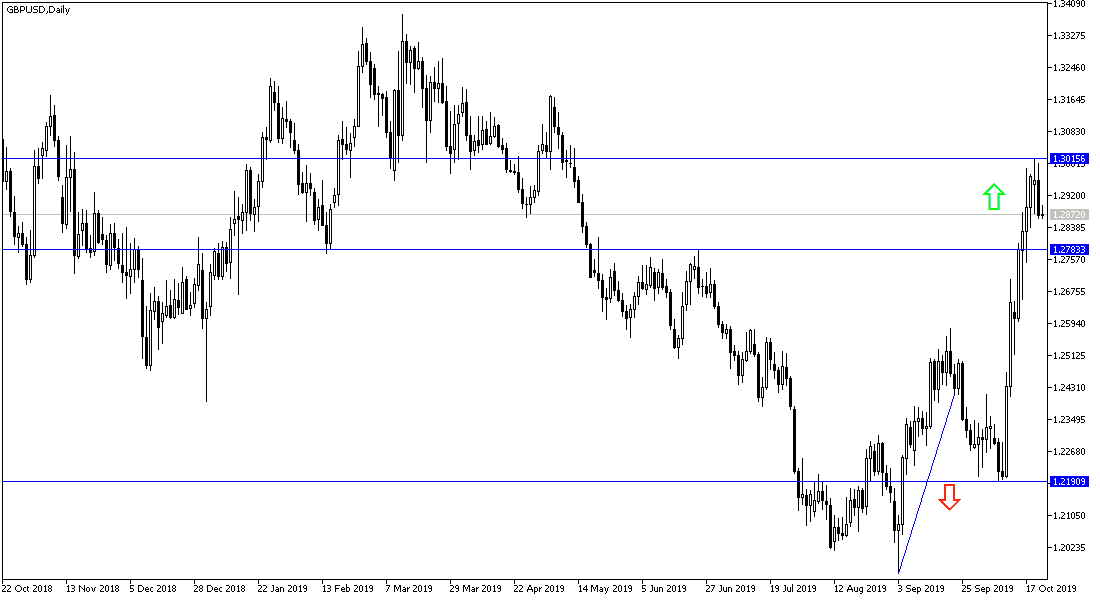

The Pound began to lose its recent gains that came in based on hopes of reaching an agreement to end Britain's chaotic exit from the European Union. After eight bullish trading sessions, which pushed the GBP/USD towards the 1.3012 resistance, the pair's highest level in five months, the pair resumed its downward correction to the 1.2861 support of during Tuesday's trading session, as British Prime Minister, Boris Johnson, failed to pass the latest Brexit deal with the Union through the House of Commons. The official threatened to hold early elections if parliament refused to approve, which has been long overdue since the resignation of Theresa May. British Prime Minister Johnson concluded a deal with the European Union last week in which a red line insisted by the previous government was abandoned - there would be no hard borders in the Irish Sea, so Northern Ireland would not be separated from the rest of the UK.

The UK parliament is preparing to debate and vote on Johnson's Brexit deal, after being rejected twice. Lawmakers will vote on the so-called Johnson pullout deal and then on the government narrow timetable for approval of the legislation. Speaking to the European Parliament in Strasbourg, European Council President Donald Tusk said he would decide on the UK's request to postpone Brexit in the coming days.

In contrast, data from the Office for National Statistics showed that the UK budget deficit for September increased for the first time in five years. Net borrowing from the public sector excluding banks rose by £0.6 billion from last year to £9.4 billion in September. It was the first annual increase in September for five years. Borrowing in the current fiscal year was £40.3 billion, with an increase of £7.2 billion from the same period last year.

The results of the survey released by the Confederation of British Industry showed that manufacturing production in the UK continued to decline in three months until October, reflecting a sharp decline in the automotive sector. According to the Industrial Trends Survey, production volumes fell to -10 percent from +1 percent in September.

According to the technical analysis of the pair: Despite the stalled gains and growing fears of a widening clash between the British government and the House of Commons, the GBP/USD price is still strongly breaking the bearish trend, and a move above 1.3000 psychological resistance will support the strength of the current uptrend. On the downside, the pair will be negatively affected if the price holds below 1.2800 support. The Brexit developments will set the course for the pair in the coming days as the official Brexit date on Oct. 31 is approaching.

For today's economic data: The economic calendar has no significant economic data from either the UK or the United States.