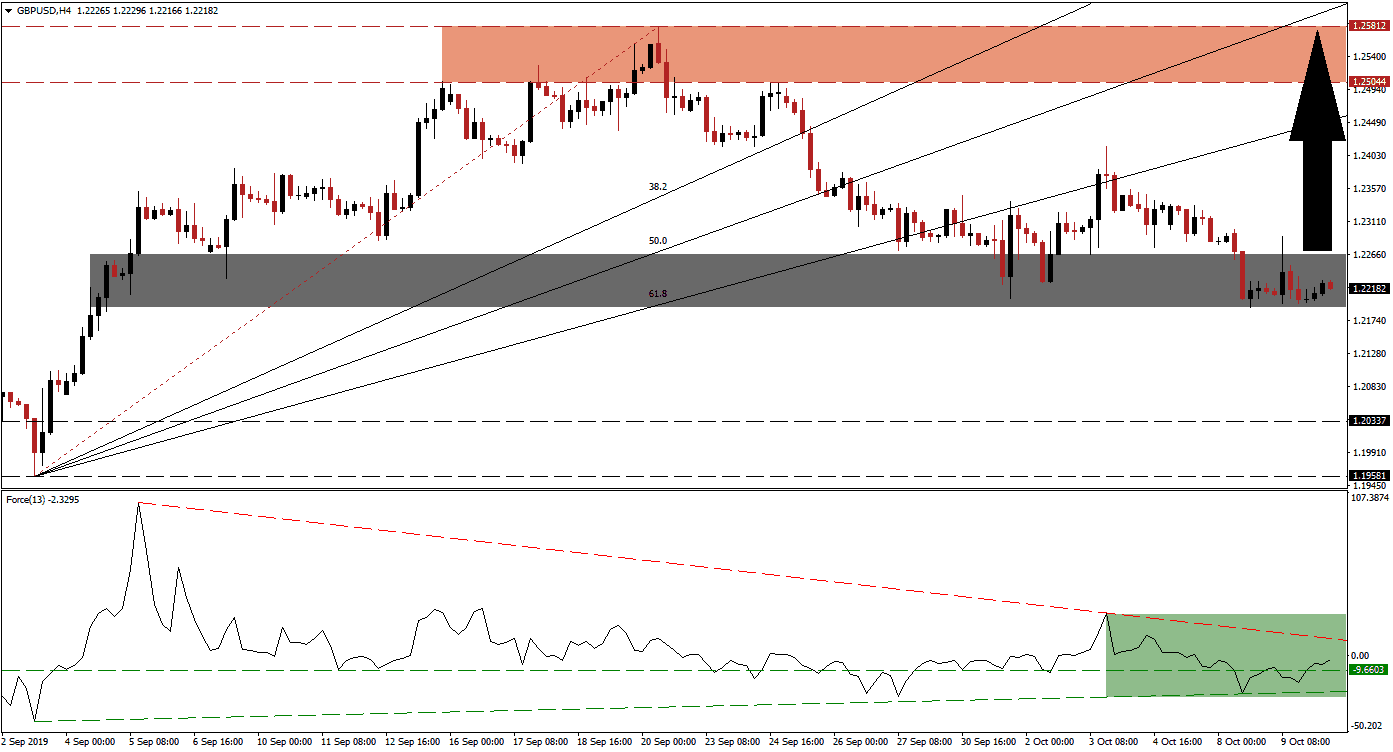

Brexit negotiations are ongoing and forex traders have to sort through conflicting reports. The range from a deal essentially impossible as Germany made unacceptable demands to the EU on the verge of giving a major concession in regards to the Irish backstop, in-line with UK Prime Minister Johnson’s new proposal. Hungary remains a wild card and the EU may have taken notice of it. At the same time trade negotiations between the US and China may not deliver the results markets expected. This has kept the GBP/USD inside its short-term support zone from where bearish momentum is fading. Price action previously used this zone in order to advance, but was rejected by its 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next generation technical indicator, is pointing towards an increase in bullish momentum. A shallow, ascending support level has pushed the Force Index above its horizontal resistance level and turned it into support. As the double support level is pushing this technical indicator towards its descending resistance level, a breakout may follow which will lead the GBP/USD into a breakout of its own. The Force Index remains in negative conditions, as marked by the green rectangle, but a move above its descending resistance level will place it in positive territory and bulls in charge. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Forex traders will get a heavy dose of economic data out of the UK which is expected to provide the next fundamental catalyst for the GBP/USD. Baring any negative disappointments, the current short-term support zone which is located between 1.21924 and 1.22655 as marked by the grey rectangle is expected to allow this currency pair to attempt a second breakout. The intra-day high of 1.22910 should be watched which represents the high of a previous spike above its short-term support zone, a sustained move above this level is expected to result in the addition of new net buy orders.

Should the Force Index complete a breakout above its descending resistance level, the GBP/USD is expected to follow with an advance which will take it first into its ascending 61.8 Fibonacci Retracement Fan Resistance Level from where an extension into its resistance zone is possible. This resistance zone is located between 1.25044 and 1.25812 which is marked by the red rectangle. This zone is also nestled between the 50.0 and 61.8 Fibonacci Retracement Fan Resistance Levels. A breakout above it is unlikely until more Brexit clarity will emerge. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.22200

Take Profit @ 1.25400

Stop Loss @ 1.21450

Upside Potential: 320 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 4.27

A disappointment from today’s UK economic data could lead to a breakdown in the GBP/USD below its short-term support zone. As long as the Force Index can maintain its position above the ascending support level, the bullish scenario remains dominant. The next long-term support zone is located between 1.19581 and 1.20337 which should be considered an excellent long-term buying opportunity.

GBP/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.21350

Take Profit @ 1.20200

Stop Loss @ 1.21900

Downside Potential: 115 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 2.09