Continued fears of the Federal Reserve for the future of the US economy amid continued trade wars led by the Trump administration consolidate expectations that the bank will continue to ease monetary policy to protect the economic growth of the country. This puts pressure on the dollar and in return halted the gold price losses to the $1477 support level, and is stable around the $1490 level at the time of writing, awaiting stronger incentives to move upwards again. The US central bank's Beige Book said the US economy grew at a slight to modest pace last month. They noted that business activity varied across the country. The report comes at a time when financial markets have witnessed strong and persistent weakness below expectations for US economic indicators, led by jobs and inflation, and recently retail sales fell to their lowest level in seven months.

The return of trade and political tensions around the world will undoubtedly be a strong supporter of gold prices to return for stronger gains. Yellow metal is the safe haven of choice for investors in times of uncertainty. The market is waiting now for third quarter earnings season from companies, and if earnings come in better than expected, as evidenced by the recent first batch, this will mean less pressure on the Fed to follow interest rate cuts, which will be positive for the US dollar. It now seems very likely that the Fed will move forward and cut interest rates at its October 30 meeting, but the long-term outlook depends on the performance of the economy.

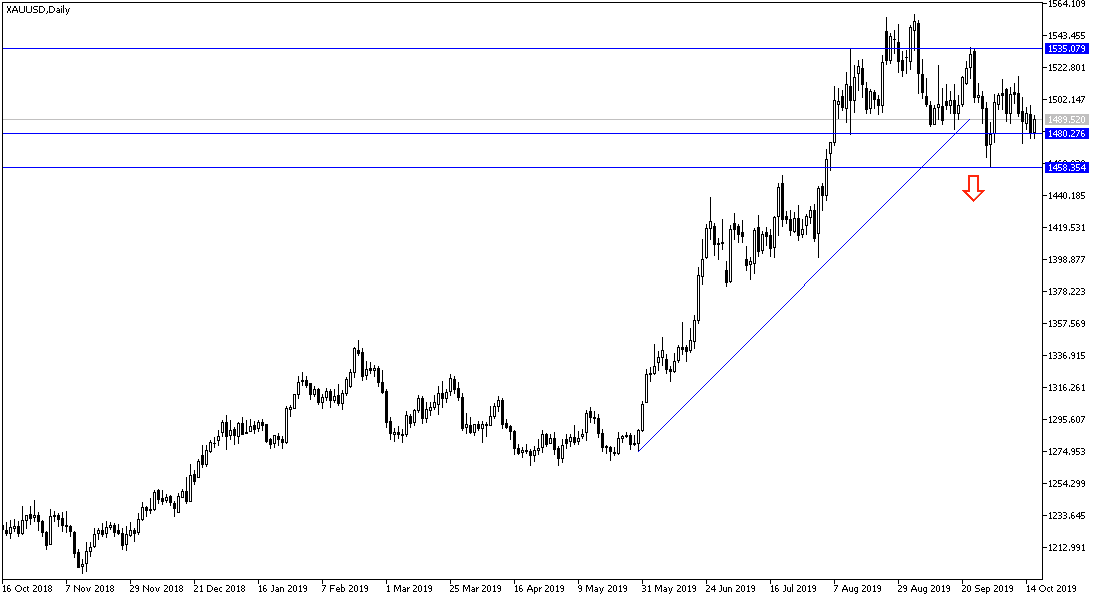

According to the technical analysis of gold: On the long term, the price of gold still has a bullish trend only, there will be a clear break of the bullish trend by moving around and below the $1460 support, as shown on the daily chart. On the upside, gold traders are waiting for the price of gold to move around and above the $1500 psychological resistance to prepare for new buying, pushing it to achieve stronger gains. The nearest resistance levels for gold are currently at 1500, 1515 and 1527 respectively.

As for the economic calendar data today: Gold prices will react to the release of a package of US economic data; the Philadelphia Industrial Index, the Unemployment Claims, Building Permits, Housing Starts, and Industrial Production data.