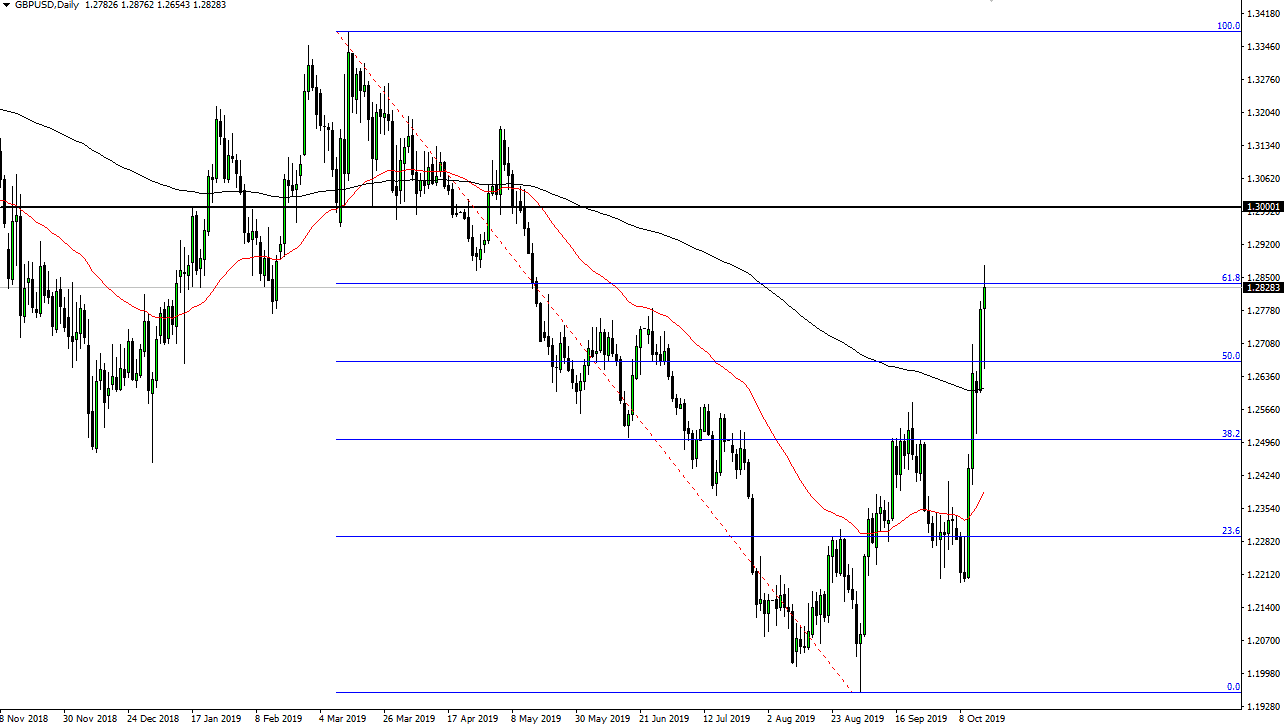

Over the last several days, we have seen the British pound skyrocketed value, based upon various Twitter headlines. However, this is very dangerous trading, and therefore something that I am stepping on the sidelines while things occur. After all, if the Brexit is finally solved and everything is awesome again, the reality is that the longer-term trend should give plenty of entries going forward. If the market was to change completely and rally based upon Brexit fixing everything, the reality is that we probably have another 50 handles or so to go before it’s all said and done. If that’s the case, I’m not worried about 200 pips one way or the other.

However, entering the market at this point is simply chasing the trade. I am more than willing to wait for a bit of a pullback offering value, and the 200 day EMA could be where we see it. Yes, we have already pulled back below it but what I need to see is a slow grind towards that area with some type of stability. The market is not stable all, and will move based upon “EU sources” from relatively unknown Twitter accounts. Unfortunately, algorithms have been swapping this currency pair, trying to take advantage of what could be the “trade of the century.” You obviously are going to have issues trying to beat the speed of these headline reading machines, which quite often burn themselves up in the process.

Liquidity is an issue, as my institutional platform has seen spreads act in a very odd manner recently. I’ve seen spreads jump from 0.2 pips to 2.0 pips randomly, which is very high for this pair. At this point in time though, I think that there is most certainly more of an upward bias but I also recognize something that most people are not thinking about: the potential for some type of break in communication. If the negotiations fall apart and obviously end up being nothing concrete, this pair could lose 500 pips and a day. This is why I’m not willing to chase the trade. You could enter the trade at 1.2826 which is the current level that the market is trading in, only to wake up the next day at 1.25 in the blink of an eye based upon some type of negative headline. With that, the trend needs to change, stabilize and build a bit of a foundation, and then you can buy and hold.