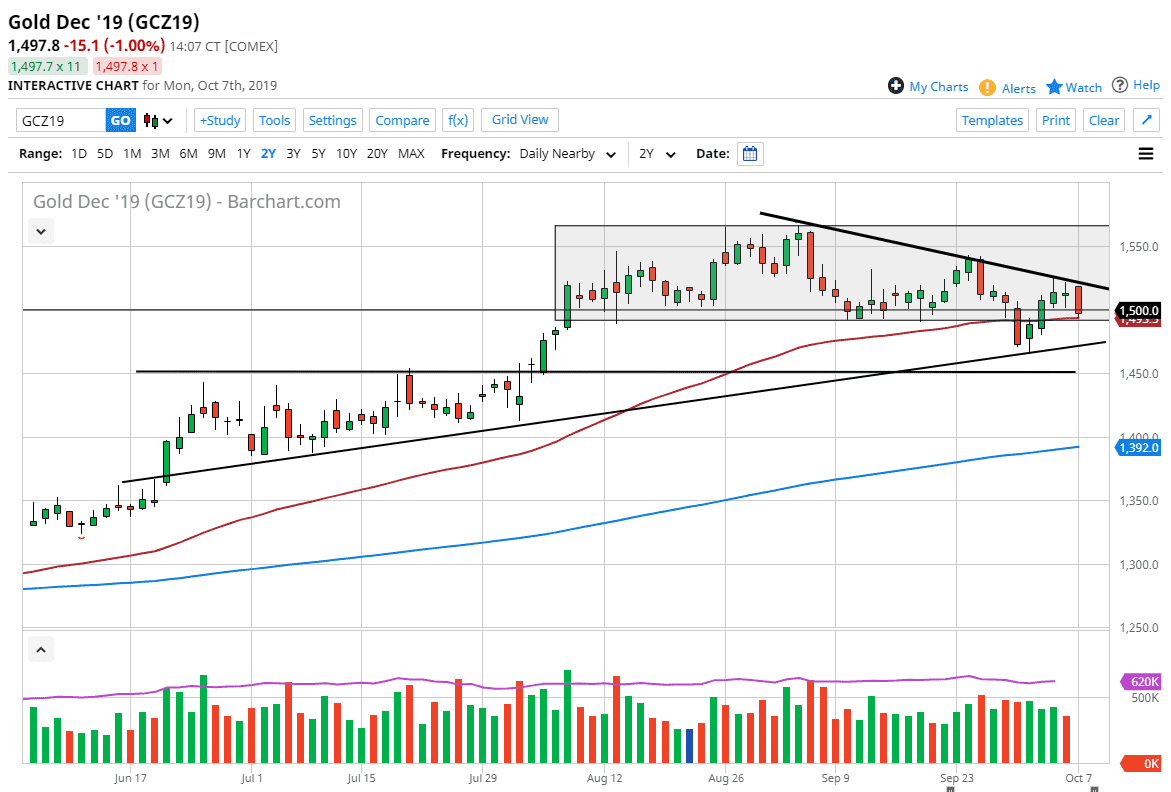

Gold markets fell hard during the trading session on Monday to kick off the week, crashing through the $1500 level. At this point, the market is dancing around the 50 day EMA which of course is an area that a lot of technical traders will be paid attention to. As you can see on the chart, I have a couple of trendlines drawn, one of which is a downtrend line, and another one which is an uptrend line and much more long term and it’s life. I do believe that at this point it is still more likely to find buyers than sellers, but gold should be looked at through the prism of a brisk asset.

Looking at the candle stick for the trading session on Monday, it’s very likely that Gold will continue to find pressure above. However, the uptrend line underneath should continue to offer plenty of buying opportunities and if we can recapture the $1500 level in the meantime, we could go looking towards the top of the trading session on Monday again. I think gold continues to see a lot of volatility in both directions, because the market is likely to find a lot of reasons to cause issues for both buyers and sellers of risk.

Looking at the chart, it’s obvious that we have been in and uptrend longer term, so I do think it’s only a matter time for the buyers take over again. With the geopolitical situations that the market is dealing with, the global growth slowing down, and then of course the Brexit, US/China trade situation, military tensions, and a million other things I’m not thinking of pushing gold back-and-forth. The US dollar of course is a major influence as well, as typically a falling US dollar is good for gold, unless of course is being bought for safety then both assets will go higher. Lately, that has been the case.

If we break above the downtrend line, it’s very likely that the market could go to the $1540 level, and then eventually the $1560 level. To the downside, if we were to break through the uptrend line, it’s likely that the market goes down to the $1450 level next, and then possibly even the 200 day EMA underneath which is closer to the $1400 handle. I do believe that buying this dip will probably work out, but we have been drifting lower as of late.