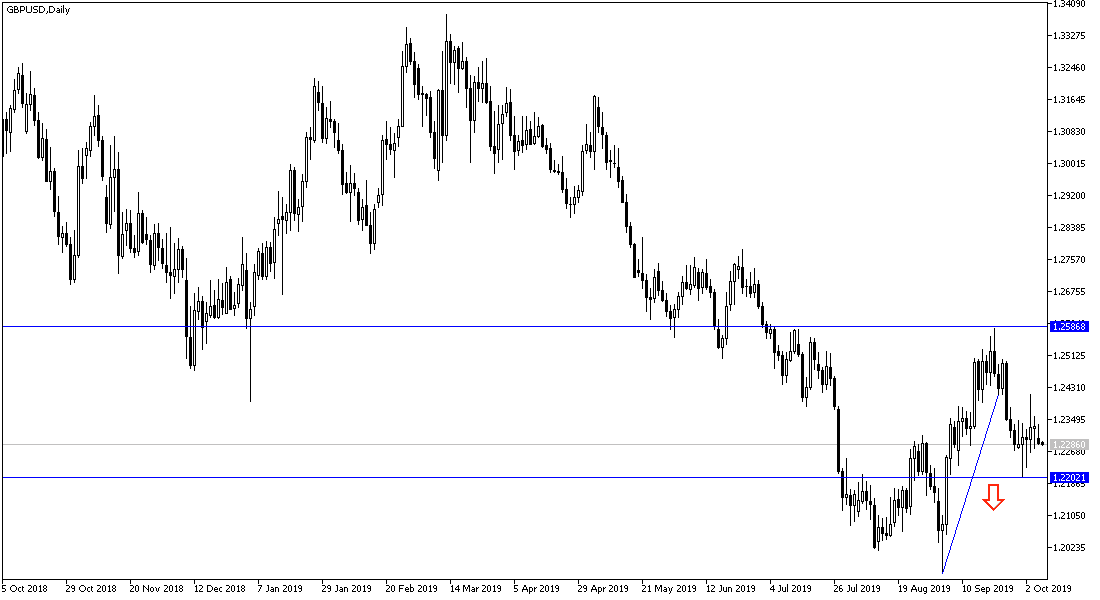

Beginning this week, the GBP/USD pair continued its bearish correction to the 1.2286 support, and the highest price during yesterday's session was the 1.2336 resistance. What further supported the bearish rebound was the US dollar strength against other major currencies, and the cautious anticipation of GBP investors from the developments of the hard Brexit file Impact on sterling course. The pair did not receive any reaction from the US Nonfarm Payrolls report, which, despite the decline in nonfarm payrolls and average hourly earnings, was highlighted by the US unemployment rate drop to a new multi-decade low during September. The report eased concerns about the current state of the US economy, but financial markets are still betting that the Fed may cut interest rates for the third time at the end of the month. An escalation of the trade dispute with China in October would make that more likely.

The recent weakness in US economic data, coupled with another escalation of the trade dispute with the world's second largest economy, could heighten concerns about US economic performance that enabled the Fed to raise interest rates four times in 2018 while the rest of the world was in recession, prompting other central banks to ease monetary policy. Interest rate dynamics have been the main driver of the rally that has pushed the dollar index to multi-year highs and many other currency rates to multi-year lows.

For the Brexit file, the UK government told a Scottish court last week that it would follow a law passed by parliament requesting a postponement of Brexit if a deal is not reached within two weeks (19 October). At the same time, Prime Minister Johnson and government officials still prefer to "die in a trench rather than ask for an extension." The Prime Minister of Ireland suggested over the weekend that the UK make a new offer by the end of the week. Most European officials saw last week's proposal as insufficient in its current form. A Bloomberg study showed that the median expectation is that the pound will fall by almost 10% when Britain exits the bloc without a deal.

According to the technical analysis: The attempts for a bullish correction for the GBP / USD still need a stronger momentum to be completed, and will not happen without a positive development on the ground for the future of Brexit, which may first push it to the resistance levels of 1.2390, 1.2475 and 1.2600 respectively. On the downside, the closest support levels are currently 1.2245, 1.2180 and psychological support 1.2000 respectively.

As for today's economic data: The Pound will be influenced by comments from Bank of England Governor Mark Carney. From the US, we will have the Producer Price Index and remarks by Federal Reserve Governor Jerome Powell.