The rising risk appetite is undoubtedly hurting the price of gold as an ideal safe haven and has pushed it to the $1477 support level during Tuesday's trading session before settling around $1483 at the time of writing. The trade agreement between the United States and China and the possibility of reaching an agreement with the imminent exit of Britain from the European Union, boosted investor confidence. But at the same time, markets still want more confidence as the recent trade agreement between the world's two largest economies has not resolved all their differences, and what has happened is only a temporary lull and it is flammable at any time. The war has weakened expectations for the future of global economic growth, the latest being the International Monetary Fund (IMF) expectations that the world economy is set to grow at a slower pace in a decade this year amid weak industrial momentum and growing trade and geopolitical tensions. Growth this year will be the lowest since the global financial crisis of 2008-2009, the bank said.

The IMF predicted developed economies to grow by 1.7 per cent this year and next. Growth in the United States is expected to slow to 2.4 percent this year and 2.1 percent next year. In the Eurozone, growth may slow to 1.2 per cent this year and then rebound to 1.4 per cent next year. In the UK, a similar trend is expected. China's growth is expected to slow to 6.1 percent this year and 5.8 percent next year. Growth in India is slowing to 6.1 percent this year, but rising to 7 percent in 2020.

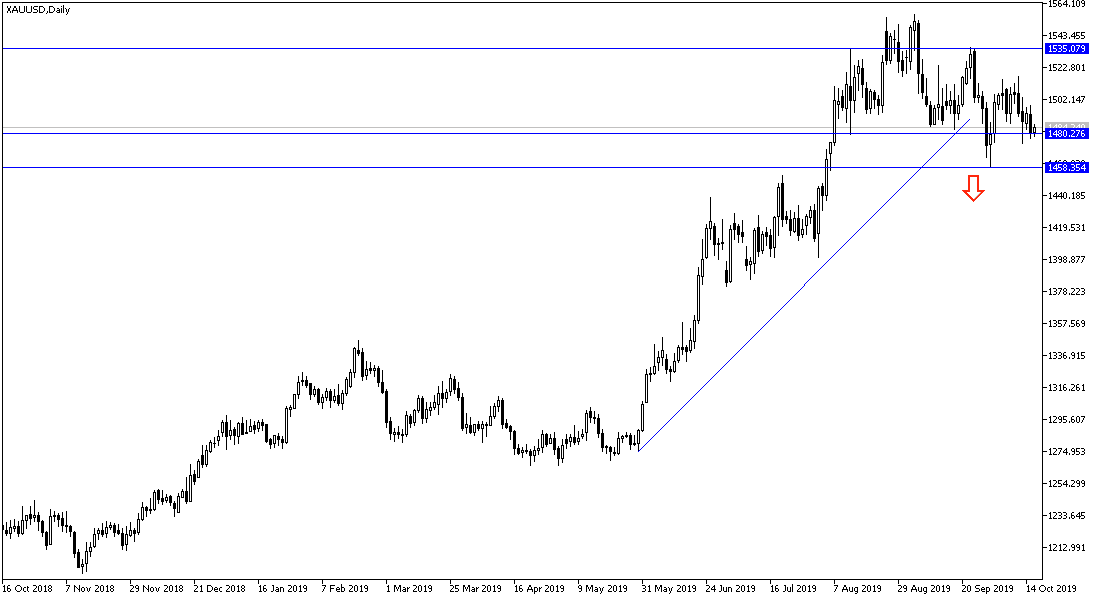

According to the technical analysis of gold: The return of gold price around and below the $1480 support will stimulate investors to consider new buying levels, and may be more suitable now at 1478, 1469 and 1455 respectively. I still prefer to buy the yellow metal from every bearish level. On the upside, a move above the $1500 psychological resistance is awaited to confirm the strength of the bullish move again.

As for today's economic data: Gold will react today with the release of UK and Eurozone inflation figures. From the US, retail sales will be announced. Taking into account that the return of global trade and geopolitical tensions will support the strength of gold again.