The gold markets have been all over the place during the trading session on Wednesday as the FOMC Statement came out as well as the press conference. While the Americans have cut interest rates by 25 basis points, further interest rate cuts aren’t necessarily a given, and as a result gold has not taken off like people would have thought. In fact, the initial reaction was lower, but we have seen the market stabilized since then which of course is a good sign.

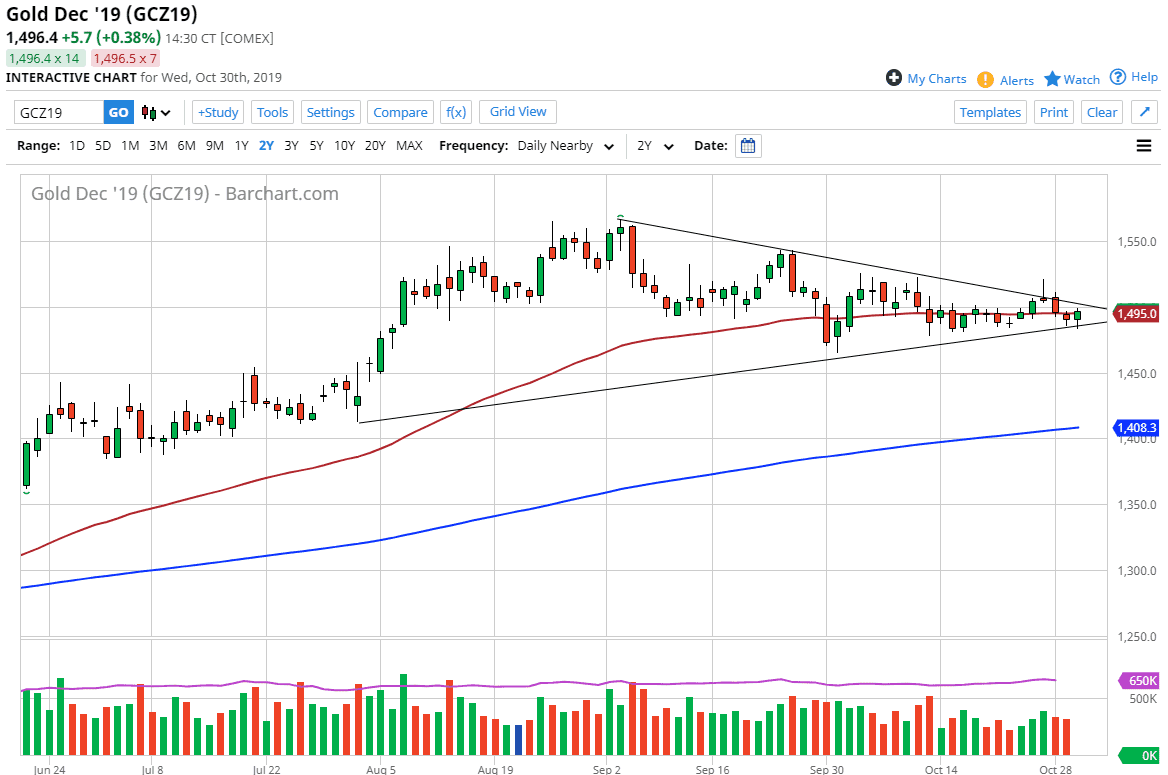

Looking at the longer-term chart, there is a significant uptrend line that the market is testing, just as there is a significant downtrend line just above. The market building up this momentum continues, as the market hasn’t necessarily decided what it wants to do next, and the 50 day EMA flattening doesn’t show much in the way of continuation. At this point, the market is very likely to continue to be very noisy, but eventually we should get some type of impulsive candlestick to get moving in one direction or the other.

If the market was to break above the downtrend line, the market could continue to go much higher, perhaps reaching towards the $1520 level, and then eventually higher than that. Markets do look likely to continue to go higher, but we need some type of catalyst in order to push the market to the upside. However, if the market was to break down from here it’s likely that the market goes looking towards the recent lows at the $1467 level, and that eventually the $1450 level.

All things being equal, markets have been bullish for quite some time, but have recently pulled back a bit to digest some of the massive gains that we had seen. The question is whether or not the uptrend line will continue to hold the market higher. If the market goes to the upside, it’s likely that the market will continue to find a longer-term grind to the upside. Ultimately though, if the market were to break down below the $1450 level, then we will test the 200 day EMA, possibly even lower than that. That will more than likely continue to be a major issue, but we don’t have a catalyst quite yet to make gold suddenly tanked. There are still plenty of geopolitical issues out there that could continue to push this market to the upside.