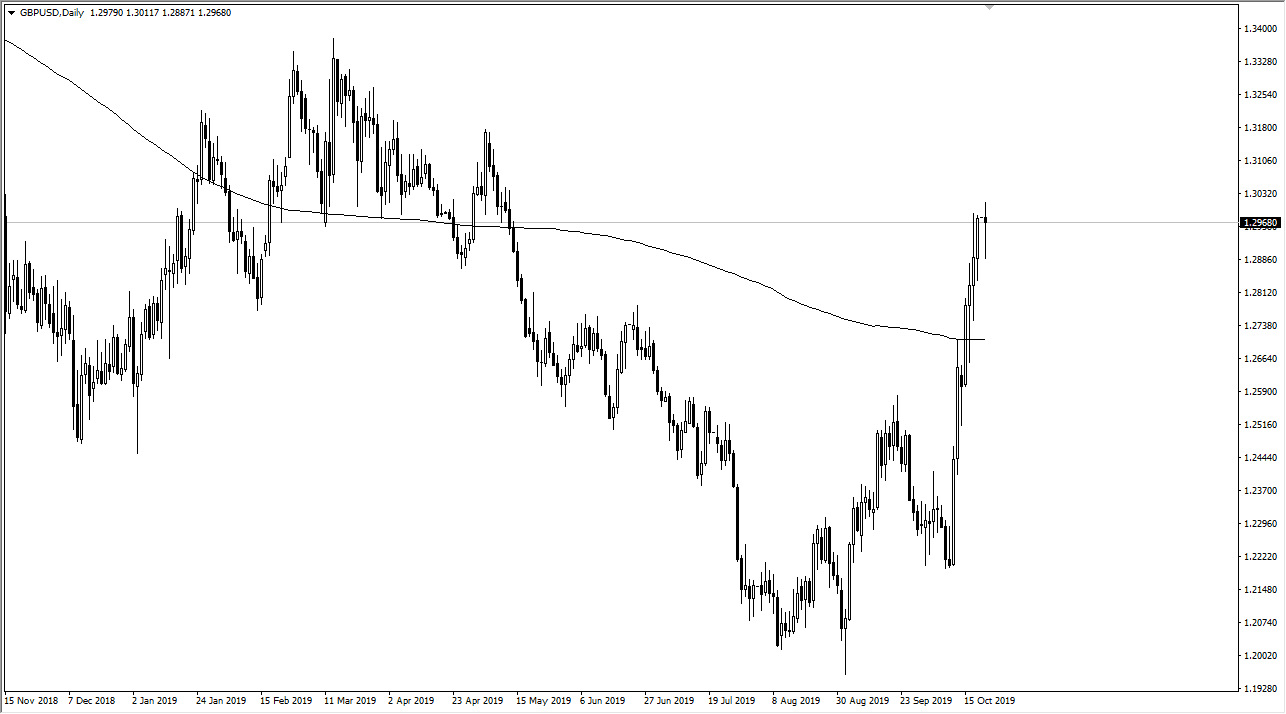

The British pound has gone back and forth for the bulk of the Monday session, essentially settling for an unchanged candlestick. That being the case, the market looks as if it is trying to figure out whether or not there is yet another reason to go higher, but at the very least you can say that the market is overextended. I recognize that there has been a lot of short covering here, so that might be part of what has pushed the British pound so high in such a short amount of time. Regardless, the reason it’s rallied doesn’t matter when you start looking at the fact that the pair has rallied 800 pips in just two weeks, which is even more remarkable considering that a couple of the days were essentially unchanged. In other words, if you’re buying at current levels, you are “chasing the trade.” I can think of no better way to start losing money.

The 200-day EMA should be rather significant support, which is near the 1.27 level. If we were to break down below that level, the market is likely to resound towards the psychologically and obvious 1.25 support level, which was previous resistance. Either way, the British pound certainly has gotten far ahead of itself. This doesn’t mean that I’m willing to short this market still, what it means is that I need to find some type of value in the market to start putting money to work. Chasing the trade at this point is extraordinarily reckless.

There are a lot of headlines out there that are going to move the British pound based upon the Brexit and all of the nonsense coming out of the UK Parliament, so it’s probably only a matter of time before this happens. I’ll be waiting to pick up value as soon as it appears, but right now we are far too overextended. Again, I believe that the 200-day EMA will attract a lot of attention, so it’s my first “line in the sand” when it comes to supporting Sterling. At this point, selling just simply would be too dangerous as well, even though we are “too expensive.” After all, this market has proven that it can rip straight up in the air for a while, and that will probably continue to be the case going forward. Expect volatility and choppiness, look for value underneath.