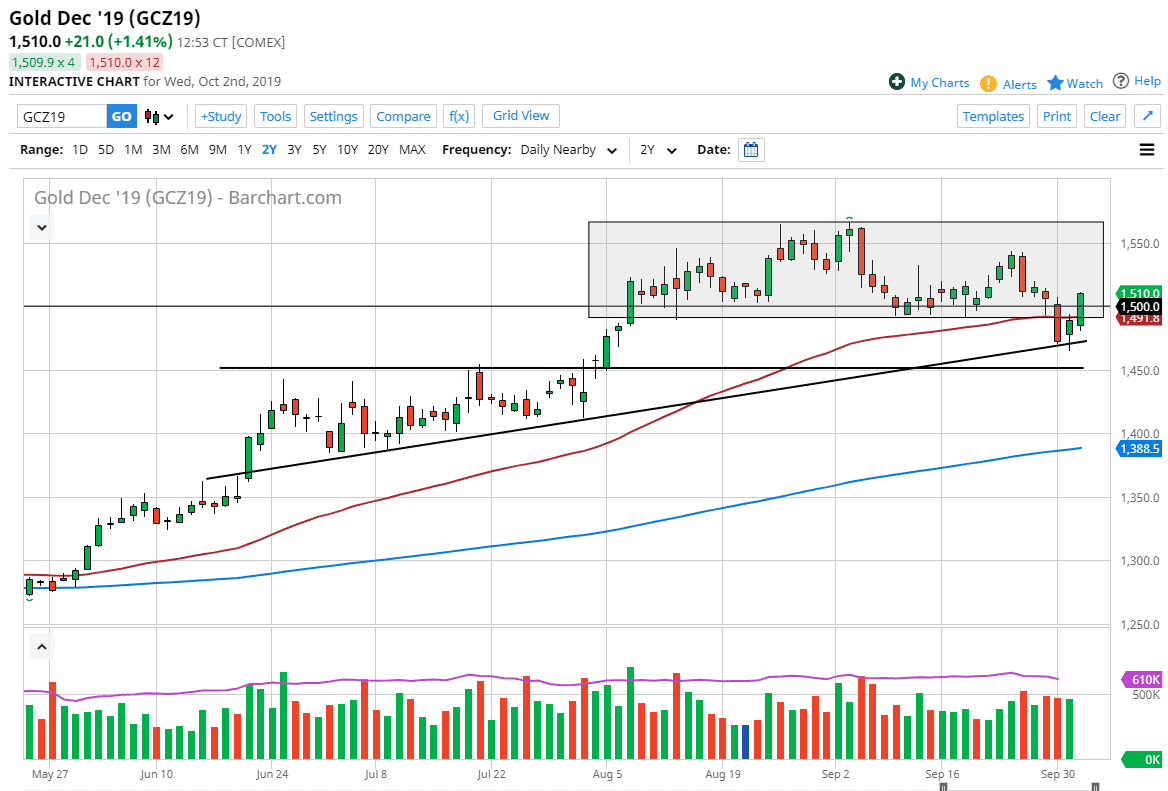

Gold markets have rallied quite nicely during the trading session on Wednesday, as we have broken back above the $1500 level which of course is a psychologically important victory. We are now well above the 50 day EMA and it looks as if the Gold markets are going to try to reenter the previous consolidation range. At this point, the $1540 level should offer resistance, but minor at best. Remember, a lot of this is going to be due to central banks around the world continue to cut interest rates and of course adding to quantitative easing. At this point in time, I think that is one of the great propellants of gold to the upside.

Beyond that, the market has been in an uptrend for some time anyway, so of course I prefer buying rather than selling. I believe that Gold will eventually reach towards the highs again and break out to the upside, looking towards the $1600 level. At this point, pullbacks are still to be bought as there is no reason not to go long at this point. The uptrend line underneath should continue to be respected, and now I believe the 50 day EMA will be. That doesn’t mean that we go straight up in the air but it does mean that short-term pullbacks should continue to offer a nice buying opportunities.

The candle stick is very bullish and the fact that we are closing towards the top of it says a lot about the overall strength as well. All things being equal I do think that shorting is all but impossible, because not only do we have interest rates dropping around the world and of course central banks doing things along the lines of quantitative easing, but we also have a lot of geopolitical risks out there that gold is quite often hedged against. At this point, I think there are plenty of reasons to think that gold continues higher, even as the US dollar strengthens. This tells me that the biggest driver at this point is probably recessionary and geopolitically. All things being equal, I’m a buyer of dips and I believe that we are not only going towards the highs but probably to fresh, new highs given enough time. Selling is all but impossible less something changes drastically, and I wouldn’t consider that until we break down significantly below the $1450 level.