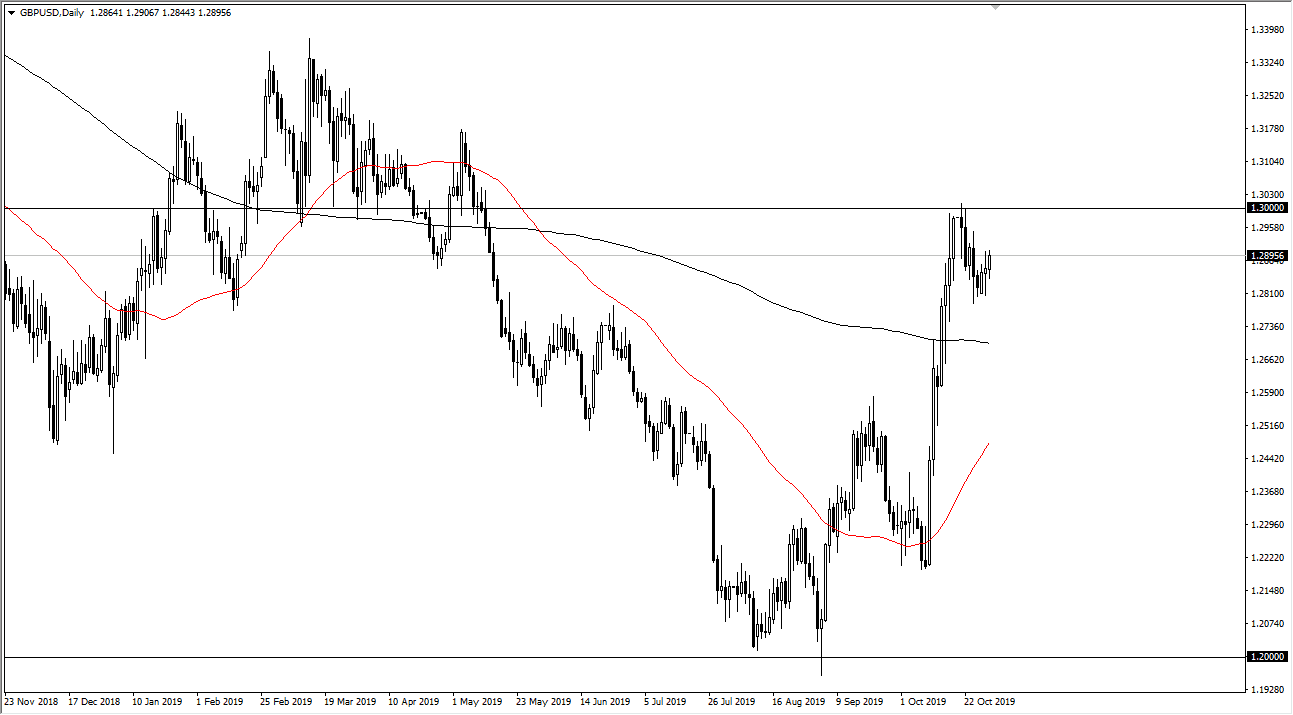

The British pound initially dipped on Wednesday, but then shot higher later in the day. As the market closed out, it was testing the 1.29 USD level. At this point, the market is likely to continue going higher over the longer-term but will obviously need some type of catalyst to get moving. The catalyst is probably going to be something related to Brexit, which of course is a massive catalyst for where the British pound goes next. All things being equal, the market is forming a massive bullish flag that could send this pair much higher. Granted, the 1.30 level is going to cause a lot of psychological resistance.

At this point, the 200 day EMA underneath should continue to be passive support, offering a bit of a marker for the overall attitude of the market to continue going higher. The pole part of the bullish flag suggests that the market could go as high as 800 pips, giving the market an opportunity to reach towards the 1.37 level on the longer-term charts. Granted, it’s going to take a lot of momentum to finally get there, and I do see quite a few areas between here and there that could cause some issues. The 1.33 level as the initial resistance barrier that is going to be difficult to break above, as it is structurally important.

Looking at this chart, if we were to turn around and breakdown below the 200 day EMA, the market could go down to the 1.25 handle, which is a large, round, psychologically significant figure and an area where we have seen a lot of choppiness on short-term charts. The 50 day EMA is starting to reach that area now as well, so that’s another reason to think that people will be interested in buying this work it down there.

The alternate scenario is that we simply slice off the 1.30 level, which of course is a bullish sign as well. I don’t have any interest in shorting this market, for me it’s obvious that we have seen a pretty significant move to the upside and perhaps the beginning of a major trend change. This is a market that continues to look at the British pound through the prism of being historically cheap, but we also have to worry about all of the noise involving Brexit and whether or not there is some type of an agreement. At the very least, we have another 90 days to think about it.