The British pound has rocketed higher during the trading session on Thursday as rumor mill participants have been kicking it into high gear via Twitter. Ultimately, there has been these times before, so I have a sneaking suspicion that as soon as the truth comes out, we probably role right back over. The Brexit scenario is a never ending hassle for traders, and it has become obvious that algorithms have taken over this pair. All it will take is Twitter to start talking about the Brexit and some possible positive movement for the British pound to jump higher. Obviously, the exact opposite has been true for some time, so I suspect that sooner or later somebody comes out and says something to smack this pair back down. In the Forex world, the GBP/USD pair has been one of the most highly manipulated pairs in the last couple of years.

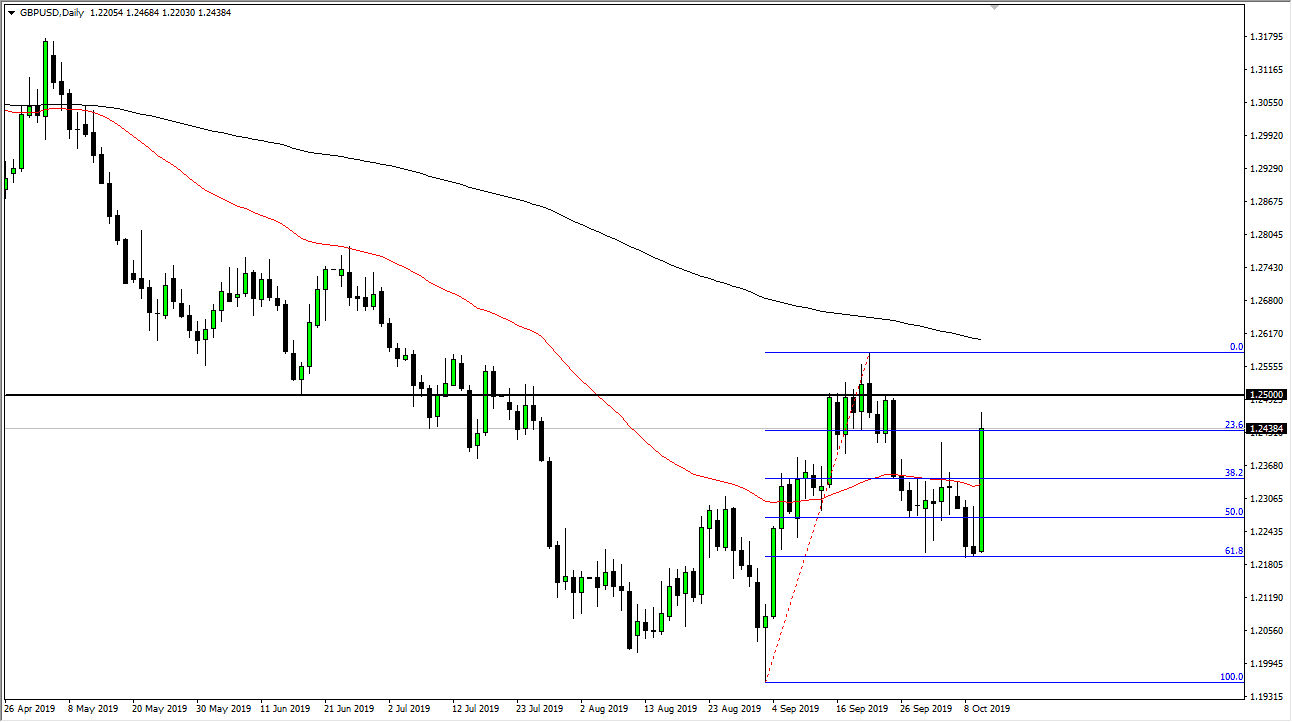

Looking at the size of this candle though, you do need to take it somewhat seriously. Above at the 1.25 handle I would anticipate that there is a lot of resistance, and of course the 200 day EMA racing towards that level as well will also offer quite a bit of resistance. That being said though, the candle stick from the Wednesday session which was an inverted hammer has now been kicked off to the upside so technically that is a buying signal. I would not be a buyer here though, because it is on flimsy news at best.

All one needs to do is ask how many times traders have been disappointed about Brexit? In fact, many of the professional traders I know won’t even touch the British pound anymore because of how manipulated it has become. That being said, there is a significant amount of resistance, and I do believe that the US dollar has its say here as well. After all, the US/China trade talks could send a rush into “safety”, which would work against this pair as well. Ultimately, it looks to me as if this market will continue to jump around but I anticipate that by the end of the day on Friday we may end up having a sell signal. On the other hand though, I’m not willing just to jump in and start shorting right away as at this point anybody can say anything and the right Twitter feed, and the market jobs or falls.