Although we did see a bit of bullish pressure during the trading session on Thursday, the British pound also did see a bit of selling pressure. In other words, it is grinding sideways in general, and Thursday of course may have been a slightly skewed trading session as the jobs number in America comes out for Friday. Because of this, it makes sense that a lot of traders probably closed their positions at the end of the day.

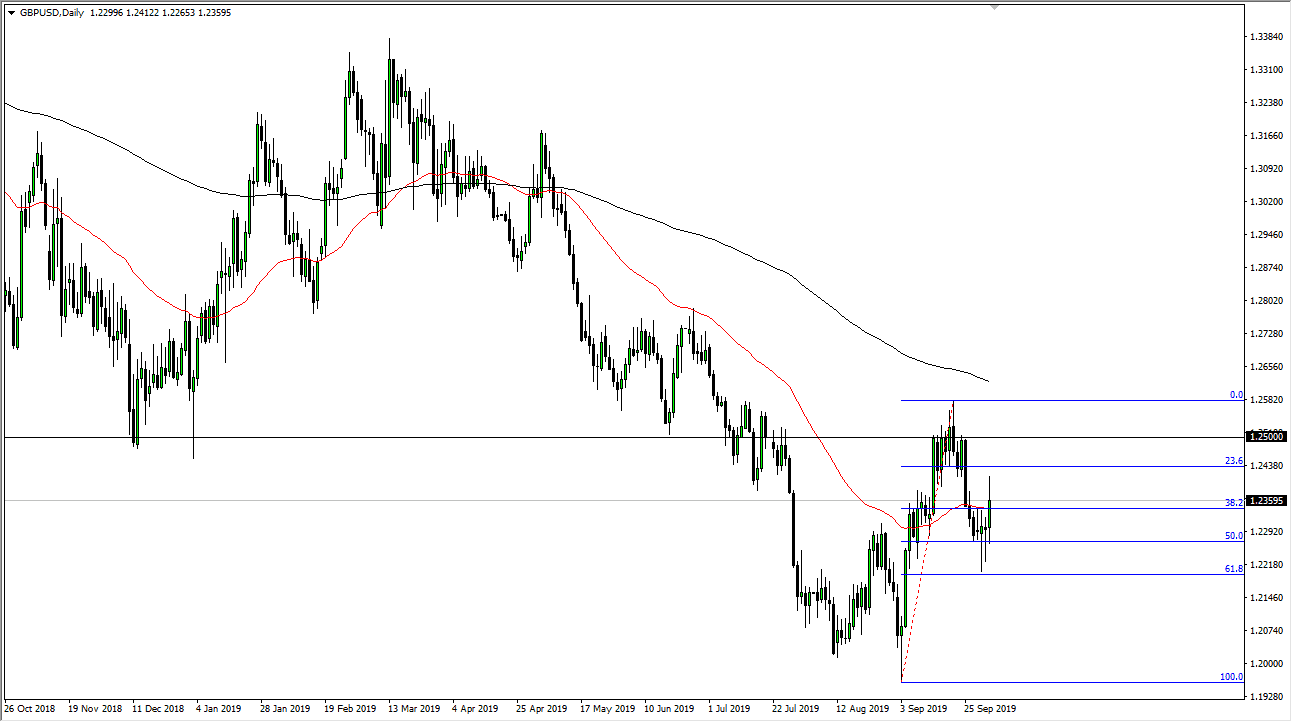

I will be the first to admit that it was very bullish to break above the 50 day EMA and of course the pair of hammers was a very strong play. However, there is a lot of resistance above, especially near the 1.25 level. That’s an area that we had broken down from so I think that somewhere between here and there we will continue to see the market jump around and grind back and forth as it is roughly a significant area of volume. Remember, as Forex doesn’t show volume, you have to assume certain things and at this point we have seen a lot of noise just above, with a lot of noise just below. That typically means there’s a lot of volume in those regions. To the downside, I see the 1.2250 level as pretty significant.

I do think that given enough time the British pound will probably break back down, more than likely due to some type of headline coming out of Brexit negotiations. Beyond that, the US dollar is more than likely going to continue to be attractive to a lot of traders as the bond yields in the United States are still healthy and positive. The US dollar of course is the “safety currency” in this equation, so as long as there are concerns out there it makes sense that there would be a lot of bearish pressure.

That being said, the 1.20 level underneath may end up being the bottom of the entire move, mainly because we are getting close to the end of Brexit negotiations. It appears that the United Kingdom is going to try to leave October 31 with or without a deal, and once that’s done it’s more than likely going to be a scenario where value comes back into play. In the short term, I fully anticipate that this market will sell off but longer-term I’ll be looking for a buying opportunity underneath.