Continued optimism about the possibility of an agreement between the parties of the Brexit helped the GBP/USD pair to complete strong gains, which led the during Tuesday's session to test the 1.2798 resistance, a five-months high, before settling around 1.2746 at the time of writing. According to a report published by Bloomberg, the negotiators between the UK and the EU in Brussels are concluding the Brexit deal draft with optimism, and that there will be a breakthrough before the EU summit. EU and UK negotiators continue to seek a solution to the troublesome issue of Northern Ireland's borders.

Sources in Brussels and London told the paper that there had been "cautious optimism" that an agreement could now emerge, suggesting a more optimistic tone than the assessment by European Union chief negotiator Michel Barnier on Sunday. Barnier told reporters in Luxembourg that the deal was still possible this week, but said the UK should now issue a legal text.

In the event of failure to conclude a deal, that will reverse the recent pound gains, as markets begin pricing new delays and an uncertain outcome, as the UK will certainly go to the polls in a general election before the end of the year. Care should be taken until the formal announcement and parliamentary approval by both sides of the Brexit deal.

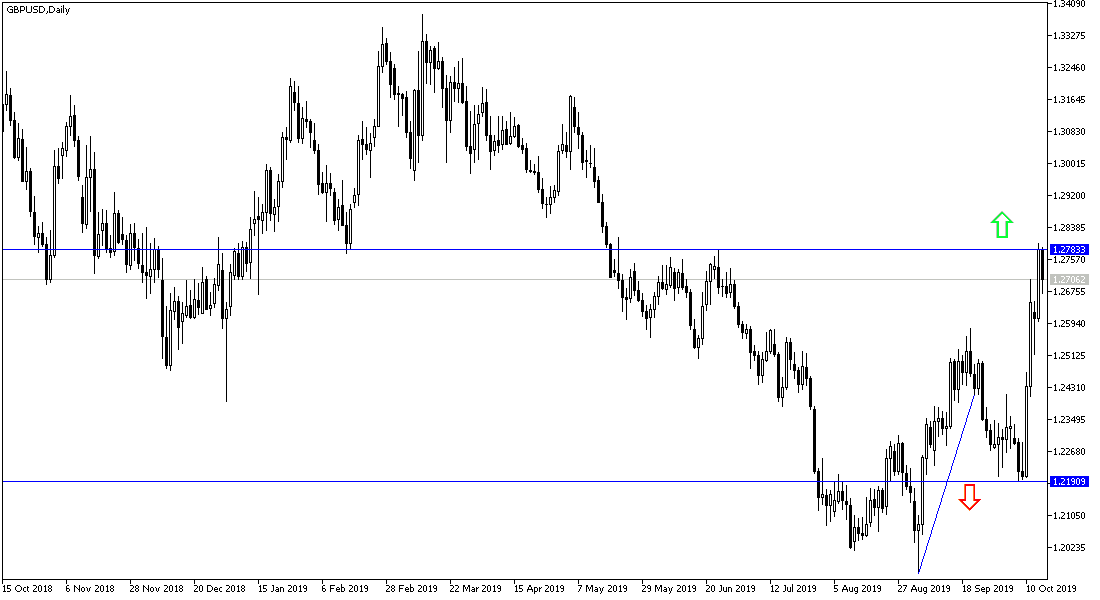

According to the technical analysis of the pair: On the daily chart, there is a clear break of the bearish trend and an upwards momentum for the GBPUSD pair. The closest resistance levels are currently at 1.2820, 1.2885 and 1.3000 respectively. This will be tested in a very short time if further measures supporting the Brexit deal are announced ahead of the official deadline at the end of this month. Any disappointing hints could negatively impact the pair's gains and at the moment the nearest support levels are 1.2690, 1.2600 and 1.2525 respectively.

As for the economic calendar data: From the UK, the inflation figures will be announced through the consumer price index, producer prices and retail prices. From the US, retail sales and NAHB housing market index will be announced.