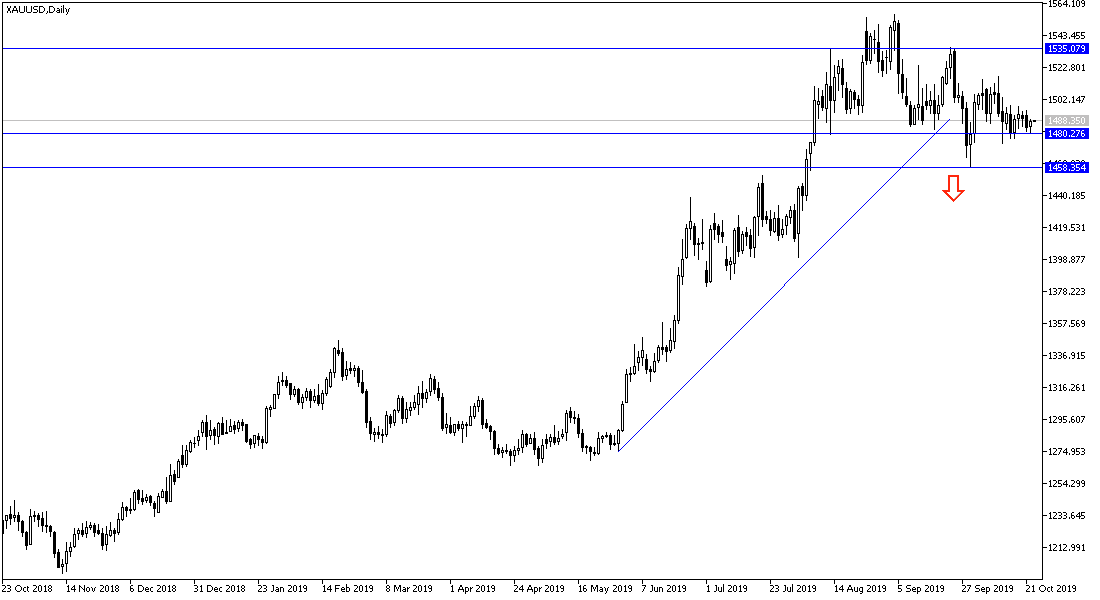

On the daily chart, it seems clear that the gold price hasn’t been moving much for several sessions as investors dispersed due to recent developments regarding the World Trade War and Brexit. The yellow metal is moving between the $1497 resistance and the $1481 support. Despite the recent partial agreement between the United States and China, the foundations of their trade dispute still exist and their tariffs remain high on each other's products. Investors are still waiting for optimistic statements between the two sides to be translated into comprehensive decisions and agreements to end the war that threatens to stagnate the global economy. For Brexit, the latest optimism is gradually evaporating as British Prime Minister Boris Johnson failed to persuade the British House of Commons to pass his final deal with the EU on their most important points of contention, the Irish border. The vote failure prompted Johnson to threaten of early elections unless parliament approves his plan.

The return of trade and political tensions around the world would favor the return of gold price gains, as gold is one of the most important safe havens for investors in times of uncertainty.

For economic news. The National Association of Realtors released a report showing current home sales fell more-than-expected in September. Existing home sales fell 2.2 per cent to an annual rate of 5.38 million in September after jumping 1.5 per cent to 5.50 million in August, the statement said.

Economists had expected current home sales to fall 0.7 percent to 5.45 million from 5.49 million the previous month. Despite the monthly decline, the report said existing home sales in September rose 3.9 percent from the same month last year. On Thursday, the Commerce Department is due to release a separate report on new home sales in September. New home sales are expected to fall 1.7% to 701,000 homes year on year in September after rising 7.1% to 713,000 homes in August.

According to the technical analysis of gold: Stability of performance means no change in my technical view, the strength of the upward rebound still depends on moving around and the above the $1500 psychological resistance, which paves the way to test new record highs of gold price to its highest level in six years. On the downside, stability below 1480 support will increase the bearish momentum of the yellow metal and support the move towards support levels at 1473 and 1460 respectively. I still prefer to buy gold from every bearish level.

Today's economic calendar is devoid has no significant announcements affecting the gold price trends.