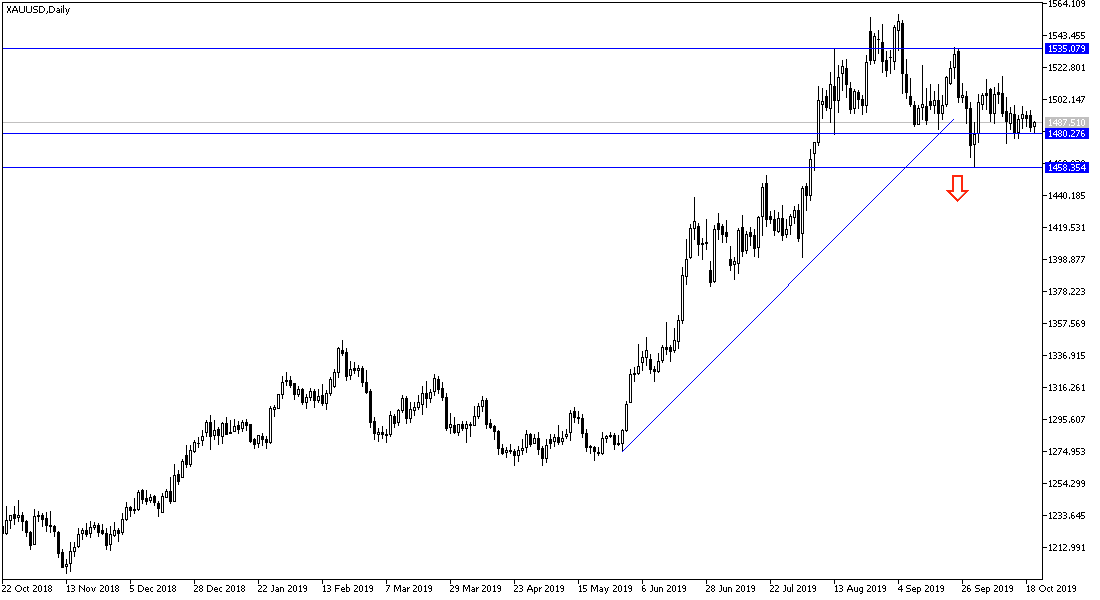

Gold prices dropped to the $1418 support in early trading on Tuesday before settling around $1487 at the time of writing. Yesterday, prices tried to breach the highest resistance at $1495, but failed to get strong support to penetrate the $1500 psychological resistance, which would have helped strengthen the bullish outlook. Investors risk appetite increased amid continued optimism that a messy Brexit could be avoided and EU-China trade talks could continue even after the recent partial agreement to avoid imposing more tariffs on their products. Before the week's trading, US President Trump said optimistically that more progress could be made and that everything was going well.

The yellow metal is one of the most important safe havens for investors in times of uncertainty. The price of gold will not strengthen without the return of trade and political tensions around the world. In less than 10 days we will have a major event when Britain will exit the EU with or without a deal as British Prime Minister Boris Johnson wishes. Ahead of this, we will be on schedule with the US Federal Reserve announcing its monetary policy decisions amid strong expectations that the Fed will cut US interest rates for the third time to protect the country's longest economic growth period. These expectations were reinforced by the continued weakness of the US economic data, notably inflation, retail sales, housing and industrial production. US industrialization is suffering from a prolonged trade dispute with the world's second largest economy.

According to the technical analysis of gold: I do not see any change in our technical outlook on gold, the strength of the bullish rebound still depends on moving around the highest psychological resistance at $ 1500, which paves the way to test new record highs of gold prices, towards its highest level in six years. On the downside, stability below 1480 support will increase the bearish momentum of the yellow metal and support the move towards support levels at 1473 and 1460 respectively. I still prefer to buy gold from every bearish level.

As for the economic calendar data today: From the UK, the public sector net lending will be announced. There is an important session for the House of Commons vote on the Brexit deal. From Canada retail sales will be announced. Then the announcement of existing US home sales.