president said the United States is doing well in the ongoing trade talks with China. For Brexit, UK Prime Minister Boris Johnson won a partial victory in his quest for secession from the European Union after voting on the fast-track deal before the October 31 deadline by parliament, ahead of a vote that approved in principle the Brexit plan. The result means that Johnson should go to the European Commission for an extension of the exit date, raising some doubts about whether Brexit will be organized.

In light of the uncertainty and some decline in global stocks after mixed earnings reports for large companies; concerns about global economic growth are back, supporting gold.

Gold Price Technical Analysis: The $1500 psychological resistance is still the key to completing the price bullish correction and supports it to test the stronger peaks, the closest being at 1512, 1527 and 1540 respectively. Bulls’ failure in this direction may support strong selling, pushing the price of the yellow metal towards the support areas at 1488, 1475 and 1460 respectively. Taking into account that renewed trade and geopolitical concerns around the world will increase the gains of gold as one of the most important safe havens.

As for today's economic data: Gold will react to the release of PMIs for the manufacturing and services sectors of the Eurozone economies. Then the ECB's monetary policy decisions and the comments of its Governor Draghi, and US data on durable goods orders, jobless claims and new home sales.