The United Kingdom's departure from the European Union is still unknown, as attempts to pass the necessary legislation through parliament on Tuesday to approve Johnson's agreement with the European Union continue. Many market participants seem optimistic that Prime Minister Johnson's plan will eventually succeed. This supported the GBP/USD move to the 1.3012 resistance, after a bearish move at the beginning of yesterday's session pushed the pair towards the 1.2874 support, and now settles around 1.2980 at the time of writing, as a new session of the British House of Commons is expected in an attempt of the British government to approve the latest Brexit deal. On Saturday, Johnson lost approval to pass the deal and is struggling to rally more lawmakers to succeed in his plan to get Britain out of the block on Oct. 31, with or without a deal.

On the other side. The Dollar weakened sharply last week as investors turned to riskier assets. The United States and China have agreed to a truce in the trade war that is straining global economic growth, and since then the US economic data has continued to raise more bets that the Fed will cut interest rates again at the end of October.

US factories are struggling to cope with the consequences of a 15-month US trade war with China. Economists are increasingly concerned that the slowdown in manufacturing may soon spread to the rest of the US economy, which could slow growth and undermine inflation expectations. Markets are betting heavily on the need for policymakers to cut the federal funds rate to 1.75% on October 30. Official data showed last week that US industrial production fell -0.4% in September and the markets were looking for a decline of only 0.1%, followed by the Philadelphia Fed Manufacturing Index that also fell sharply, and housing numbers that also weakened in September. The weak figures followed a retail sales report that showed a surprise drop in store spending last month, all of which helped undermine the dollar's strength.

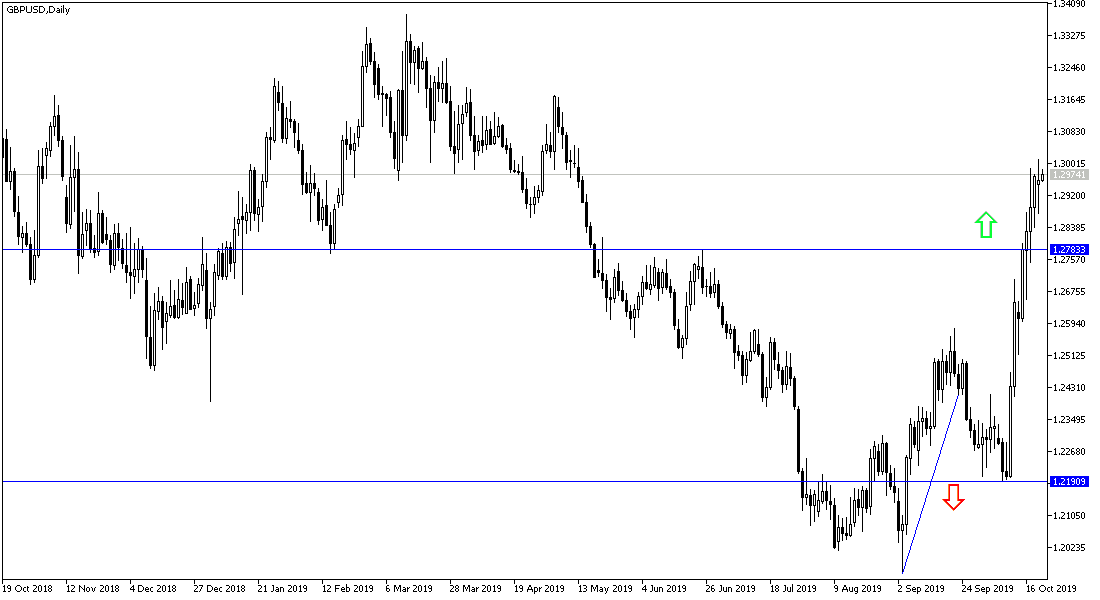

According to the technical analysis of the pair: The general trend of the GBP / USD continues to strengthen towards the completion of the bullish correction. As we expected, the pair moved towards 1.3000 psychological resistance. This may increase the momentum for the pair to test new record highs, the closest are 1.3085, 1.3145 and 1.3300, as the positive outlook for the Brexit continues. On the downside, the nearest support is currently at 1.2910, 1.2830 and 1.2750, respectively. The pair's gains could collapse quickly unless Boris Johnson succeeds in getting parliamentary approval ahead of Oct. 31.

At the economic data level. From Britain, net public sector lending will be announced and the House of Commons vote will be monitored. From the US, existing home sales will be released.