After the GBP / USD tested the area above 1.2700 resistance at the end of last week's trading, which is a 3 months high, profit taking pushed the pair towards 1.2515 before stabilizing on the 1.2600 resistance level, awaiting any developments after the latest optimism, which led to last week's gains that supported the break of the bearish trend which was dominating for a very long time. The Pound's gains were heightened by the prospects for a Brexit deal after a meeting between UK and Ireland leaders, where it was agreed that there was a clear way forward to reach an agreement to prevent a chaotic Brexit hurting both sides.

The UK has proposed new ideas on how to solve Northern Ireland's northern borders mystery, and Ireland's suggestion that the proposals could reactivate Britain's Brexit negotiations and thus pushed the pound to its biggest daily jump since March. Most analysts agree that the Brexit deal is a positive route for the UK economy and investors; therefore, this should lead to stronger gains for the Pound. Despite the optimism, the road is still full of obstacles. First, an agreement must be reached no later than Tuesday, 15 October, so that an agreement can be ratified at the EU summit on Thursday and Friday. After that we will see whether the British House of Commons will also approve Boris Johnson's agreement with the European Union. It is known that the British parliament became a strong opponent to Johnson after the latter's attempt to suspend their work, but the parliament returned by a court ruling.

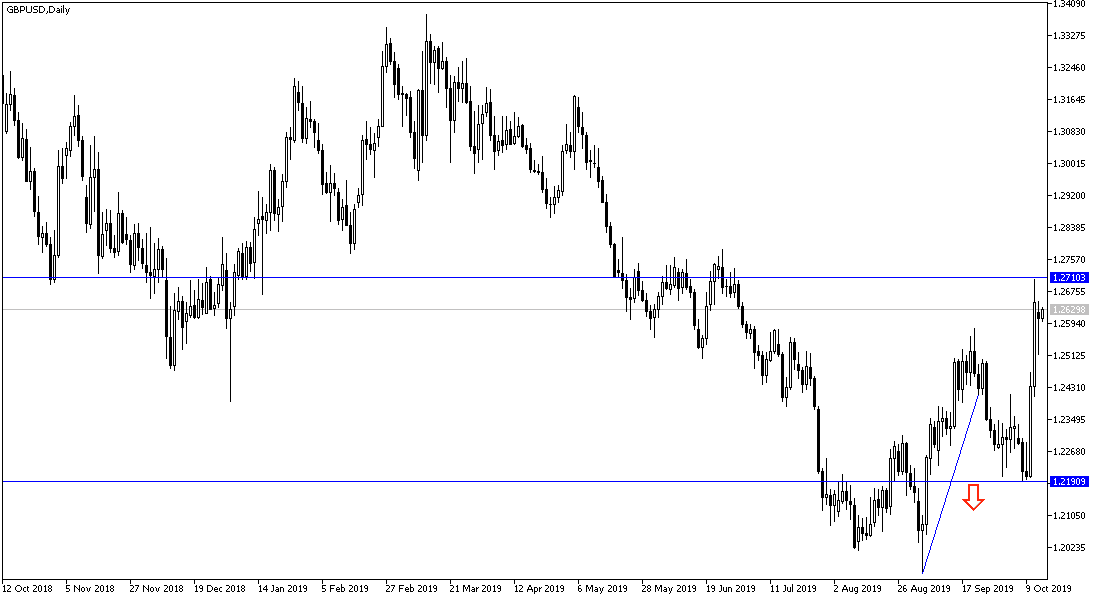

According to the technical analysis of the pair: GBP / USD price is still in an upward correction as seen on the provided daily chart below, and the return of stability above 1.2700 resistance will pave the way towards the next psychological resistance at 1.3000 as soon as possible. On the downside, stability below 1.2500 support will support the bears to take the pair below 1.2430, 1.2350 and 1.2280 areas which threaten the future of the current correction.

In the economic data: From Britain there will be the announcement of figures on unemployment and wages in the country amid expectations of continuing gains for average wages around 4.0%, a change less than in the previous one in employment rate, and a steady unemployment rate in the country at 3.8% unchanged. There will be comments by Bank of England Governor Carney. From the US, the Empire State Industrial Index will be announced.