Amid strong bearish momentum for GBP/USD below the 1.2200 support, today the pair is awaiting important data and events that could strongly affect its performance. Updates on the Brexit are likely to further extend the GBP's weakness. The main reason for predicting the Pound's weakness is that the UK government is taking an increasingly tough stance in the Brexit negotiations, increasing the likelihood of leaving the bloc without a deal. Recently, there was a phone call between Prime Minister Boris Johnson and German Chancellor Angela Merkel, which confirmed that the deal had become "almost impossible". Early elections in the UK are still possible, and the hard exit seems to be certain now, just 22 days away from the October 31 deadline. All of this is enough for further GBP selling.

On the American side. The minutes of the Fed meeting indicated that most participants in the meeting believed that the 25bp rate cut announced after the September meeting was appropriate, despite notable opposition. Members who favor modest rate cuts argued that the move would insure against further downside risks from weak global economic growth and trade policy uncertainty, with two members noticing that monetary policy measures affect overall spending. Kansas City Fed President Esther George and Boston Fed Chairman Eric Rosengren preferred to keep the current interest rates unchanged. The bank's view that market expectations for future US rate cuts were exaggerated.

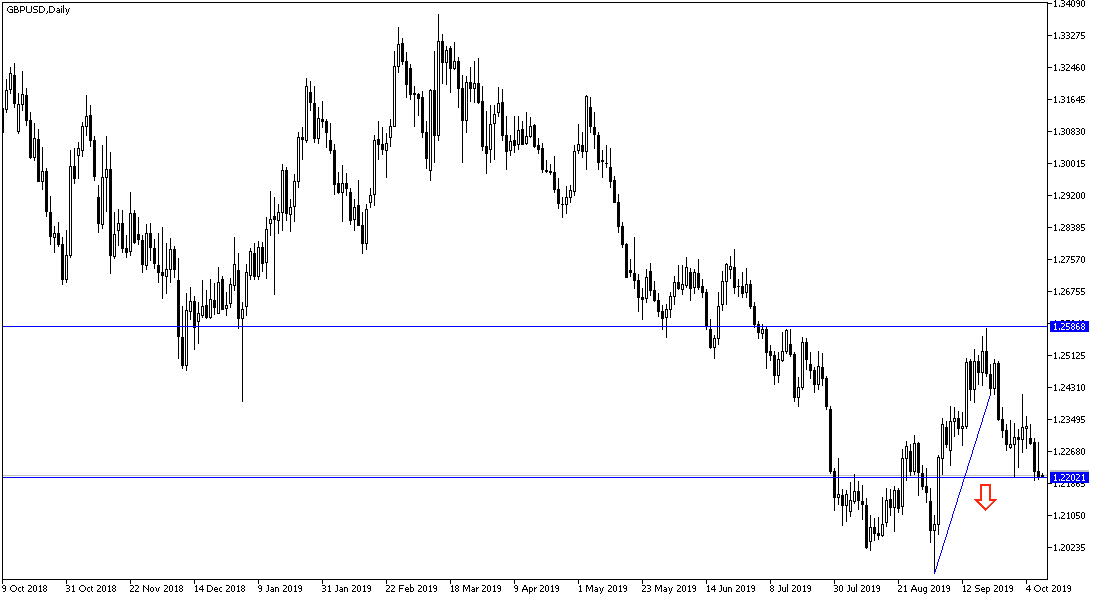

According to the technical analysis of the pair: On the daily chart below, the GBP / USD performance, it appears that there is a clear downward pressure, since the pair gave up gains above the 1.2500 resistance since September 20. Stability below 1.2200 support consolidates downward pressure and foreshadows a move towards support levels of 1.2165, 1.2090 and 1.2000 respectively. The upward correction will not strengthen again without moving towards and above 1.2500 resistance. This will not happen without positive developments on the ground for the Brexit crisis.

As for the economic calendar data today: The Pound will be on schedule with the release of the UK's GDP, along with manufacturing production and trade balance of goods. From the US, the consumer price index figures to measure US inflation as well as jobless claims are expected.