British Prime Minister Boris Johnson has presented his government with a final proposal to the European Union (EU) on the future of his country's exit from the European Union, which is officially scheduled for October 31. GBP/USD moved positively to the 1.2412 resistance during last week's trading session before closing around 1.2332, pending the European response on Johnson's offer, and expectations remain high that the block will not accept the British proposals, which will further complicate the conflict between Johnson and the opposition, who are demanding an extension of the exit date if the government does not agree with the union before the Oct. 19 deadline. Time is running out for everyone and the crisis is worsening, and the most prominent expectation now is the no-deal Brexit, which will be catastrophic for all parties.

Chart studies still indicate that the Pound may continue to weaken. We are in the midst of a new critical week for Brexit negotiations, and this could lead to a two-way volatility for the Pound. Investors are on a caution lookout to see how Prime Minister Boris Johnson is leaving the EU without an agreement on October 31. The Pound may be supported by news that Johnson will send a letter to the EU requesting a postponement of Brexit if the Brexit deal is not agreed by October 19. This means that the government intends to abide by Ben's law requiring the prime minister to extend Britain's exit from the EU if a deal is not passed by parliament on October 19.

The UK recently put forward an alternative proposal to resolve the Irish “support” problem, but the initial reaction of EU negotiators and key stakeholders has not been very positive, noting that the two sides are still far from agreement. In this regard, the Prime Minister of Ireland, Leo Faradkar, said that the current UK proposals "do not form the basis for deeper negotiations".

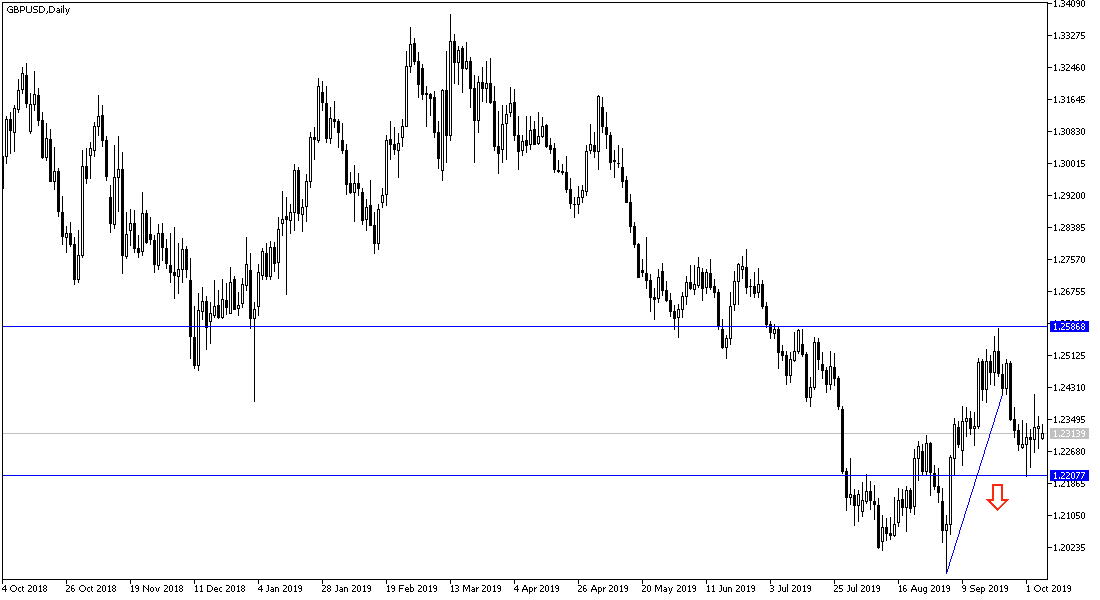

According to the technical analysis of the pair: Despite the recent GBP / USD gains, it is still bearish in the long run, and any stronger gains for the pair will be new targets for sale by traders. The nearest resistance levels are currently at 1.2410, 1.2500 and 1.2585 respectively. On the downside, any move below 1.23 support will negatively impact the upside correction as it will support the move towards support areas at 1.2245, 1.2180 and 1.2090 respectively.

As for today's economic data: From Britain, we have the Halifax House Price Index. From the US there will be comments from Federal Reserve Governor Jerome Powell.