Since the beginning of this week, the GBP / USD has continued to decline, ignoring the disappointing results of US jobs announced last Friday. The pair fell back to the 1.2286 support level, where it is also stable around at the beginning of Tuesday's trading, after a media report indicated that British Prime Minister Boris Johnson is ready to take legal action in his attempts to ensure that Britain could leave the European Union this month without any agreement. The Daily Telegraph reported that the Prime Minister was prepared to go to the Supreme Court to avoid a request to extend Article 50.

The aim of the move was to avoid delays regarding Brexit, as stipulated in Ben's law passed by parliament. The prime minister could provide evidence in an attempt to persuade judges personally not to force him to demand that the EU postpone Brexit.

In terms of economic news. Figures from Lloyds Bank's Halifax and IHS Markit showed that UK house prices unexpectedly fell in September. House prices fell -0.4 percent month-on-month in September, reversing a 0.2 percent rise a month ago. It was the first decline in prices in four months. Prices were expected to rise 0.1 percent.

Last week Boris Johnson presented a new proposal to the EU. He described it as a "reasonable compromise" that would solve the most difficult issue in Brexit talks - how to maintain an open border between Northern Ireland in the UK and EU member Ireland. The bloc commented that the proposals did not meet the UK's commitment to friction-free borders, because there should be customs inspections of some goods and because the arrangement was under review by Northern Ireland politicians.

Johnson urged EU leaders to settle and sit for direct talks. So far, the European Union has refused, saying the UK should show more "realism" in its proposals.

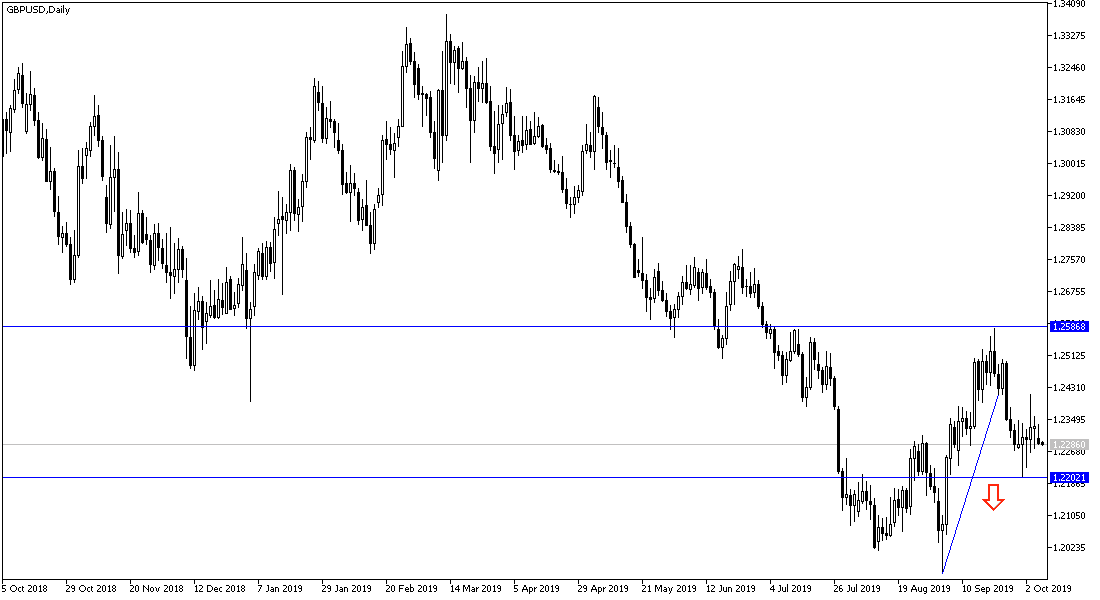

From a technical perspective: GBP / USD will have the opportunity for a bullish correction by stabilizing above the resistance levels of 1.2330, 1.2410 and 1.2500 respectively. If it breaks down to the 1.2200support level, we may see a return to the 1.2000 psychological support level again and in less time. The pound will be influenced by comments from Bank of England Governor Mark Carney. The dollar is on schedule with the release of the producer price index and remarks by Federal Reserve Governor Jerome Powell.