For three trading sessions in a row, the price of the GBP/USD was trying to rebound up from the threshold of 1.2800 support, but gains did not exceed the 1.2930 resistance, where it is stable in early trading on Thursday. The pair failed to make stronger gains despite yesterday's Federal Reserve announcement of a quarter-point cut in US interest rates for the third time in 2019. The Pound's performance is constrained by the Brexit developments, as the UK is heading for early elections to break the deadlock that dominates the Brexit process. With Boris Johnson and his government failing to pass his agreement with the EU, and amid a chronic conflict with the opposition, Johnson was forced to submit a request to the block to extend the Brexit deadline, scheduled for October 31, 2019, and after consultations that didn’t take long, the European Union agreed to extend the Brexit date by another three months to January 31, 2020.

On the US side. The economy is experiencing its 11th year of growth, driven by consumer spending and a strong, but recently weakened, labor market. By cutting interest rates, the Fed tried to counter growing uncertainty over President Donald Trump's trade disputes, a weak global economy and a downturn in US manufacturing.

The third rate cuts partially reflected the four hikes the Fed made last year in response to the strength of the economy. This was before the increased global risk led the Fed to change course and begin to ease credit to encourage more borrowing and spending. Powell said the central bank's interest rate cut was a kind of insurance against risks to the economy. Powell noted similar interest rate cuts in 1995 and 1998.

The Federal Reserve is also considering the consequences of lower inflation expectations. This is a problem for the Federal Reserve, because its preferred inflation index has been stuck below the 2% target for most of the past seven years.

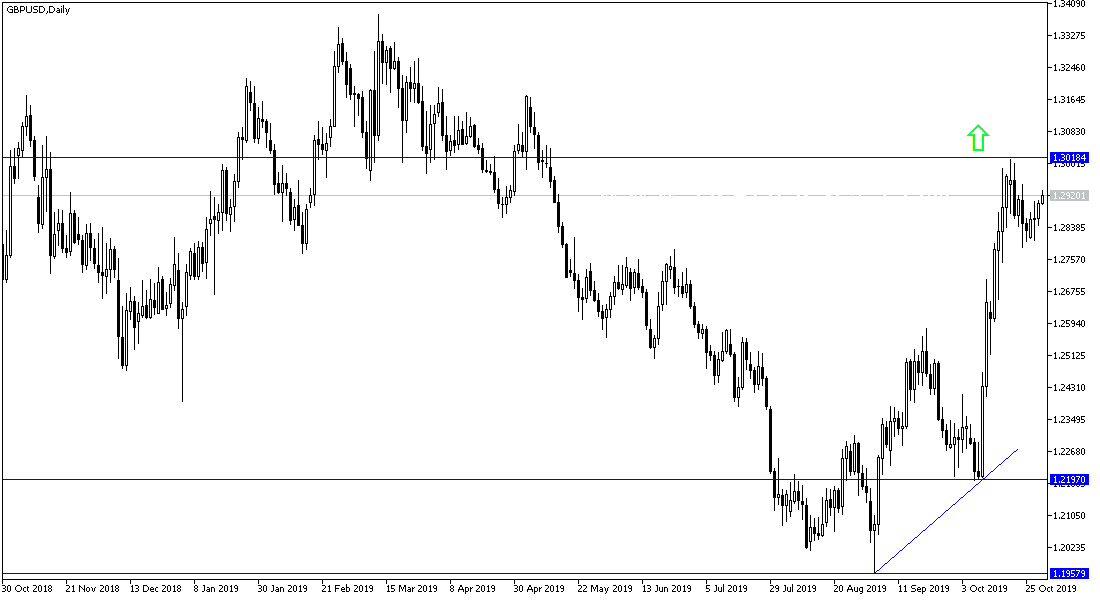

According to the technical analysis of the pair: GBP/USD is still moving within a prominent bullish channel on the daily chart, and as mentioned in recent technical analysis, the 1.3000 psychological resistance will support the strength of the upward correction and stimulate the pair to test stronger bullish levels. On the downside, any attempt for the bears to take the price below the 1.2800 support would be a strong and direct threat to the current bullish outlook. It should be borne in mind that Brexit developments will determine the course of the pair in the coming period.

As for today's economic data: The focus will be on the US session data with the release of the Federal Reserve's preferred inflation gauge, the personal consumption expenditure price index, the average US citizen's spending and income, the jobless claims and the cost of employment index.