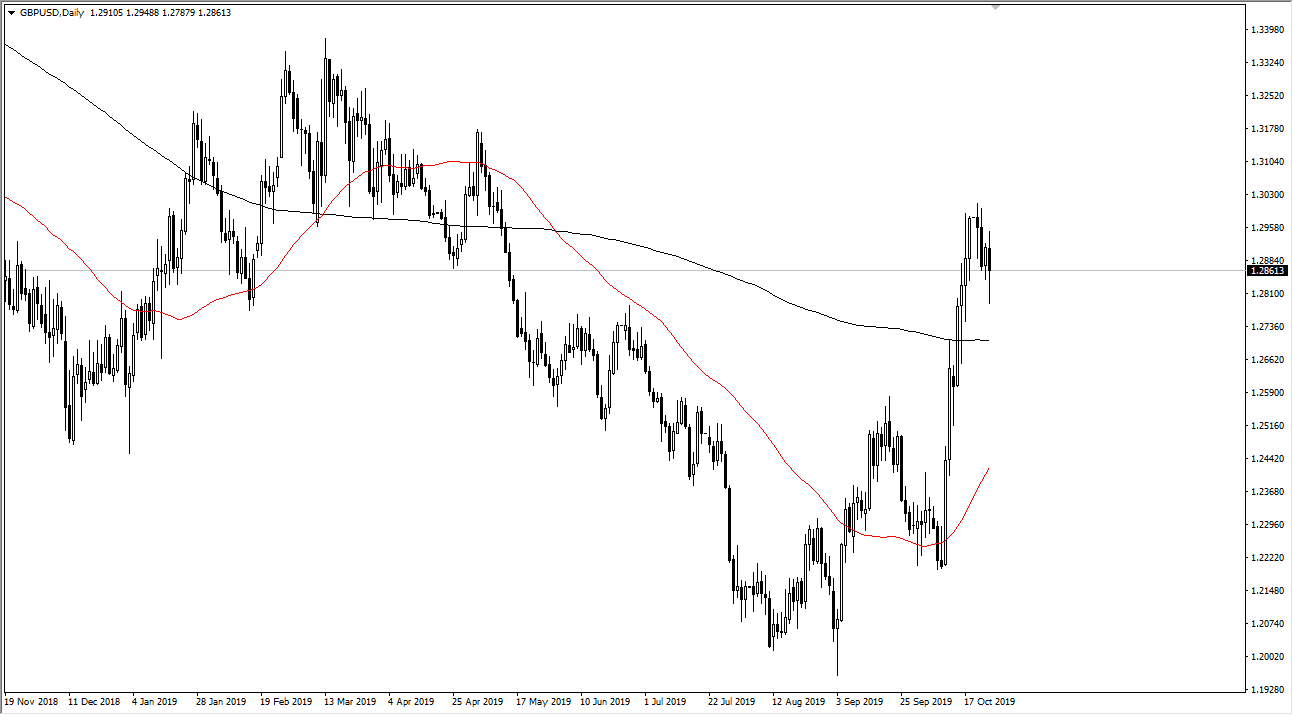

The British pound initially try to rally during the training session on Thursday but then broke down rather significantly. Later in the day, we found support near the 1.2750 level to bounce and form a bit of a hammer. This is a market that continues to be very erratic and thrown around by a lot of different headlines. Brexit is a complete nightmare and a quagmire politically, so at this point it looks very unlikely to be an easy market to trade. However, markets are basing their trading on the idea that the “no deal Brexit” is becoming less of a likelihood. That being said though, there are still plenty of negative headlines ready to come out and throw the British pound right back down at any moment. On the other hand, it looks as if pullbacks continue to offer plenty of buying opportunities.

The 200 AMA should now offer support, and if we can get closer to that level it’s likely that we will continue to see buyers come back into this market and perhaps try to pick up a bit of value. At this point, the trend for the British pound has changed by most metrics, and at this point it’s likely that we will eventually see the market go to the upside. Pullbacks of this point should continue to attract a lot of attention because a lot of people will have missed this move, and I am one of them. However, paying up at this point makes no sense. At this point, the market is undervalued from the longer term, and at this point it’s likely that the historical norm will be where we go, meaning that we probably have another 25 handles before it’s all said and done. Obviously, that will be overnight so look at this as a longer-term set of just waiting to happen.

Expect volatility, but also expect more of an upward bias in general. After all, the market has been so negative for so long there isn’t much left to push it down at this point with the exception of the occasional headline that will probably be bought into on a dip. The British pound has been taken over by algorithms that read twitter, so the only way you can trade this market is to look at it from a longer-term standpoint.