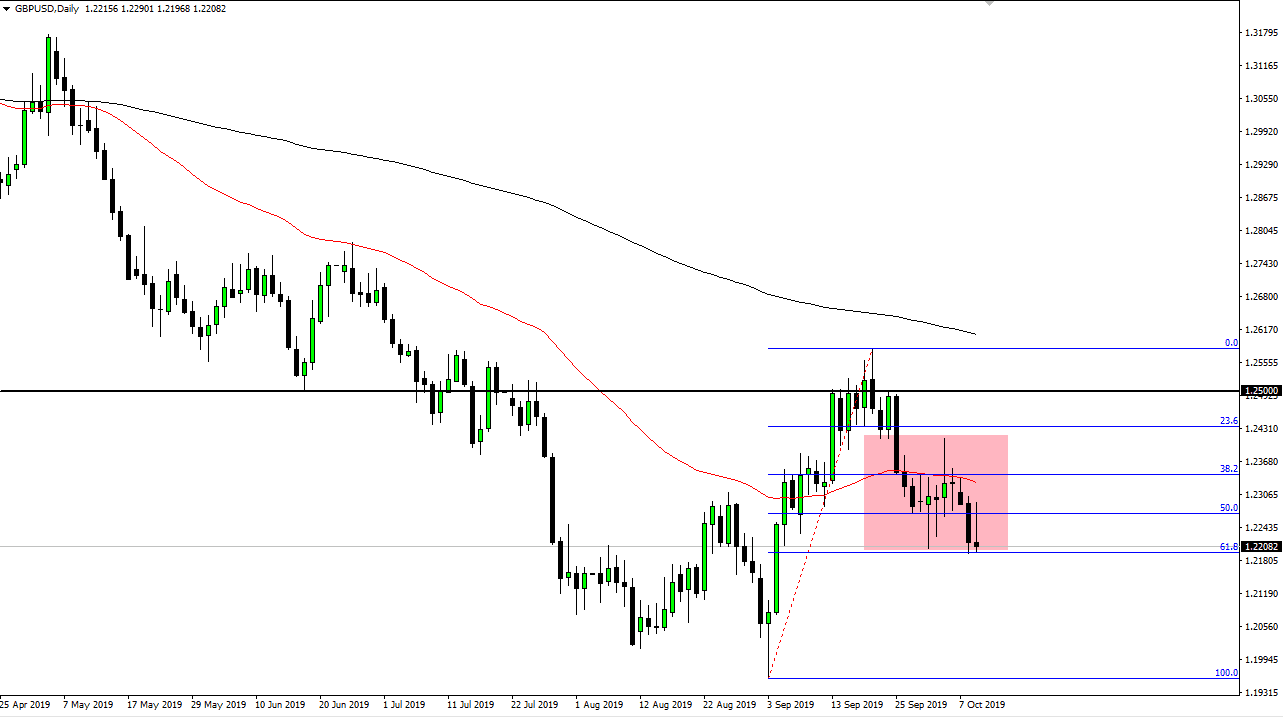

The British pound has rallied a bit initially during the trading session on Wednesday but has rolled over again as the DUP has suggested that they were not willing to go along with the potential EU deal rumored to be offered. At this point, it seems as if the market is getting ready to break down below the 1.22 level, which is not only a large, round, psychologically significant figure, but it is also the lows from the last week or so, and importantly than that it is also the 61.8% Fibonacci retracement level. By testing this area yet again and failing to hang onto gains, this suggests to me that we are more than likely going to see a break down.

There are a whole world of potential issues out there to deal with, but of course the main deal here is going to be Brexit. Brexit continues to be a huge mess, and it’s likely that the market participants will continue to struggle to digest the news cleanly. I do think that more often than not people will error on the side of caution, which means buying the US dollar and selling this pair.

A break down below the 1.22 level of course offers a negative selling opportunity, as the support will have given way and the 61.8% Fibonacci retracement level will have as well. This typically opens up the door for a move down to the 100% Fibonacci retracement level, which is just below the 1.20 level, another large, round, psychologically significant figure. Overall, this is a market that should continue to see a lot of volatility, but I think that the market is getting a bit “heavy” and the rally failing the way it did during the trading session on Wednesday for me is a very negative harbinger.

I do think it’s only a matter of time before the market has to settle on something and will eventually make a bigger move. In the short term though, I think it’s very likely that the market will find some support eventually, and I do think that eventually we will get one more “flush lower” that offers value underneath. We aren’t quite there yet, so overall I believe that flush still is to come, so therefore I still prefer the downside. The closer we get to the conclusion of Brexit, the more likely we are to finally break down and have a bit of a “capitulation low” in this market.