The European Union has been given a three-month deadline as a new date for Brexit, until Jan. 31, instead of the earlier date of Oct. 31. GBP/USD reaction was limited as its gains did not exceed the 1.2875 resistance, before settling around 1.2850 in early trading on Tuesday. The reaction was weakened by the continuing political conflict between the British government and the opposition. British Prime Minister Boris Johnson failed to pass legislation allowing him to hold early elections. Lawmakers voted by 29 votes to 70 in favor of Johnson's proposal for December 12 elections - less than a two-thirds majority of the 650-member parliament he needs to pass.

However, the election seems inevitable before the next election, scheduled for 2022, if Britain is to move from a political stalemate as Johnson wants to get Britain out of the EU as soon as possible, but his country's parliament is preventing his goal.

Johnson said he would try again on Tuesday, using a different procedure: a bill that only needs a simple majority to pass. "We will not allow this paralysis to continue," Johnson said. "One way or another we have to move directly to the elections." Earlier, he accused his opponents of betraying voters' decision to leave the EU by thwarting his government's plans to fulfill their will. It was the third time the Brexit deadline had been changed since British voters decided in a 2016 referendum to leave the bloc.

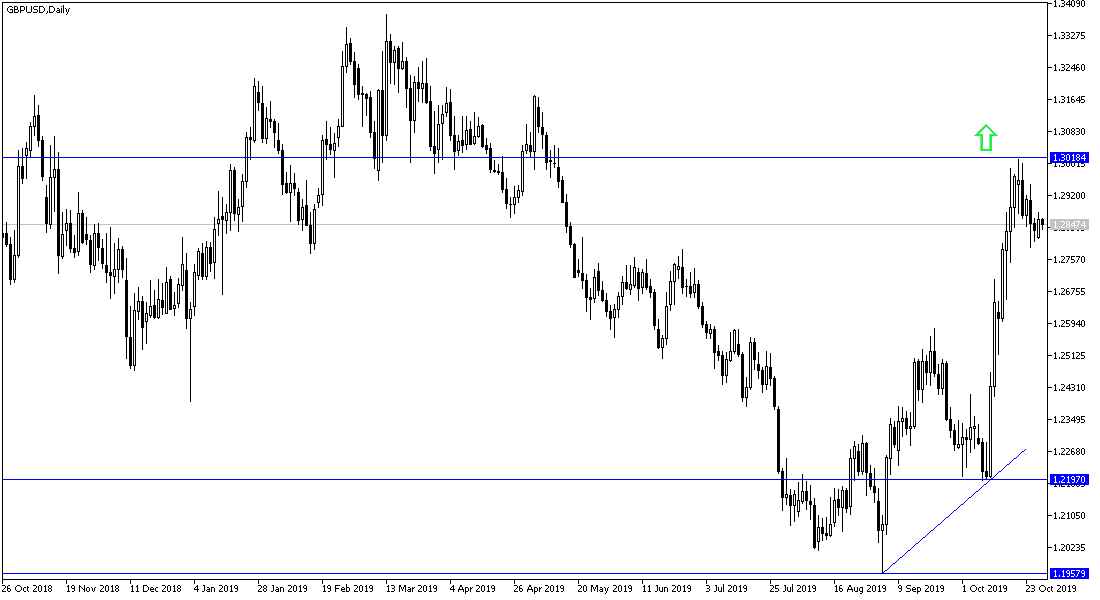

GBP/USD remains volatile and droped 1.1% last week. The Brexit developments still have a strong impact on the Pound's movement. With the October 31 deadline and uncertainty over the possibility of an exit deal, the GBP may not be attractive to investors this week.

According to the technical analysis of the pair: I still hold on to the previous expectations, the attempt of GBP/USD to break below the 1.2800 support will strengthen the sale and thus the pair loses much of its recent gains and then psychological support 1.2600 may be the nearest short-term target. Luster will not return without stability above 1.3000 psychological resistance again. Brexit developments are fast and many, so a lot of caution is advised before trading on the GBP.

As for the economic calendar data: From Britain, the house price index, money supply, mortgage approvals and net lending to individuals will be announced. From the US, consumer confidence and pending home sales data will be released.