The GBP is trying to take advantage of any positive development on the Brexit track to avoid further record losses. Upon the UK government announcement of presenting their proposal to the EU to avoid a hard Brexit, the GBP/USD recovered from the 1.2204 support all the way to 1.2323 resistance. It settled around 1.2300 at the beginning of Thursday's trading, waiting for a European response to Boris Johnson's government proposals. Johnson's final offer is to abolish the European support proposal and set hard border between Northern Ireland and the rest of the United Kingdom, as it is for four years. The Irish foreign minister said this was unacceptable. In contrast, the European Commission always opposes a time limit for these boarders.

Johnson made the same mistake over and over again. He broke the basic rule of politics by continually underestimating his opponents, and his strategy was to have the Labor Party surrendering, then Parliament, and now the European Commission. The whole issue could be traced back to British politics, where parliament has ordered the prime minister to request an extension if no agreement is reached by mid-month. This was rejected by Johnson.

In terms of economic news. Survey data from IHS Markit showed that the UK construction sector continued to contract during September. Construction PMI fell to a reading of 43.3 in September from 45.0 in August. The result was expected to remain unchanged at 45.0. From the US, data from ADP showed that employment in the US private sector rose less than expected in September. Private sector employment increased by 135,000 in September, compared to estimates of an increase of about 140,000.

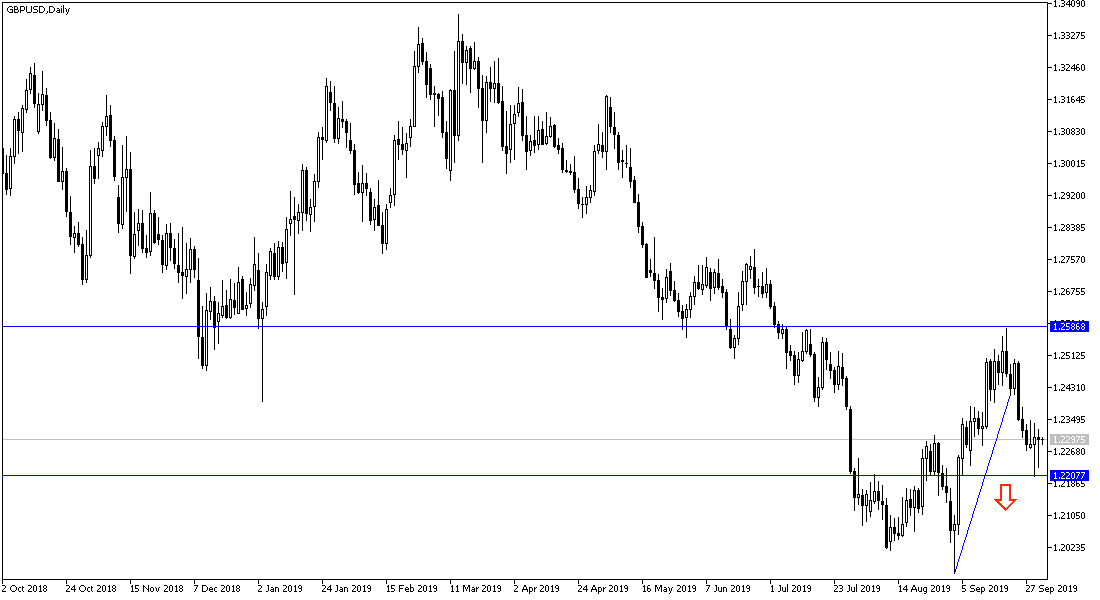

According to the technical analysis of the pair: In the long term, the GBP / USD price is still in a bearish channel and it appears that the key resistance level at 1.2320 remains intact, which prevents a significant rise. Bulls are targeting long-term profits at around 23.60% and at Fib 0.00% at 1.2446 and 1.2585 respectively, while bears - will look for profits to 76.40% and Fib 100% at 1.2145 and 1.2000 respectively.

On the economic data front today: The GBP is set to receive the release of the UK Services PMI. The dollar is set for the jobless claims, ISM services and US factory orders.