The British pound went back and forth during the trading session on Thursday, as it was reported that Boris Johnson agreed to a deal in principle with the European Union, which now has to be ratified in Parliament. Ultimately, the market shot higher during the trading session on Thursday but was turned around rather quickly as the leader of the DUP said that there were still significant holes in the agreement that needed to be addressed. In other words, it’s not necessarily known that Parliament will pass the deal.

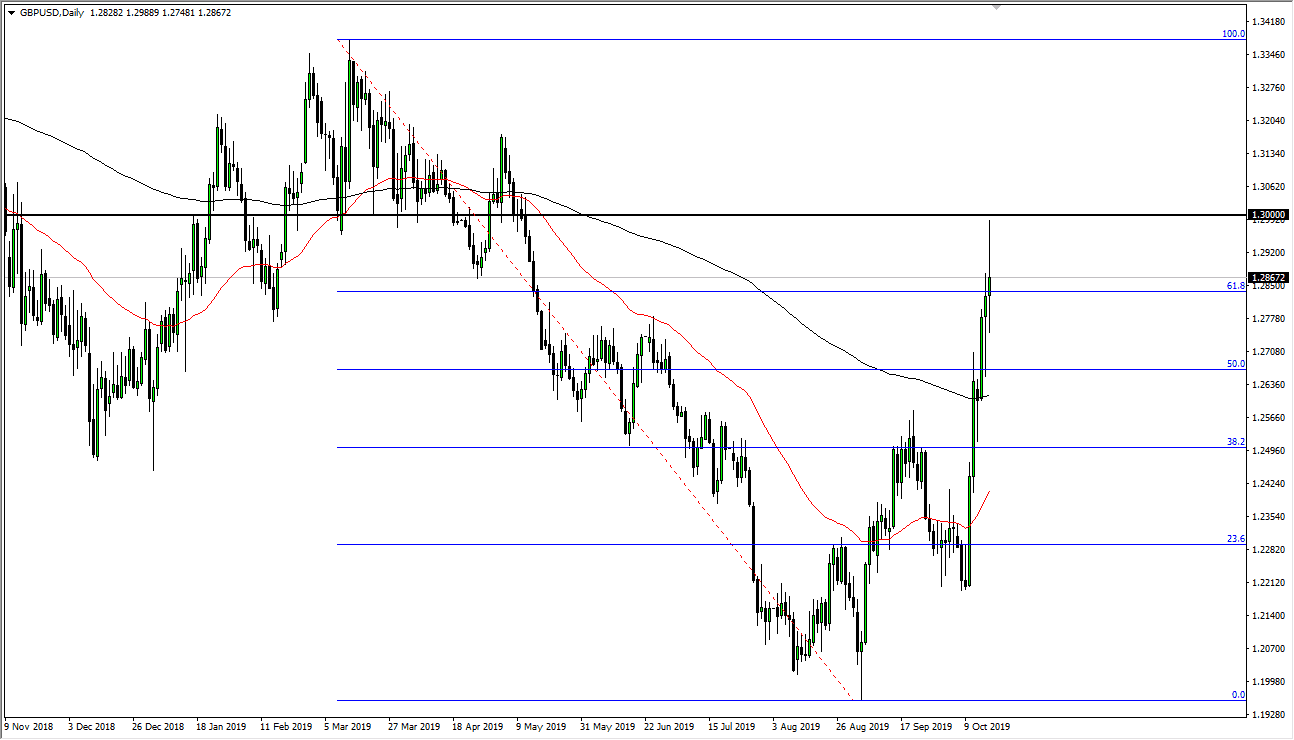

Beyond that, we also have the fact that the British pound has shot straight up in the air for several days in a row, so one would have to wonder exactly who is left to start buying. The market trying to get above the 1.30 level, but obviously that large, round, psychologically significant figure will attract a certain amount of attention. That being said, the candle stick for the trading session looks rather sick, so I think that a pullback may be coming. The market looks as if it is trying to change the overall trend, and it’s very likely that the market will eventually be a “buy-and-hold” situation. However, we need to pull Bank in order to offer some type of value. After all, wasn’t that long ago that we were 800 pips lower than we are right now. Some type of pullback would make quite a bit of sense.

The 200 day EMA is near the 1.26 level, an area that will attract a certain amount of psychological importance as well. There is a hammer at that level that looks like it’s trying to pick up support at that area as well. I like the idea of dropping from here rather slowly, perhaps building up momentum over time to take advantage of. The alternate scenario of course is that we break above the 1.30 level, but I think is very unlikely to happen right away without some type of confirmed the deal. Even if that happens, there is the possibility that the deal isn’t as attractive as one would hope, and you may see the British pound pulled back before finding that base again to be a “buy-and-hold” scenario. Overall, this is a market that is trying to change the overall attitude, but it doesn’t happen overnight. Beyond that, this sudden surge is getting awfully expensive.