Outlooks for Brexit are still uncertain, and the sell-off in sterling pairs is increasing, the GBP/USD share was a return to the 1.2204 support, the lowest level in almost 1 month, before recovering to 1.2310, supported by the negativity of the US Manufacturing sector. Regarding Brexit, UK Prime Minister Johnson continues to insist that the UK will leave the EU on 31 October, regardless with or without an agreement. Before being suspended illegally (according to the UK High Court ruling), Parliament approved a request from the Prime Minister to request a delay of three months from the current exit date if no agreement was reached. The prime minister has indicated that he will not follow parliament's advice, paving the way for a constitutional struggle between him and the opposition.

On the economic side. The UK Manufacturing PMI rose to 48.3 from 47.4. This was better than expected, but does not change anything physically. The manufacturing sector remains in deflation as long as it is below the 50 level. Uncertainty about Brexit remains, and the market seems more convinced of a rate hike next year, than the way of Brexit. It is expected that Prime Minister Johnson to send a new text to Brussels later includes new proposals for the Irish border. Initial reports indicate that it is seeking customs clearance on both sides of the border.

From the US, the ISM Manufacturing PMI fell to 47.8 in September from 49.1 in August, and any reading below the 50 level indicates a contraction in manufacturing activity. Economists had expected the index to rise to 50.1. With the unexpected drop, the index fell to its lowest level since it hit 46.3 in June 2009, the last month of the Great Recession.

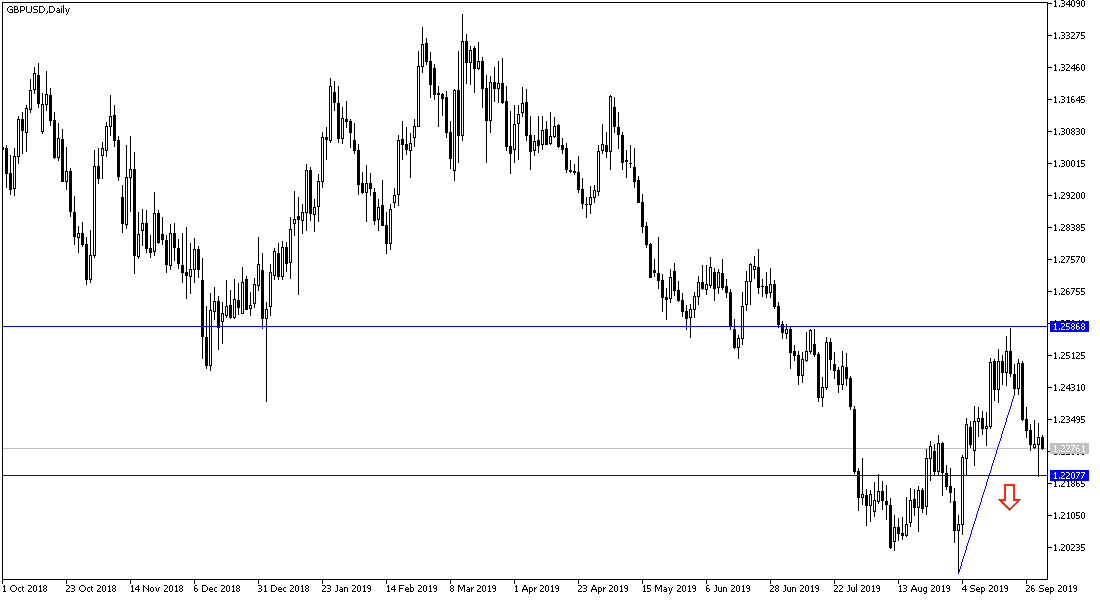

Technically, any gains in the GBP/USD will remain selling targets as long as the future of the Brexit is uncertain, and the nearest resistance levels are currently at 1.2375, 1.2445 and 1.2535 respectively. Conversely, any move below the support level of 1.2200, and according to the performance on the daily chart below, will increase the bearish momentum of the pair. Time is running out and the official Brexit date is approaching and the views between the EU and Britain are still far apart and everyone fears the de facto Brexit will be without agreement.

As for today's economic data, today's economic calendar will focus on the release of the UK Construction PMI. From the US, the ADP survey for the change in the number of nonfarm payrolls and crude oil inventories.